Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) Raytheon Co. is a U.S based MNC that purchases most of the materials from Australia and generates a small portion of its sales

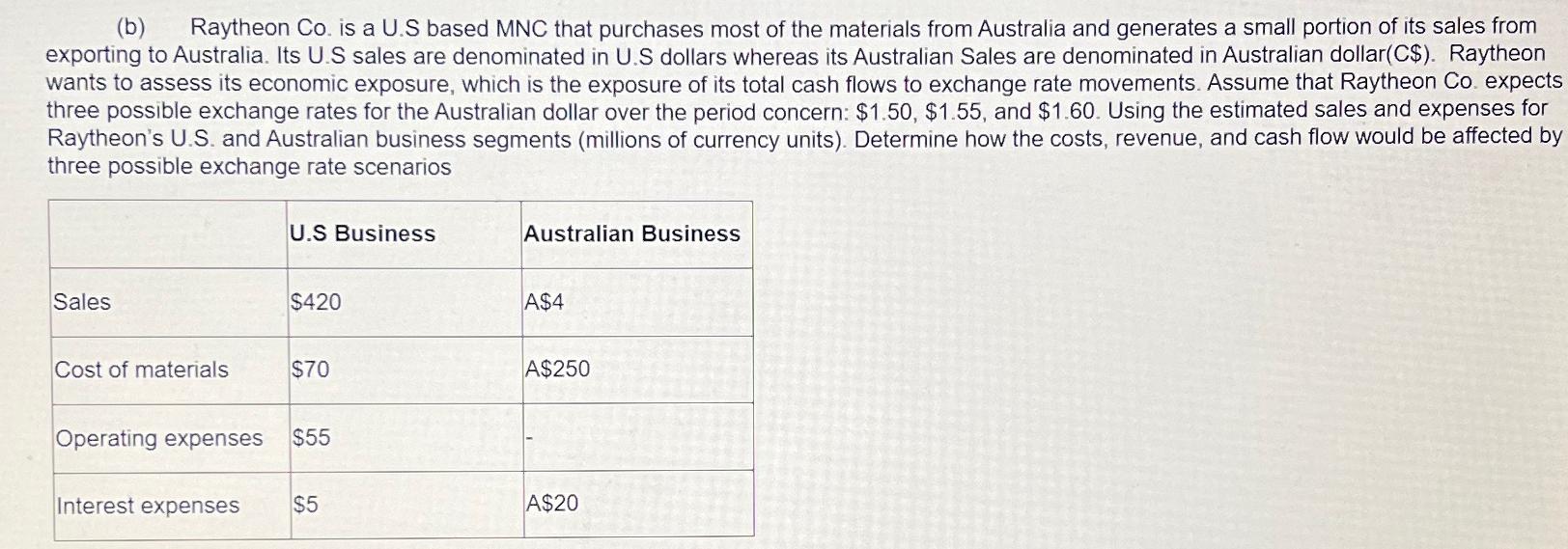

(b) Raytheon Co. is a U.S based MNC that purchases most of the materials from Australia and generates a small portion of its sales from exporting to Australia. Its U.S sales are denominated in U.S dollars whereas its Australian Sales are denominated in Australian dollar (C$). Raytheon wants to assess its economic exposure, which is the exposure of its total cash flows to exchange rate movements. Assume that Raytheon Co. expects three possible exchange rates for the Australian dollar over the period concern: $1.50, $1.55, and $1.60. Using the estimated sales and expenses for Raytheon's U.S. and Australian business segments (millions of currency units). Determine how the costs, revenue, and cash flow would be affected by three possible exchange rate scenarios Sales Cost of materials Operating expenses Interest expenses U.S Business $420 $70 $55 $5 Australian Business A$4 A$250 A$20

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To assess the economic exposure of Raytheons total cash flows to exchange rate movements we need to consider the potential impact of three po...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started