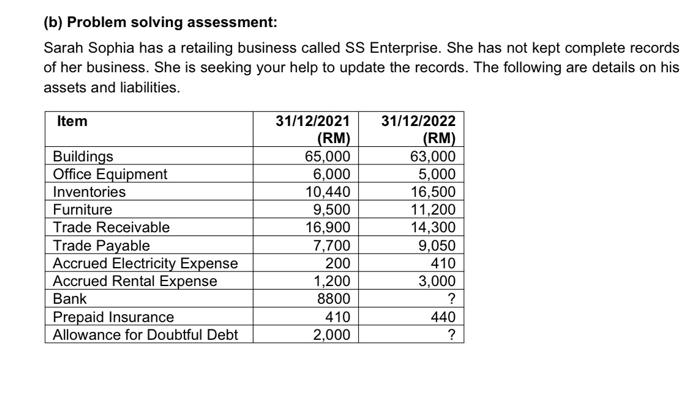

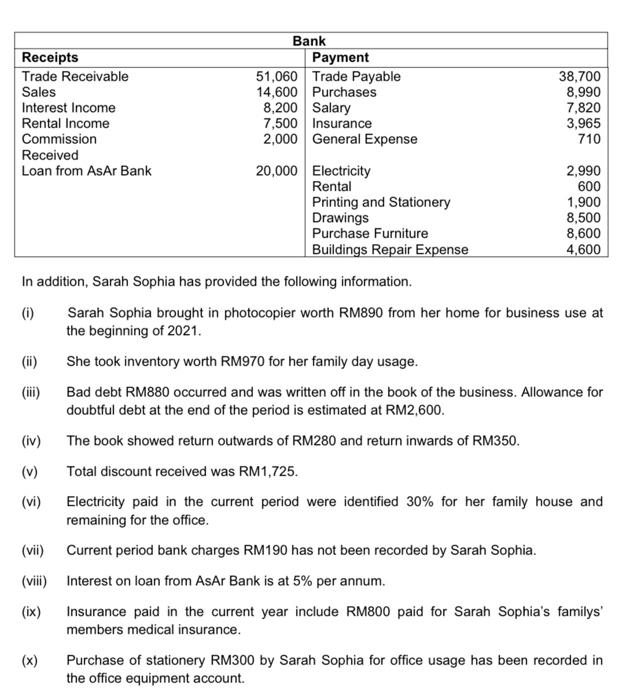

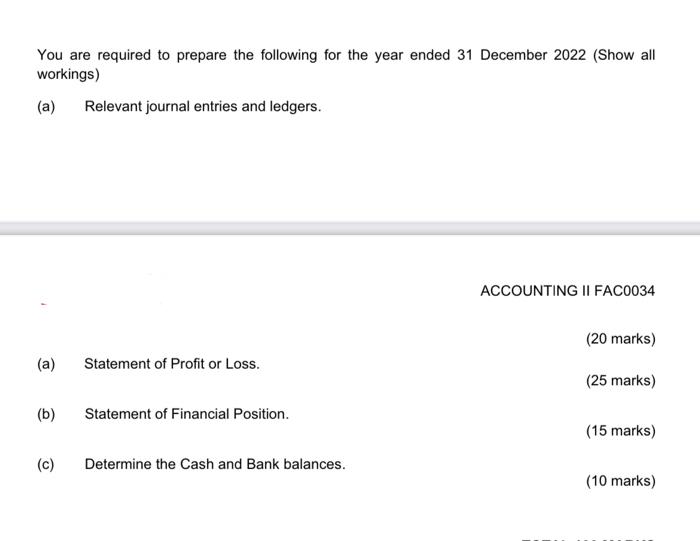

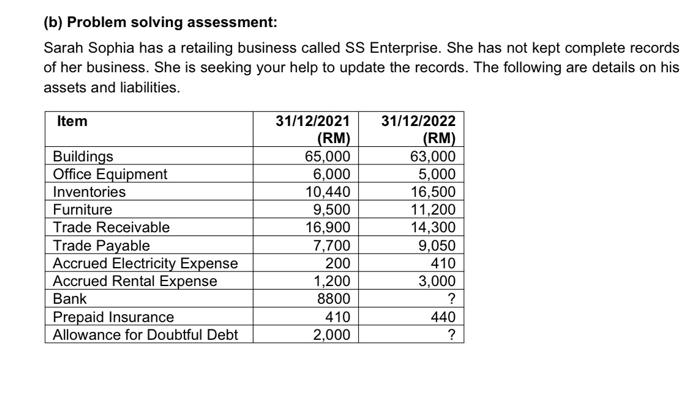

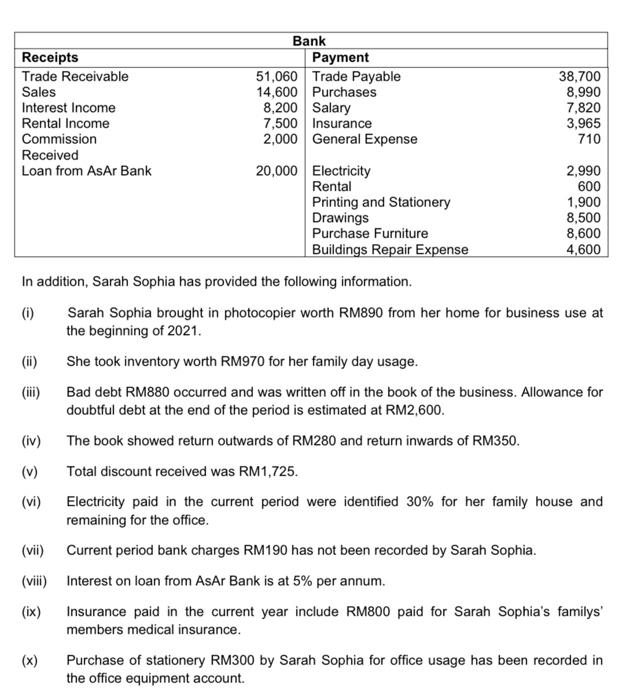

(b) Problem solving assessment: Sarah Sophia has a retailing business called SS Enterprise. She has not kept complete records of her business. She is seeking your help to update the records. The following are details on his assets and liabilities. (i) Sarah Sophia brought in photocopier worth RM890 from her home for business use at the beginning of 2021 . (ii) She took inventory worth RM970 for her family day usage. (iii) Bad debt RM880 occurred and was written off in the book of the business. Allowance for doubtful debt at the end of the period is estimated at RM2,600. (iv) The book showed return outwards of RM280 and return inwards of RM350. (v) Total discount received was RM1,725. (vi) Electricity paid in the current period were identified 30% for her family house and remaining for the office. (vii) Current period bank charges RM190 has not been recorded by Sarah Sophia. (viii) Interest on loan from AsAr Bank is at 5% per annum. (ix) Insurance paid in the current year include RM800 paid for Sarah Sophia's familys' members medical insurance. (x) Purchase of stationery RM300 by Sarah Sophia for office usage has been recorded in the office equipment account. You are required to prepare the following for the year ended 31 December 2022 (Show all workings) (a) Relevant journal entries and ledgers. ACCOUNTING II FAC0034 (20 marks) (a) Statement of Profit or Loss. (25 marks) (b) Statement of Financial Position. (15 marks) (c) Determine the Cash and Bank balances. (10 marks) (b) Problem solving assessment: Sarah Sophia has a retailing business called SS Enterprise. She has not kept complete records of her business. She is seeking your help to update the records. The following are details on his assets and liabilities. (i) Sarah Sophia brought in photocopier worth RM890 from her home for business use at the beginning of 2021 . (ii) She took inventory worth RM970 for her family day usage. (iii) Bad debt RM880 occurred and was written off in the book of the business. Allowance for doubtful debt at the end of the period is estimated at RM2,600. (iv) The book showed return outwards of RM280 and return inwards of RM350. (v) Total discount received was RM1,725. (vi) Electricity paid in the current period were identified 30% for her family house and remaining for the office. (vii) Current period bank charges RM190 has not been recorded by Sarah Sophia. (viii) Interest on loan from AsAr Bank is at 5% per annum. (ix) Insurance paid in the current year include RM800 paid for Sarah Sophia's familys' members medical insurance. (x) Purchase of stationery RM300 by Sarah Sophia for office usage has been recorded in the office equipment account. You are required to prepare the following for the year ended 31 December 2022 (Show all workings) (a) Relevant journal entries and ledgers. ACCOUNTING II FAC0034 (20 marks) (a) Statement of Profit or Loss. (25 marks) (b) Statement of Financial Position. (15 marks) (c) Determine the Cash and Bank balances. (10 marks)