Answered step by step

Verified Expert Solution

Question

1 Approved Answer

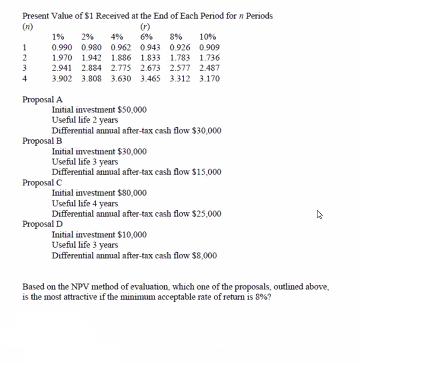

Present Value of $1 Received at the End of Each Period for n Periods (14) (r) 1% 1 2 2% 0.990 0980 0.962 0.943

Present Value of $1 Received at the End of Each Period for n Periods (14) (r) 1% 1 2 2% 0.990 0980 0.962 0.943 1970 1942 1.886 1.833 4% 6% 8% 10% 0.926 0.909 3 1.783 1.736 2.941 2.884 2.775 2.673 2.577 2.487 3.902 3.808 3.630 3.465 3.312 3.170 Proposal A Initial investment $50,000 Useful life 2 years Differential annual after-tax cash flow $30,000 Proposal B Initial investment $30,000 Useful life 3 years Differential annual after-tax cash flow $15,000 Proposal C Initial investment $80,000 Useful life 4 years Differential annual after-tax cash flow $25,000 Proposal D Initial investment $10,000 Useful life 3 years Differential annual after-tax cash flow $8,000 Based on the NPV method of evaluation, which one of the proposals, outlined above, is the most attractive if the minimum acceptable rate of return is 8%?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the most attractive proposal based on the net present value NPV method of evaluation we need to calculate the NPV for each proposal using ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started