Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) Required information [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in

b)

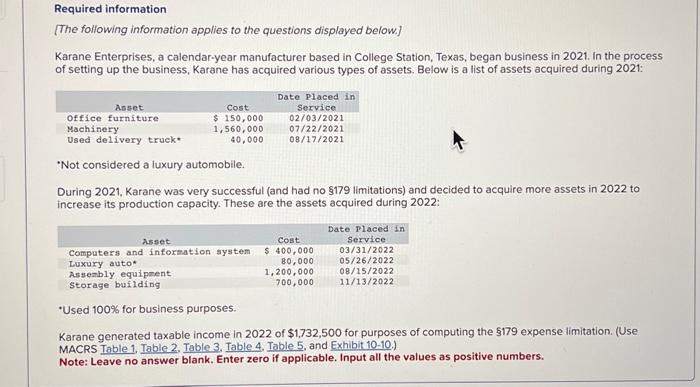

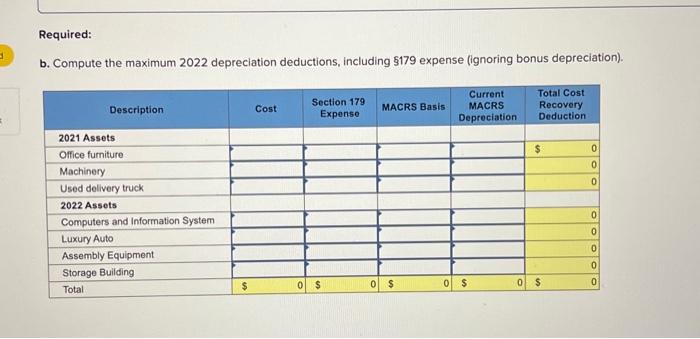

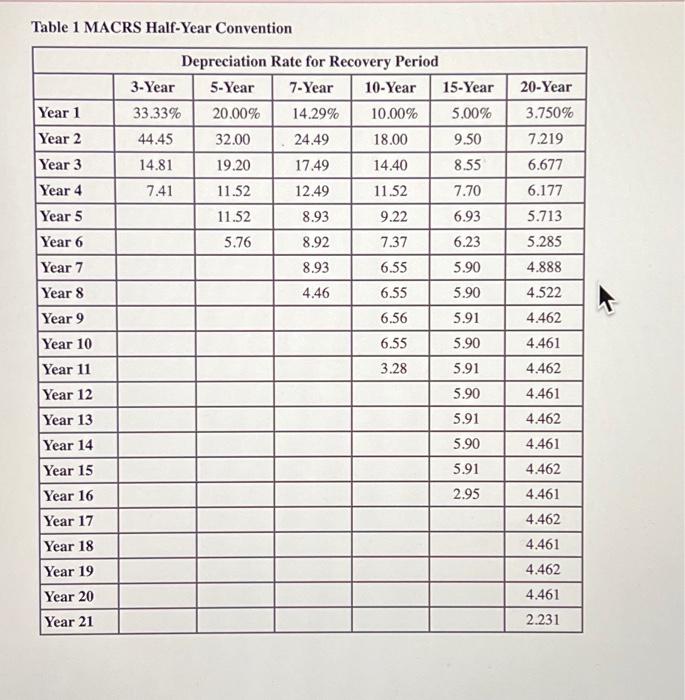

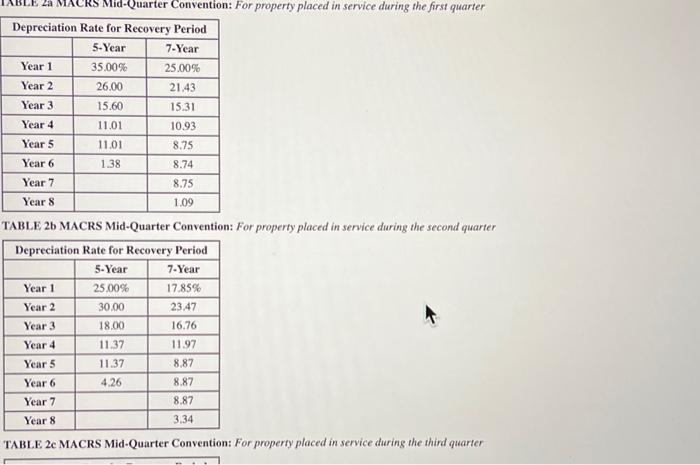

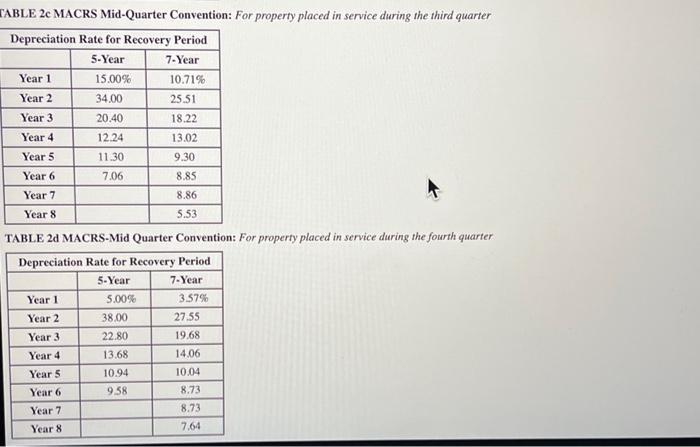

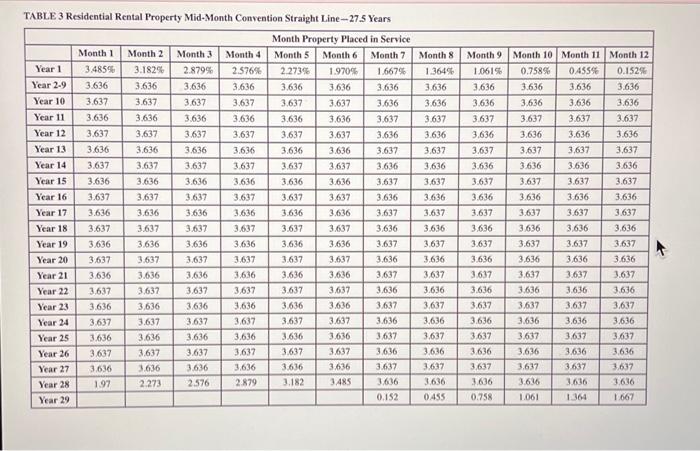

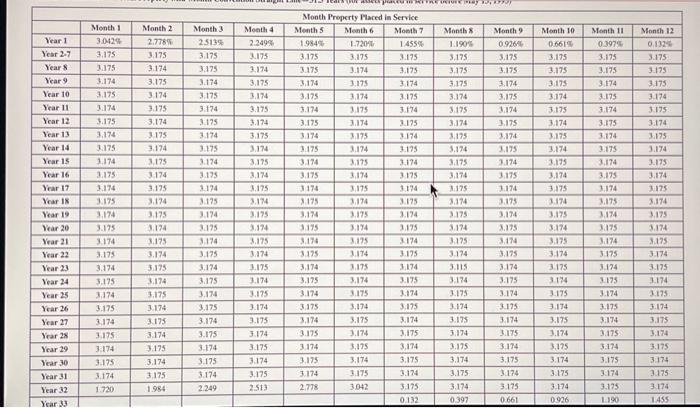

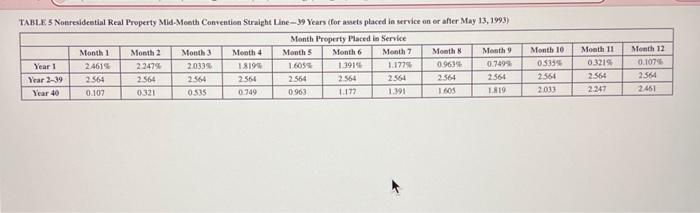

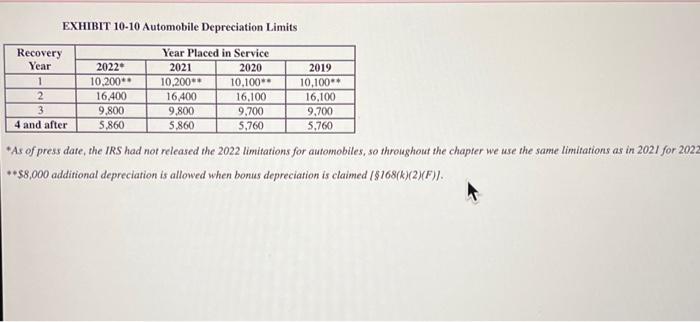

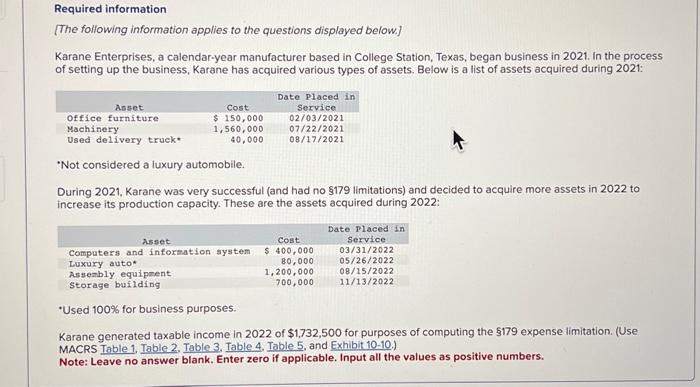

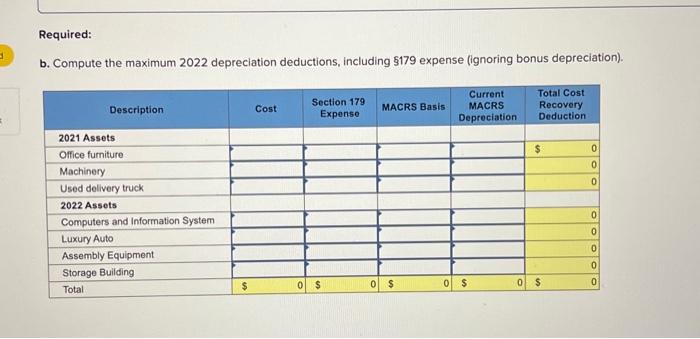

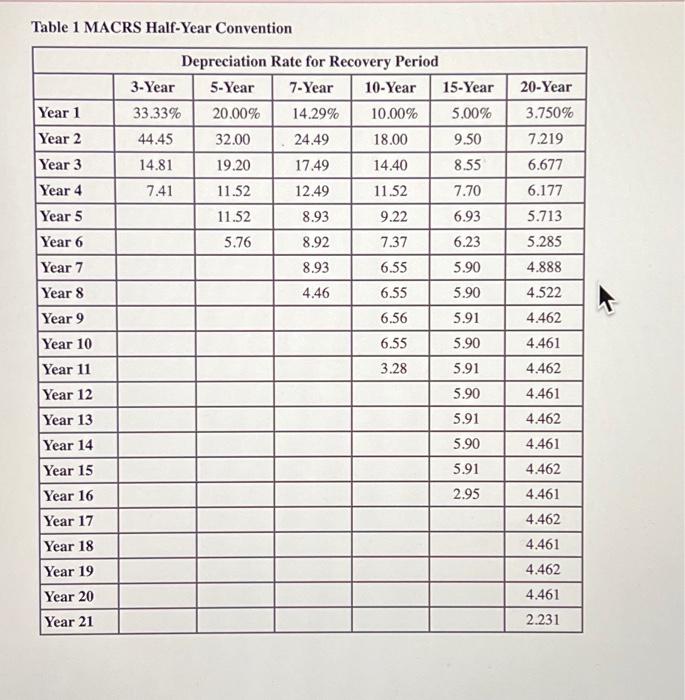

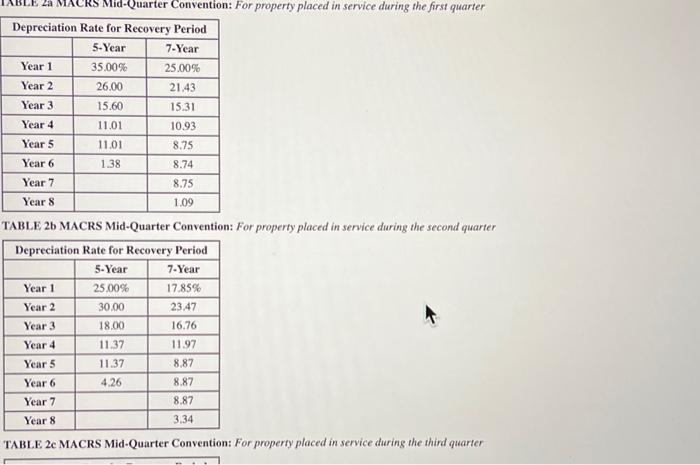

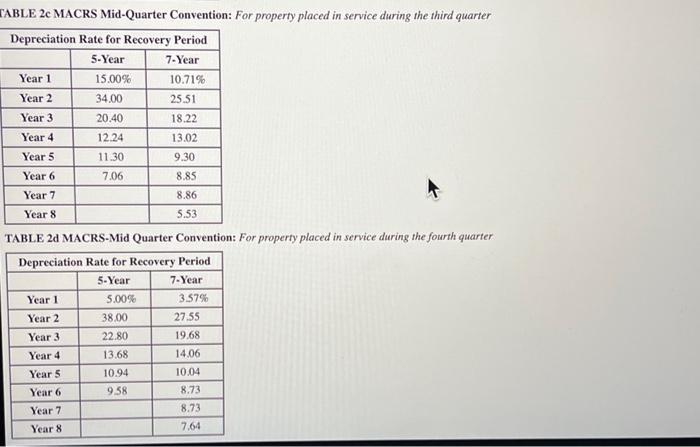

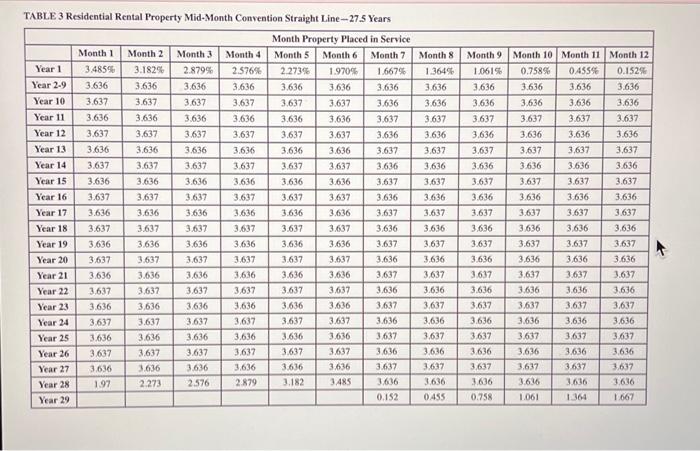

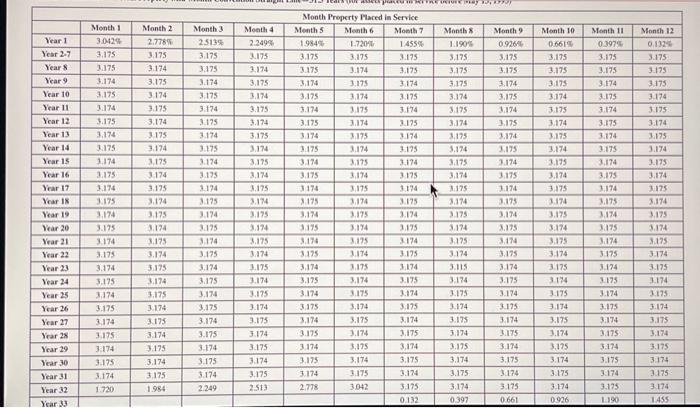

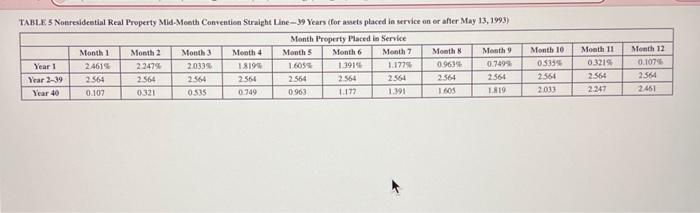

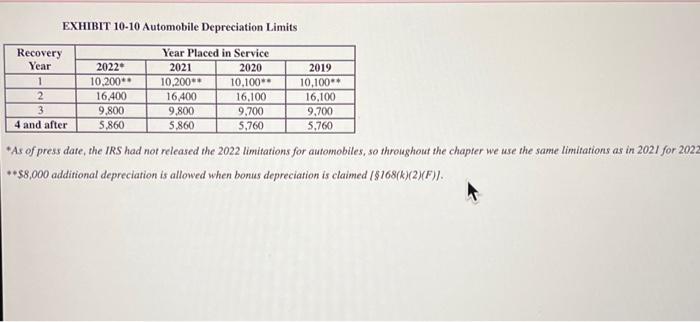

Required information [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2021: "Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 to increase its production capacity. These are the assets acquired during 2022: 'Used 100% for business purposes. Karane generated taxable income in 2022 of $1,732,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1, Table 2. Table 3, Table 4. Table 5, and Exhibit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. b. Compute the maximum 2022 depreciation deductions, including $179 expense (ignoring bonus depreciation). Table 1 MACRS Half-Year Convention TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter ABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE 3 Residential Rental Froperty Mid-Month Convention Straight Line -27.5 Years TABL.E. 5 Nouredidestial Real Property Mid-Moeth Conventien Straight Uine-39 Vears (for assets placed in service on or affer May 13, 1993) EXHIBIT 10-10 Automobile Depreciation Limits *As of press date, the IRS had not released the 2022 limitations for automobiles, so throughout the chapter we use the same limitations as in 2021 for 202 $8,000 additional depreciation is allowed when bonus depreciation is claimed ($168(k)(2)(F))

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started