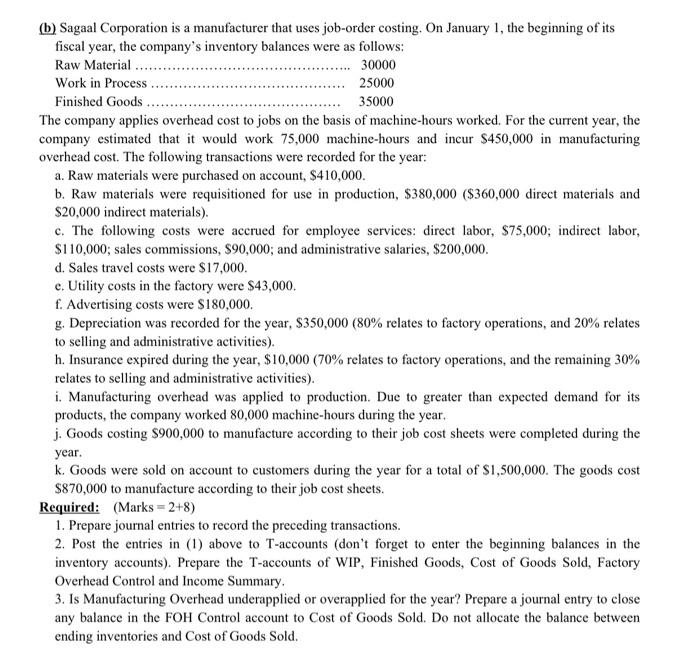

(b) Sagaal Corporation is a manufacturer that uses job-order costing, On January 1, the beginning of its fiscal year, the company's inventory balances were as follows: Raw Material 30000 Work in Process 25000 Finished Goods .. 35000 The company applies overhead cost to jobs on the basis of machine-hours worked. For the current year, the company estimated that it would work 75,000 machine-hours and incur $450,000 in manufacturing overhead cost. The following transactions were recorded for the year: a. Raw materials were purchased on account, $410,000. b. Raw materials were requisitioned for use in production, $380,000 ($360,000 direct materials and $20,000 indirect materials). c. The following costs were accrued for employee services: direct labor, $75,000; indirect labor, $110,000; sales commissions, S90,000; and administrative salaries, $200,000. d. Sales travel costs were $17,000. c. Utility costs in the factory were $43,000 f. Advertising costs were $180,000 g. Depreciation was recorded for the year, $350,000 (80% relates to factory operations, and 20% relates to selling and administrative activities). h. Insurance expired during the year, $10,000 (70% relates to factory operations, and the remaining 30% relates to selling and administrative activities). i. Manufacturing overhead was applied to production. Due to greater than expected demand for its products, the company worked 80,000 machine-hours during the year. j. Goods costing $900,000 to manufacture according to their job cost sheets were completed during the year. k. Goods were sold on account to customers during the year for a total of $1,500,000. The goods cost $870,000 to manufacture according to their job cost sheets. Required: (Marks = 2+8) 1. Prepare journal entries to record the preceding transactions. 2. Post the entries in (1) above to T-accounts (don't forget to enter the beginning balances in the inventory accounts). Prepare the T-accounts of WIP, Finished Goods, Cost of Goods Sold, Factory Overhead Control and Income Summary 3. Is Manufacturing Overhead underapplied or overapplied for the year? Prepare a journal entry to close any balance in the FOH Control account to Cost of Goods Sold. Do not allocate the balance between ending inventories and Cost of Goods Sold