Answered step by step

Verified Expert Solution

Question

1 Approved Answer

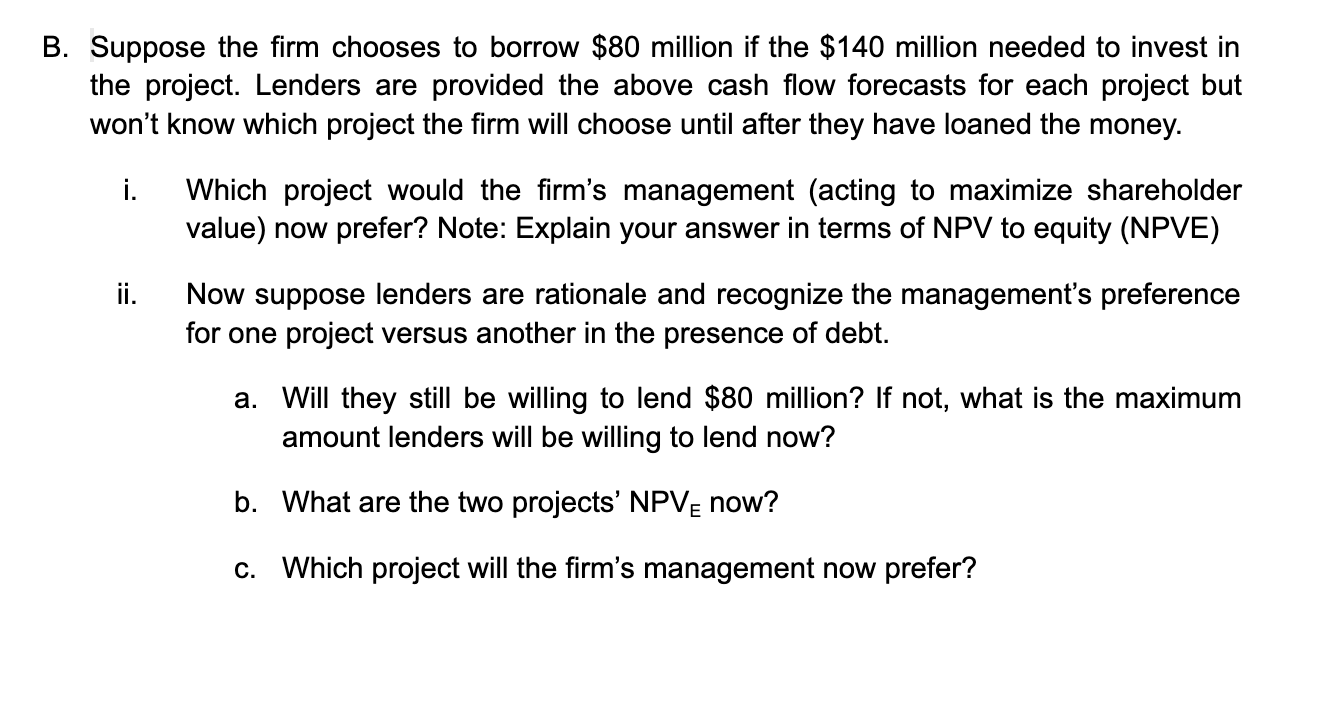

B. Suppose the firm chooses to borrow $80 million if the $140 million needed to invest in the project. Lenders are provided the above

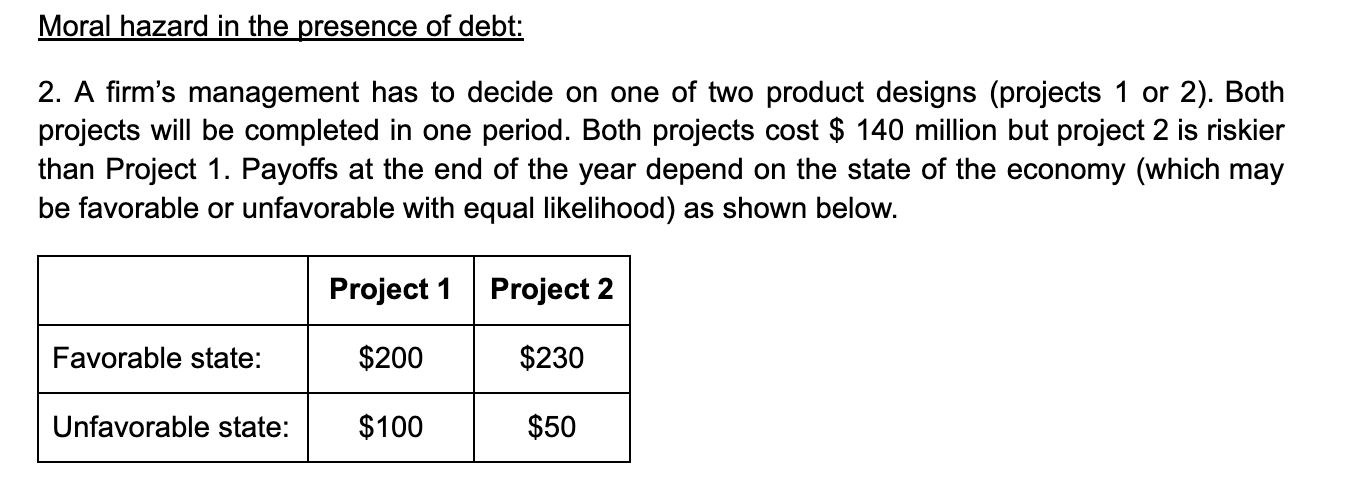

B. Suppose the firm chooses to borrow $80 million if the $140 million needed to invest in the project. Lenders are provided the above cash flow forecasts for each project but won't know which project the firm will choose until after they have loaned the money. i. ii. Which project would the firm's management (acting to maximize shareholder value) now prefer? Note: Explain your answer in terms of NPV to equity (NPVE) Now suppose lenders are rationale and recognize the management's preference for one project versus another in the presence of debt. a. Will they still be willing to lend $80 million? If not, what is the maximum amount lenders will be willing to lend now? b. What are the two projects' NPV now? c. Which project will the firm's management now prefer? Moral hazard in the presence of debt: 2. A firm's management has to decide on one of two product designs (projects 1 or 2). Both projects will be completed in one period. Both projects cost $ 140 million but project 2 is riskier than Project 1. Payoffs at the end of the year depend on the state of the economy (which may be favorable or unfavorable with equal likelihood) as shown below. Favorable state: Unfavorable state: Project 1 $200 $100 Project 2 $230 $50

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

i To determine which project the firms management would prefer we need to evaluate the NPV to equity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started