Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Inflation Rate of Return (Nominal) IARR N FV in current dollar FV in future dollar Exisiting saving Year 1 2 3 4 5 6 7

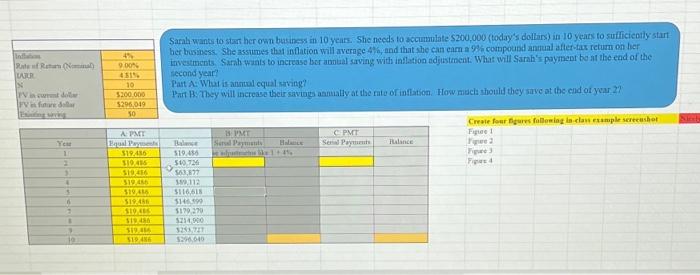

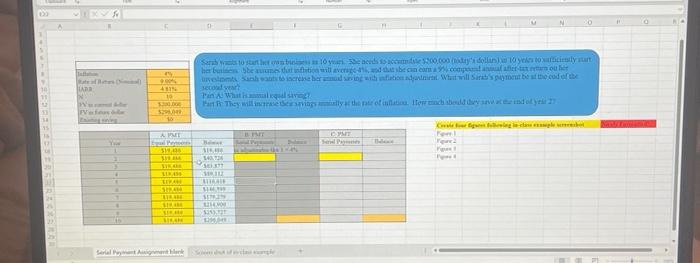

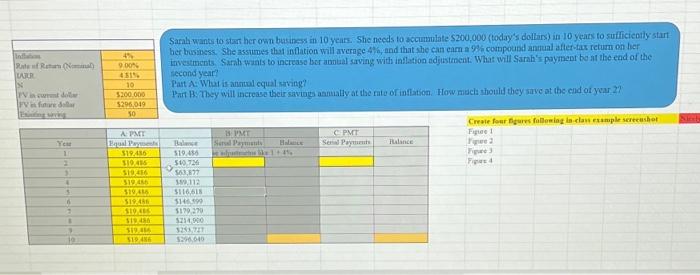

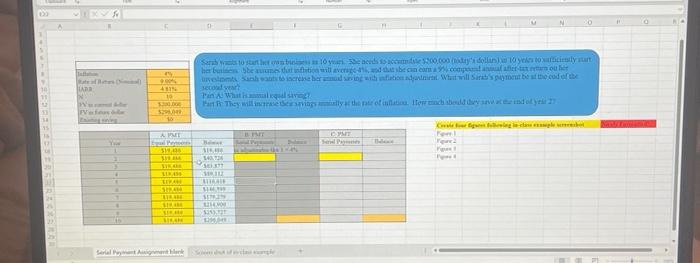

Inflation Rate of Return (Nominal) IARR N FV in current dollar FV in future dollar Exisiting saving Year 1 2 3 4 5 6 7 8 9 10 4% 9.00% 4.81% 10 $200,000 $296,049 SO A: PMT Equal Payments $19,486 $19,486 $19,486 $19,486 $19,486 $19,486 $19,486 $19,486 $19,486 $19,486 Sarah wants to start her own business in 10 years. She needs to accumulate $200,000 (today's dollars) in 10 years to sufficiently start her business. She assumes that inflation will average 4%, and that she can earn a 9% compound annual after-tax return on her investments. Sarah wants to increase her annual saving with inflation adjustment. What will Sarah's payment be at the end of the second year? Part A: What is annual equal saving? Part B: They will increase their savings annually at the rate of inflation. How much should they save at the end of year 2? + Balance $19,486 $40,726 $63,877 $89,112 $116,618 $146,599 $179,279 $214,900 $253,727 $296,049 B: PMT Serial Payments Balance se adjustmetns like 1 + 4% C: PMT Serial Payments Balance Create four figures following in-class example screenshot Figure 1 Figure 2 Figure 3 Figure 4 Nicely

Sarah wants to start her om business in 10 years. She needs to accumulate $200,000 (today's dollirs) in 10 years to sufficiently start sccond year? Pat A: What is anmol cqual saving? Par B. They will increase their sivings asmally at the nite of inflation. How mech should they save ot the cend ot your 27 Fines 1 rowee 2 Firues 3 Figat 4 yecost wait

Sarah wants to start her om business in 10 years. She needs to accumulate $200,000 (today's dollirs) in 10 years to sufficiently start sccond year? Pat A: What is anmol cqual saving? Par B. They will increase their sivings asmally at the nite of inflation. How mech should they save ot the cend ot your 27 Fines 1 rowee 2 Firues 3 Figat 4 yecost wait

Inflation Rate of Return (Nominal) IARR N FV in current dollar FV in future dollar Exisiting saving Year 1 2 3 4 5 6 7 8 9 10 4% 9.00% 4.81% 10 $200,000 $296,049 SO A: PMT Equal Payments $19,486 $19,486 $19,486 $19,486 $19,486 $19,486 $19,486 $19,486 $19,486 $19,486 Sarah wants to start her own business in 10 years. She needs to accumulate $200,000 (today's dollars) in 10 years to sufficiently start her business. She assumes that inflation will average 4%, and that she can earn a 9% compound annual after-tax return on her investments. Sarah wants to increase her annual saving with inflation adjustment. What will Sarah's payment be at the end of the second year? Part A: What is annual equal saving? Part B: They will increase their savings annually at the rate of inflation. How much should they save at the end of year 2? + Balance $19,486 $40,726 $63,877 $89,112 $116,618 $146,599 $179,279 $214,900 $253,727 $296,049 B: PMT Serial Payments Balance se adjustmetns like 1 + 4% C: PMT Serial Payments Balance Create four figures following in-class example screenshot Figure 1 Figure 2 Figure 3 Figure 4 Nicely

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started