Answered step by step

Verified Expert Solution

Question

1 Approved Answer

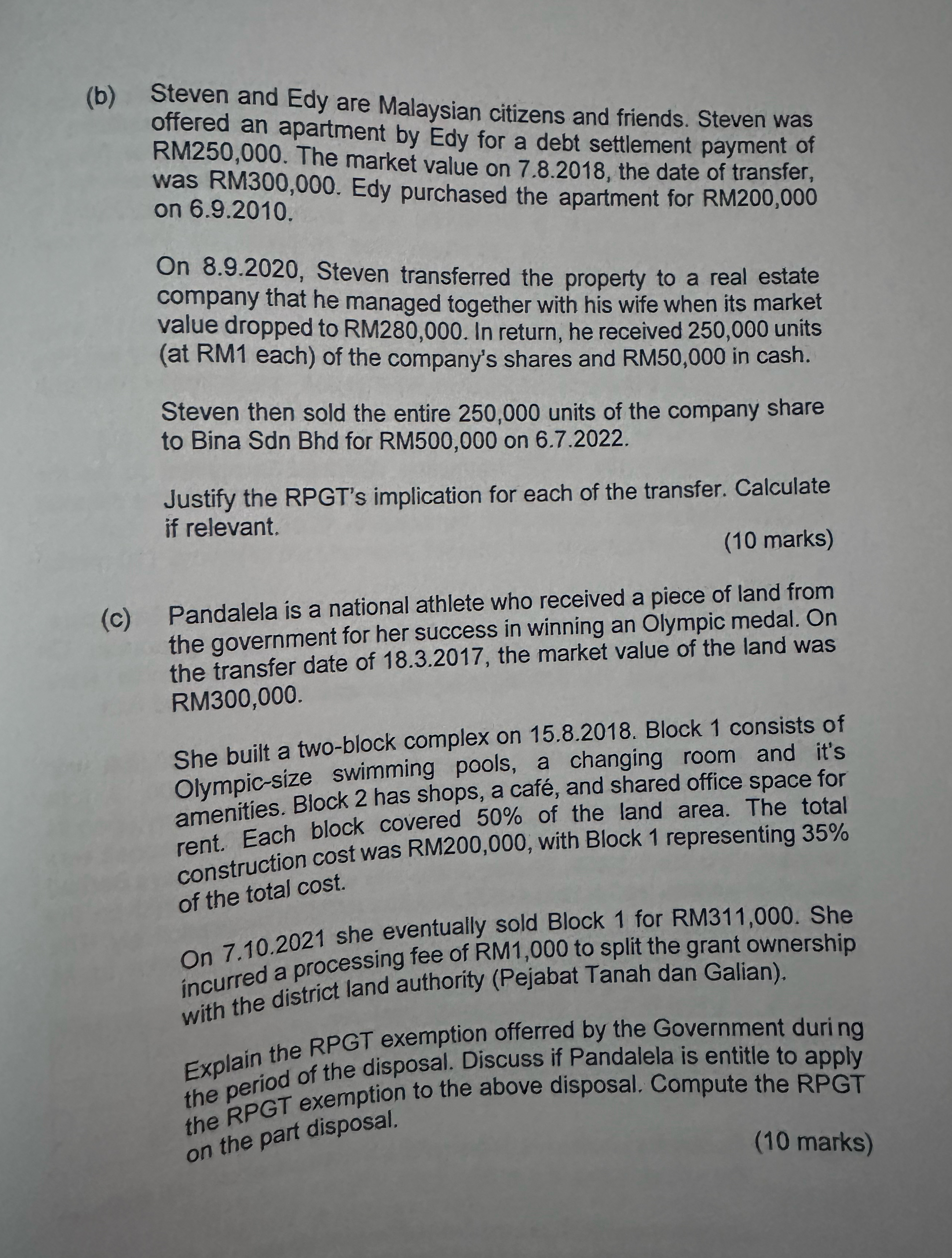

(b) Steven and Edy are Malaysian citizens and friends. Steven was offered an apartment by Edy for a debt settlement payment of RM250,000. The

(b) Steven and Edy are Malaysian citizens and friends. Steven was offered an apartment by Edy for a debt settlement payment of RM250,000. The market value on 7.8.2018, the date of transfer, was RM300,000. Edy purchased the apartment for RM200,000 on 6.9.2010. On 8.9.2020, Steven transferred the property to a real estate company that he managed together with his wife when its market value dropped to RM280,000. In return, he received 250,000 units (at RM1 each) of the company's shares and RM50,000 in cash. Steven then sold the entire 250,000 units of the company share to Bina Sdn Bhd for RM500,000 on 6.7.2022. Justify the RPGT's implication for each of the transfer. Calculate if relevant. (10 marks) (c) Pandalela is a national athlete who received a piece of land from the government for her success in winning an Olympic medal. On the transfer date of 18.3.2017, the market value of the land was RM300,000. She built a two-block complex on 15.8.2018. Block 1 consists of Olympic-size swimming pools, a changing room and it's amenities. Block 2 has shops, a caf, and shared office space for rent. Each block covered 50% of the land area. The total construction cost was RM200,000, with Block 1 representing 35% of the total cost. On 7.10.2021 she eventually sold Block 1 for RM311,000. She incurred a processing fee of RM1,000 to split the grant ownership with the district land authority (Pejabat Tanah dan Galian). Explain the RPGT exemption offerred by the Government during the period of the disposal. Discuss if Pandalela is entitle to apply the RPGT exemption to the above disposal. Compute the RPGT on the part disposal. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started