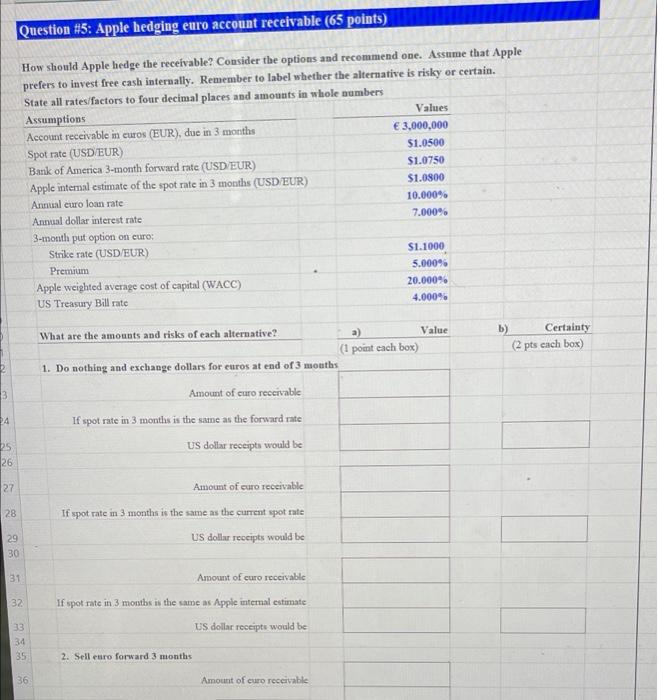

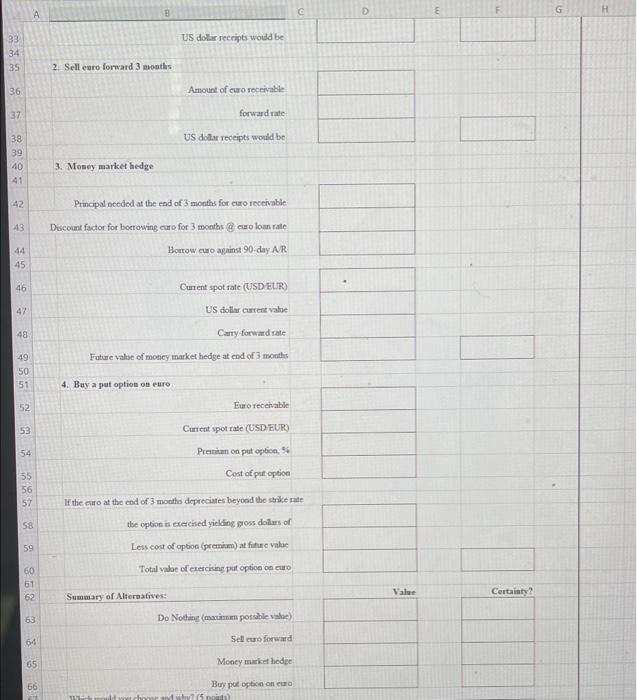

Question #5: Apple hedging euro account receivable (65 points) How should Apple hedge the receivable? Consider the options and recommend one. Assume that Apple prefers to invest free cash internally. Remember to label whether the alternative is risky or certain. State all rates/factors to four decimal places and amounts in whole numbers Assumptions Values Account receivable in curos (EUR), due in 3 months 3,000,000 Spot rate (USD/EUR) $1.0500 Bank of America 3-month forward rate (USD/EUR) $1.0750 Apple intemal estimate of the spot rate in 3 months (USD/EUR) $1.0800 Annual euro loan rate 10.000% Annual dollar interest rate 7.000% 3-month put option on curo: Strike rate (USD/EUR) $1.1000 Premium 5.000% Apple weighted average cost of capital (WACC) 20.000 US Treasury Bill rate 4.000% b) Certainty 2 pts each box) 3 What are the amounts and risks of each alternative? a) Value (point each box) 1. Do nothing and exchange dollars for euros at end of 3 months Amount of curo receivable If spot rate in 3 months is the same as the forward rate US dollar receipts would be 24 25 26 27 Amount of curo receivable 28 If spot rate in 3 months is the same as the current spot rate 29 30 US dollar recipts would be 31 Amount of curo receivable 32 If spot rate in 3 months is the same as Apple internal estimate US dollar receipts would be 33 34 35 2. Sell euro forward 3 months 36 Amount of curo receivable B c D E G US dollar receipts would be 33 34 35 2. Sell euro forward 3 months 36 Amount of emo receivable 37 forward te US dollar receipts would be 38 39 40 41 3. Money market hedge 42 Principal needed at the end of 3 months for co receivable Discount factor for borrowing cuto for 3 months @euroloanate 43 Borrowero against 90 day AR 44 45 46 Current spot rate (USD EUR) 47 US dollar cent value 48 Carry forwarte Future value of money market hedge at end of 3 months 49 50 51 4. Buy a pot option on euro 52 Euro receivable 53 Current spot rate (USD EUR) Prema on put options Cost of put option 55 56 57 the curo at the end of 3 months depreciates beyond the strikerate 58 the option is exercised yielding gross dollars of 59 Less cost of option (premium) at future value Total vabae of exercising put option on ewo 60 61 62 Vale Certainty? Summary of Alternatives: 63 Do Nothing (ma possibile vie) 64 Selo forward 65 Money make hedge 66 Buy put option on cro points Question #5: Apple hedging euro account receivable (65 points) How should Apple hedge the receivable? Consider the options and recommend one. Assume that Apple prefers to invest free cash internally. Remember to label whether the alternative is risky or certain. State all rates/factors to four decimal places and amounts in whole numbers Assumptions Values Account receivable in curos (EUR), due in 3 months 3,000,000 Spot rate (USD/EUR) $1.0500 Bank of America 3-month forward rate (USD/EUR) $1.0750 Apple intemal estimate of the spot rate in 3 months (USD/EUR) $1.0800 Annual euro loan rate 10.000% Annual dollar interest rate 7.000% 3-month put option on curo: Strike rate (USD/EUR) $1.1000 Premium 5.000% Apple weighted average cost of capital (WACC) 20.000 US Treasury Bill rate 4.000% b) Certainty 2 pts each box) 3 What are the amounts and risks of each alternative? a) Value (point each box) 1. Do nothing and exchange dollars for euros at end of 3 months Amount of curo receivable If spot rate in 3 months is the same as the forward rate US dollar receipts would be 24 25 26 27 Amount of curo receivable 28 If spot rate in 3 months is the same as the current spot rate 29 30 US dollar recipts would be 31 Amount of curo receivable 32 If spot rate in 3 months is the same as Apple internal estimate US dollar receipts would be 33 34 35 2. Sell euro forward 3 months 36 Amount of curo receivable B c D E G US dollar receipts would be 33 34 35 2. Sell euro forward 3 months 36 Amount of emo receivable 37 forward te US dollar receipts would be 38 39 40 41 3. Money market hedge 42 Principal needed at the end of 3 months for co receivable Discount factor for borrowing cuto for 3 months @euroloanate 43 Borrowero against 90 day AR 44 45 46 Current spot rate (USD EUR) 47 US dollar cent value 48 Carry forwarte Future value of money market hedge at end of 3 months 49 50 51 4. Buy a pot option on euro 52 Euro receivable 53 Current spot rate (USD EUR) Prema on put options Cost of put option 55 56 57 the curo at the end of 3 months depreciates beyond the strikerate 58 the option is exercised yielding gross dollars of 59 Less cost of option (premium) at future value Total vabae of exercising put option on ewo 60 61 62 Vale Certainty? Summary of Alternatives: 63 Do Nothing (ma possibile vie) 64 Selo forward 65 Money make hedge 66 Buy put option on cro points