Answered step by step

Verified Expert Solution

Question

1 Approved Answer

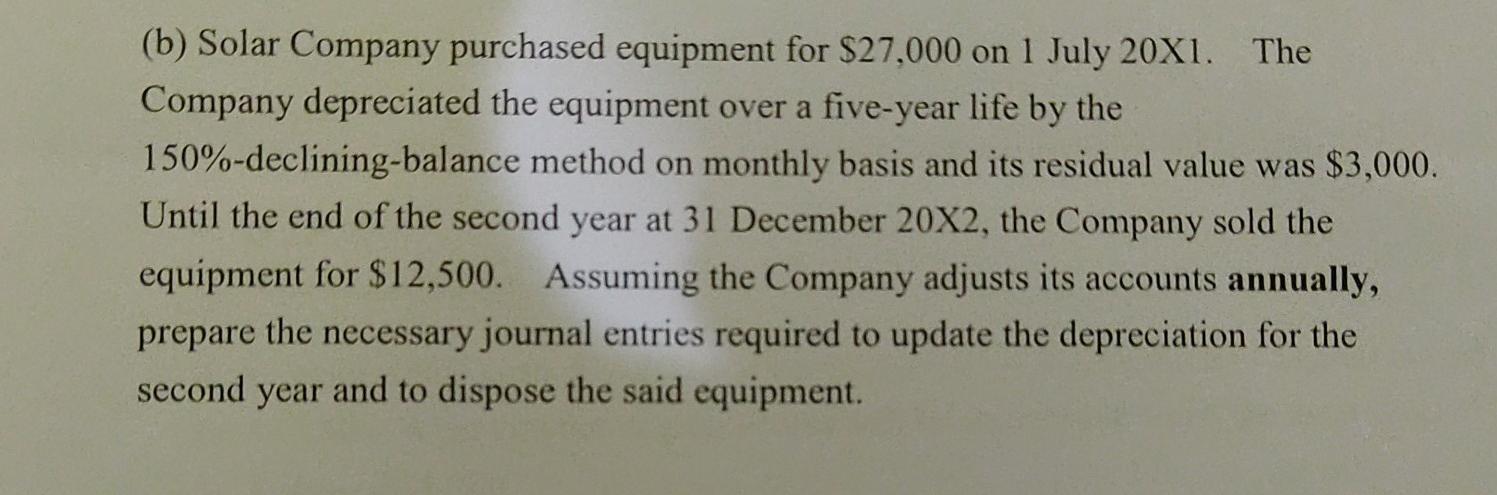

(b) Solar Company purchased equipment for $27,000 on 1 July 20X1. The Company depreciated the equipment over a five-year life by the 150%-declining-balance method on

(b) Solar Company purchased equipment for $27,000 on 1 July 20X1. The Company depreciated the equipment over a five-year life by the 150%-declining-balance method on monthly basis and its residual value was $3,000. Until the end of the second year at 31 December 20X2, the Company sold the equipment for $12,500. Assuming the Company adjusts its accounts annually, prepare the necessary journal entries required to update the depreciation for the second year and to dispose the said equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started