Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) Suppose a Spanish investor is considering the following investments: Investment A: This is the ordinary share of a matured company. The market price for

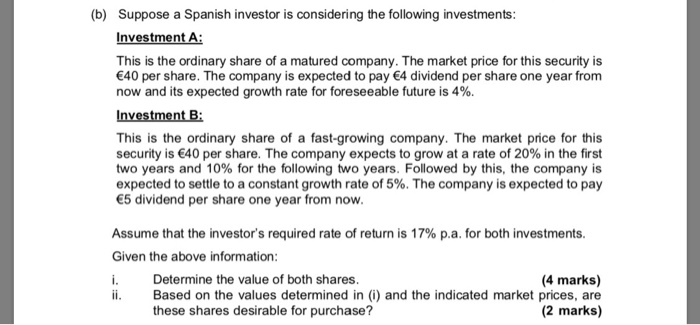

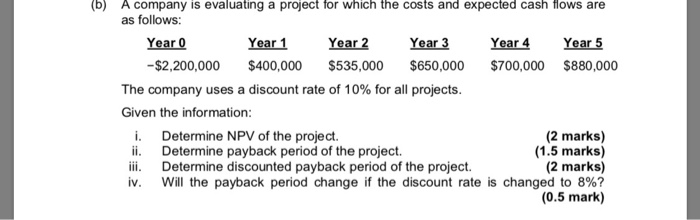

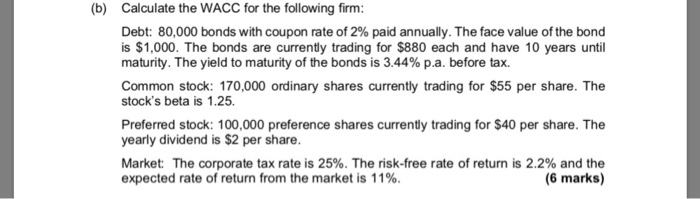

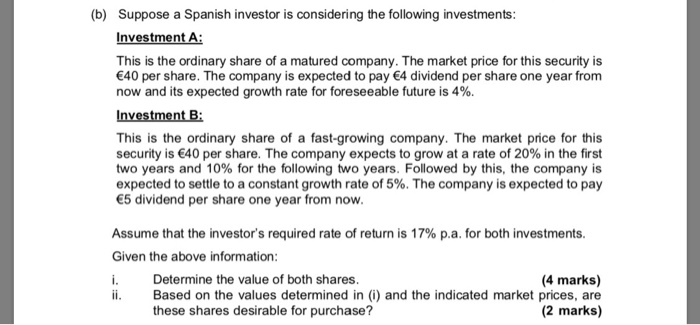

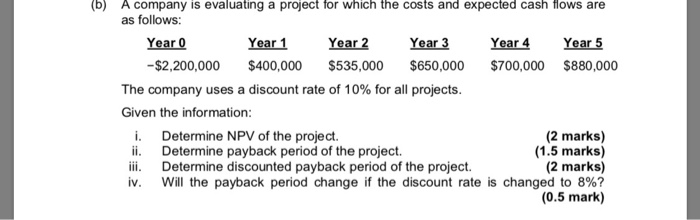

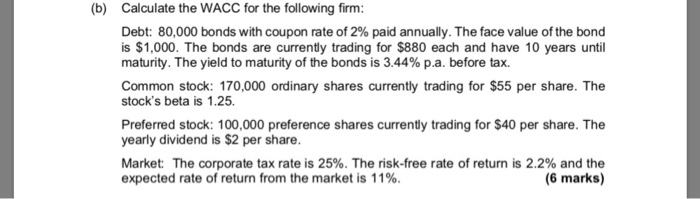

(b) Suppose a Spanish investor is considering the following investments: Investment A: This is the ordinary share of a matured company. The market price for this security is 40 per share. The company is expected to pay 4 dividend per share one year from now and its expected growth rate for foreseeable future is 4%. Investment B: This is the ordinary share of a fast-growing company. The market price for this security is 40 per share. The company expects to grow at a rate of 20% in the first two years and 10% for the following two years. Followed by this, the company is expected to settle to a constant growth rate of 5%. The company is expected to pay 5 dividend per share one year from now. Assume that the investor's required rate of return is 17% p.a. for both investments, Given the above information: Determine the value of both shares. (4 marks) ii. Based on the values determined in (i) and the indicated market prices, are these shares desirable for purchase? (2 marks) (b) A company is evaluating a project for which the costs and expected cash flows are as follows: Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 -$2,200,000 $400,000 $535,000 $650,000 $700,000 $880,000 The company uses a discount rate of 10% for all projects. Given the information: i. Determine NPV of the project. (2 marks) ii. Determine payback period of the project. (1.5 marks) iii. Determine discounted payback period of the project. (2 marks) iv. Will the payback period change if the discount rate is changed to 8%? (0.5 mark) (b) Calculate the WACC for the following firm: Debt: 80,000 bonds with coupon rate of 2% paid annually. The face value of the bond is $1,000. The bonds are currently trading for $880 each and have 10 years until maturity. The yield to maturity of the bonds is 3.44% p.a. before tax. Common stock: 170,000 ordinary shares currently trading for $55 per share. The stock's beta is 1.25. Preferred stock: 100,000 preference shares currently trading for $40 per share. The yearly dividend is $2 per share Market: The corporate tax rate is 25%. The risk-free rate of return is 2.2% and the expected rate of return from the market is 11%. (6 marks)

(b) Suppose a Spanish investor is considering the following investments: Investment A: This is the ordinary share of a matured company. The market price for this security is 40 per share. The company is expected to pay 4 dividend per share one year from now and its expected growth rate for foreseeable future is 4%. Investment B: This is the ordinary share of a fast-growing company. The market price for this security is 40 per share. The company expects to grow at a rate of 20% in the first two years and 10% for the following two years. Followed by this, the company is expected to settle to a constant growth rate of 5%. The company is expected to pay 5 dividend per share one year from now. Assume that the investor's required rate of return is 17% p.a. for both investments, Given the above information: Determine the value of both shares. (4 marks) ii. Based on the values determined in (i) and the indicated market prices, are these shares desirable for purchase? (2 marks) (b) A company is evaluating a project for which the costs and expected cash flows are as follows: Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 -$2,200,000 $400,000 $535,000 $650,000 $700,000 $880,000 The company uses a discount rate of 10% for all projects. Given the information: i. Determine NPV of the project. (2 marks) ii. Determine payback period of the project. (1.5 marks) iii. Determine discounted payback period of the project. (2 marks) iv. Will the payback period change if the discount rate is changed to 8%? (0.5 mark) (b) Calculate the WACC for the following firm: Debt: 80,000 bonds with coupon rate of 2% paid annually. The face value of the bond is $1,000. The bonds are currently trading for $880 each and have 10 years until maturity. The yield to maturity of the bonds is 3.44% p.a. before tax. Common stock: 170,000 ordinary shares currently trading for $55 per share. The stock's beta is 1.25. Preferred stock: 100,000 preference shares currently trading for $40 per share. The yearly dividend is $2 per share Market: The corporate tax rate is 25%. The risk-free rate of return is 2.2% and the expected rate of return from the market is 11%. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started