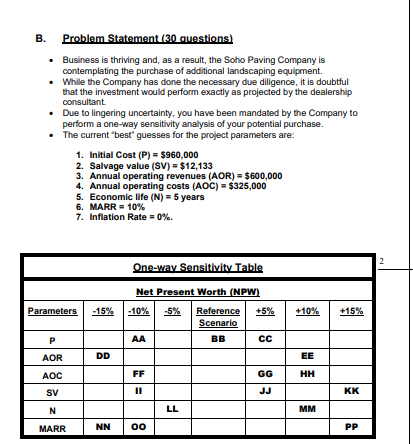

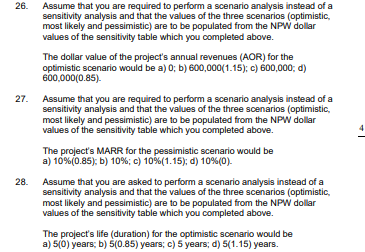

B. Problem Statement (30 questions) Business is thriving and, as a result, the Soho Paving Company is contemplating the purchase of additional landscaping equipment. While the Company has done the necessary due diligence, it is doubtful that the investment would perform exactly as projected by the dealership consultant . Due to lingering uncertainty, you have been mandated by the Company to perform a one-way sensitivity analysis of your potential purchase. The current "best" guesses for the project parameters are: 1. Initial Cost (P) = $960,000 2. Salvage value (SV) = $12,133 3. Annual operating revenues (AOR) - $600,000 4. Annual operating costs (AOC) = $325,000 5. Economic life (N) - 5 years 6. MARR = 10% 7. Inflation Rate = 0%. 2 One-way Sensitivity Table Parameters -15% +10% +15% Net Present Worth (NPW) -10% -5% Reference +5% Scenario AA BB CC P AOR DD EE AOC FF GG HH KK SV N LL MM MARR NN 00 PP 27. Assume that you are required to perform a scenario analysis instead of a sensitivity analysis and that the values of the three scenarios (optimistic, most likely and pessimistic) are to be populated from the NPW dollar values of the sensitivity table which you completed above. The dollar value of the project's annual revenues (AOR) for the optimistic scenario would be a) 0; b) 600,000(1.15); c) 600,000, d) 600.000(0.85). Assume that you are required to perform a scenario analysis instead of a sensitivity analysis and that the values of the three scenarios (optimistic, most likely and pessimistic) are to be populated from the NPW dollar values of the sensitivity table which you completed above. The project's MARR for the pessimistic scenario would be a) 10% (0.85); b) 10%; c) 10%(1.15); d) 10%(0). Assume that you are asked to perform a scenario analysis instead of a sensitivity analysis and that the values of the three scenarios (optimistic, most likely and pessimistic) are to be populated from the NPW dollar values of the sensitivity table which you completed above. The project's life (duration) for the optimistic scenario would be a) 5(0) years; b) 5(0.85) years; c) 5 years; d) 5(1.15) years. 28