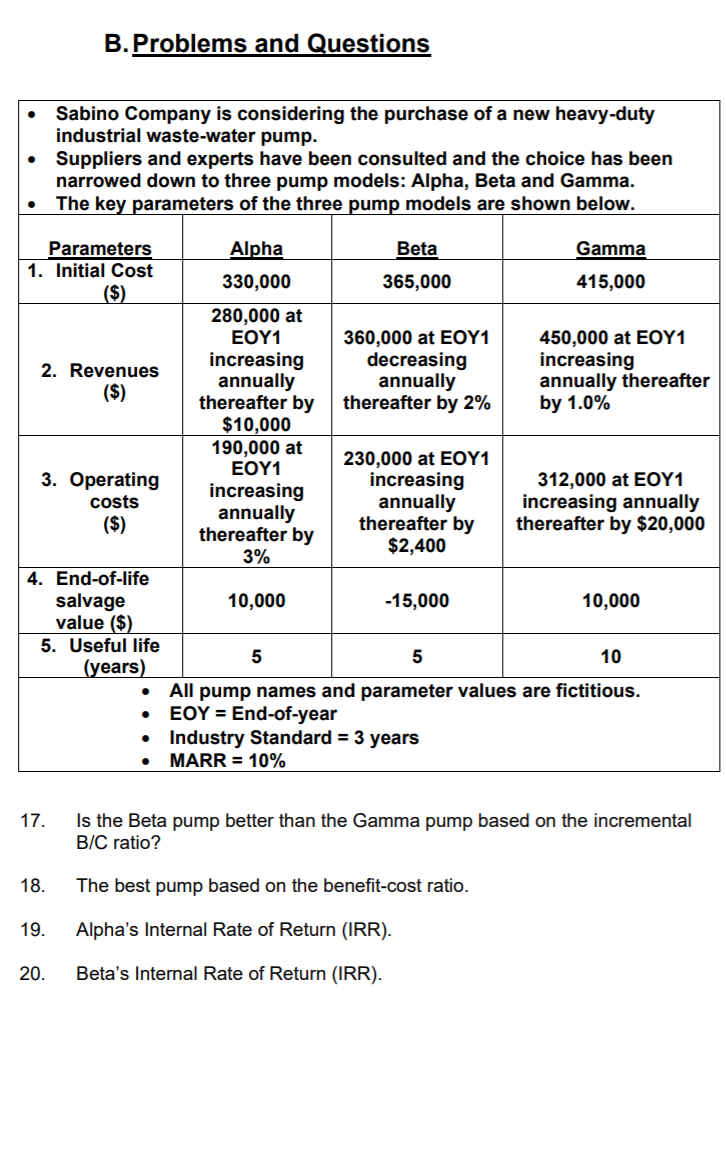

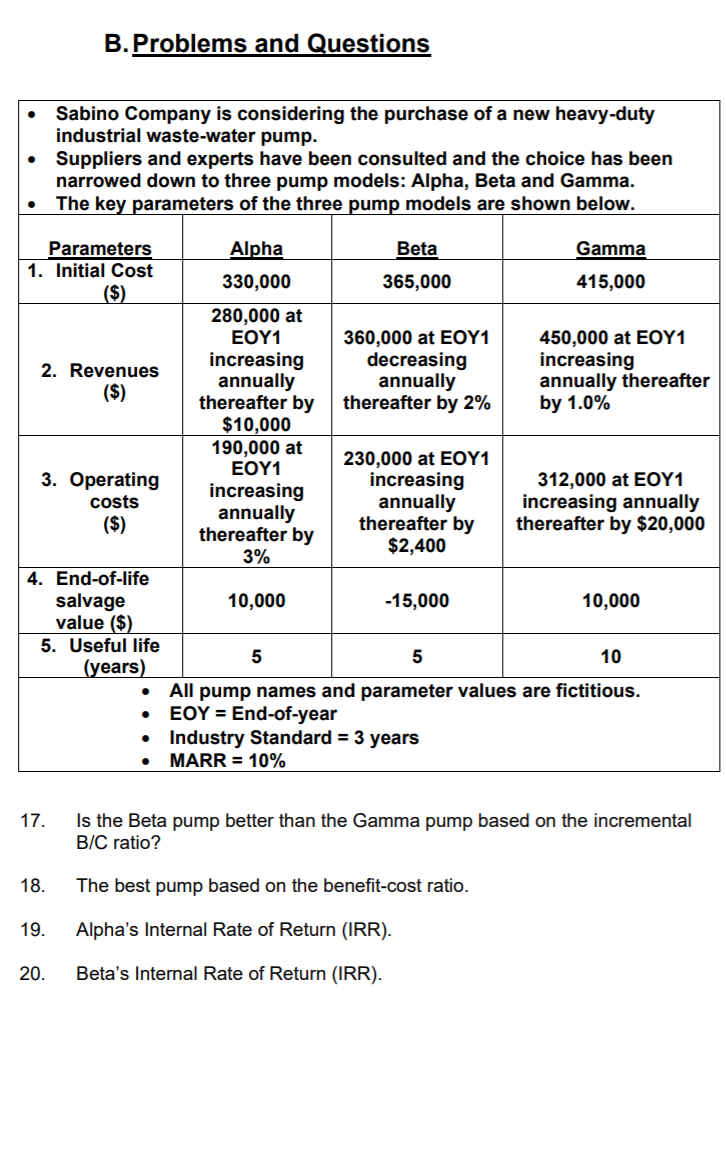

B. Problems and Questions Sabino Company is considering the purchase of a new heavy-duty industrial waste-water pump. Suppliers and experts have been consulted and the choice has been narrowed down to three pump models: Alpha, Beta and Gamma. The key parameters of the three pump models are shown below. Parameters Alpha Beta Gamma 1. Initial Cost 330,000 365,000 ($) 415,000 280,000 at EOY1 360,000 at EOY1 450,000 at EOY1 increasing decreasing increasing 2. Revenues annually ($) annually annually thereafter thereafter by thereafter by 2% by 1.0% $10,000 190,000 at EOY1 230,000 at EOY1 3. Operating increasing increasing 312,000 at EOY1 costs annually increasing annually ($) annually thereafter by thereafter by thereafter by $20,000 $2,400 3% 4. End-of-life salvage 10,000 -15,000 10,000 value ($) 5. Useful life 5 5 10 (years) All pump names and parameter values are fictitious. EOY = End-of-year Industry Standard = 3 years MARR = 10% . 17. Is the Beta pump better than the Gamma pump based on the incremental B/C ratio? 18. The best pump based on the benefit-cost ratio. 19. Alpha's Internal Rate of Return (IRR). 20. Beta's Internal Rate of Return (IRR). B. Problems and Questions Sabino Company is considering the purchase of a new heavy-duty industrial waste-water pump. Suppliers and experts have been consulted and the choice has been narrowed down to three pump models: Alpha, Beta and Gamma. The key parameters of the three pump models are shown below. Parameters Alpha Beta Gamma 1. Initial Cost 330,000 365,000 ($) 415,000 280,000 at EOY1 360,000 at EOY1 450,000 at EOY1 increasing decreasing increasing 2. Revenues annually ($) annually annually thereafter thereafter by thereafter by 2% by 1.0% $10,000 190,000 at EOY1 230,000 at EOY1 3. Operating increasing increasing 312,000 at EOY1 costs annually increasing annually ($) annually thereafter by thereafter by thereafter by $20,000 $2,400 3% 4. End-of-life salvage 10,000 -15,000 10,000 value ($) 5. Useful life 5 5 10 (years) All pump names and parameter values are fictitious. EOY = End-of-year Industry Standard = 3 years MARR = 10% . 17. Is the Beta pump better than the Gamma pump based on the incremental B/C ratio? 18. The best pump based on the benefit-cost ratio. 19. Alpha's Internal Rate of Return (IRR). 20. Beta's Internal Rate of Return (IRR)