Answered step by step

Verified Expert Solution

Question

1 Approved Answer

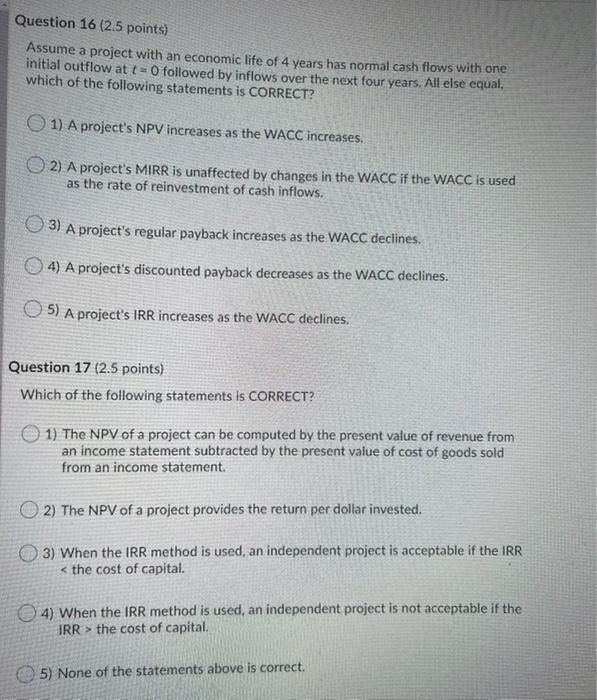

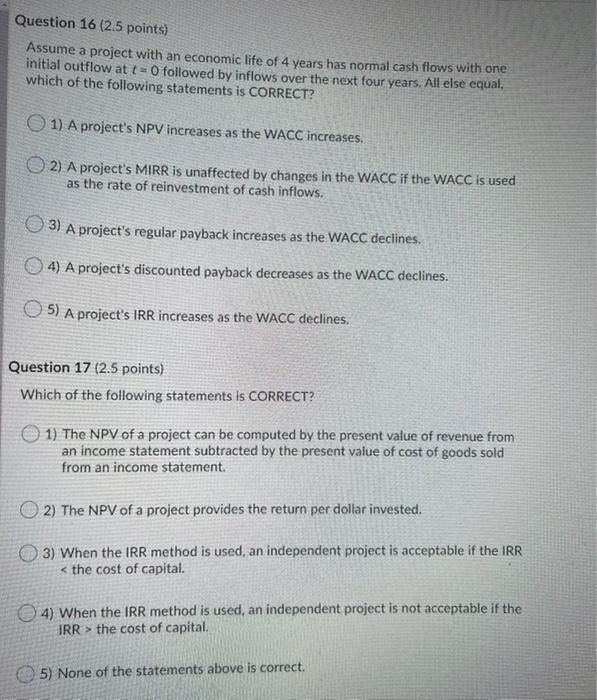

b Question 16 (2.5 points) Assume a project with an economic life of 4 years has normal cash flows with one initial outflow at t=0

b

Question 16 (2.5 points) Assume a project with an economic life of 4 years has normal cash flows with one initial outflow at t=0 followed by inflows over the next four years. All else equal, which of the following statements is CORRECT? 1) A project's NPV increases as the WACC increases. 2) A project's MIRR is unaffected by changes in the WACC if the WACC is used as the rate of reinvestment of cash inflows. 3) A project's regular payback increases as the WACC declines. 4) A project's discounted payback decreases as the WACC declines. 5) A project's IRR increases as the WACC declines. Question 17 (2.5 points) Which of the following statements is CORRECT? 1) The NPV of a project can be computed by the present value of revenue from an income statement subtracted by the present value of cost of goods sold from an income statement 2) The NPV of a project provides the return per dollar invested. 3) When the IRR method is used, an independent project is acceptable if the IRR the cost of capital. 5) None of the statements above is correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started