Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) should the company restructure? name 1 financial factor and 1 non financial factor Company JKL is considering a plan to restructure its organization in

(b) should the company restructure? name 1 financial factor and 1 non financial factor

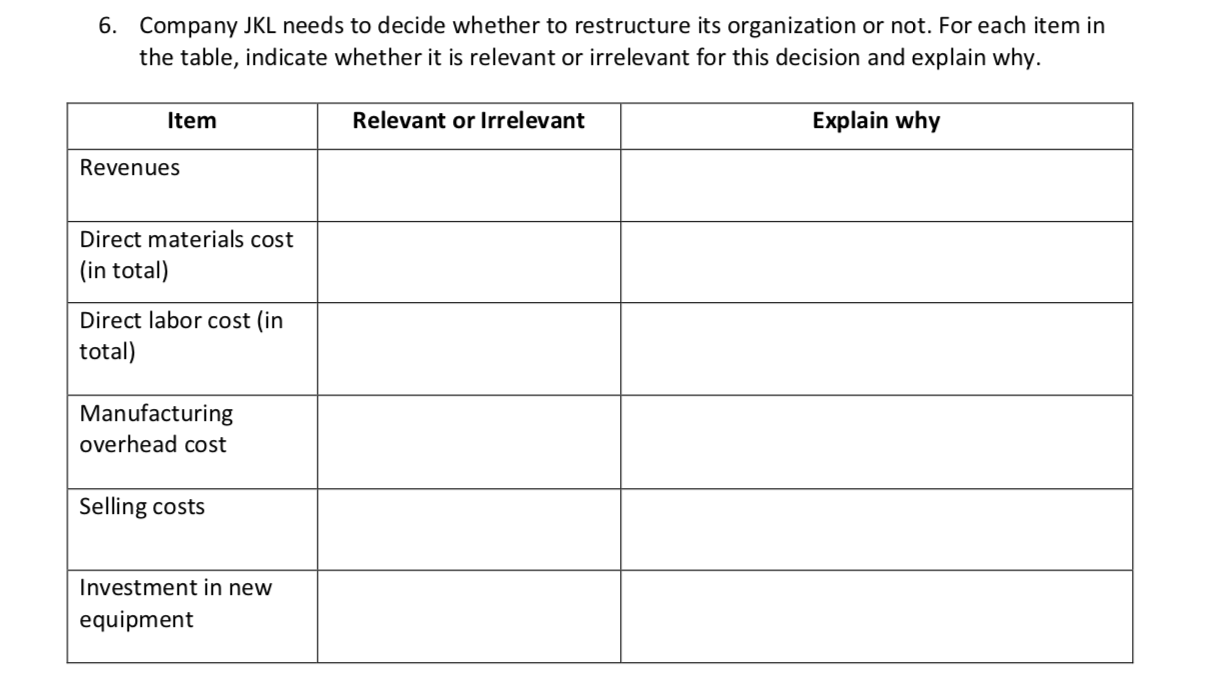

Company JKL is considering a plan to restructure its organization in an effort to reduce its costs. The company's manufacturing operations are currently being done by 350 factory workers who are paid $11 per direct labor hour (DLH) and who each work 1,500 DLH per year. Under this restructuring, the company would automate parts of its manufacturing operations. The automation would result in 20% of the factory workers losing their jobs, and it would require an investment of $1,500,000 in new equipment. Furthermore, the company would increase its hourly wage rate by $2 per DLH for the remaining factory workers. This restructuring is expected to increase output by 15% from its current level of 40,000 units, although management does not plan to change the selling price for its customers from its current price of $200 per unit. The new equipment is not expected to impact the direct materials cost per unit of $15 or the manufacturing overhead costs of $750,000; however, selling costs are currently $400,000 but they would increase to $440,000 if the company restructures. 6. Company JKL needs to decide whether to restructure its organization or not. For each item in the table, indicate whether it is relevant or irrelevant for this decision and explain why. Item Relevant or Irrelevant Explain why Revenues Direct materials cost (in total) Direct labor cost (in total) Manufacturing overhead cost Selling costs Investment in new equipmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started