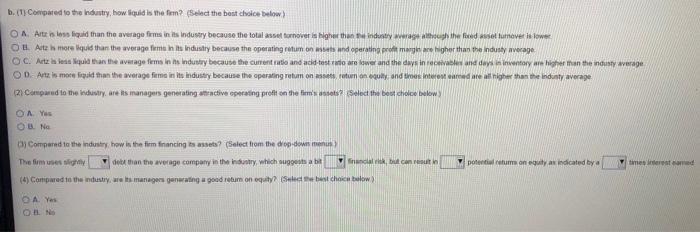

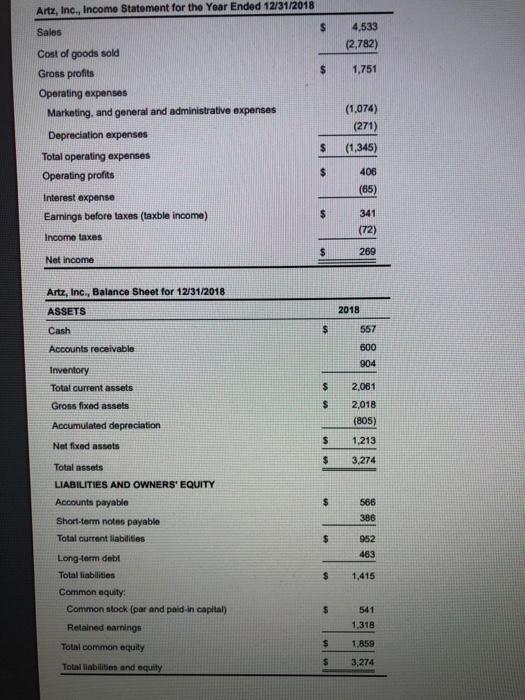

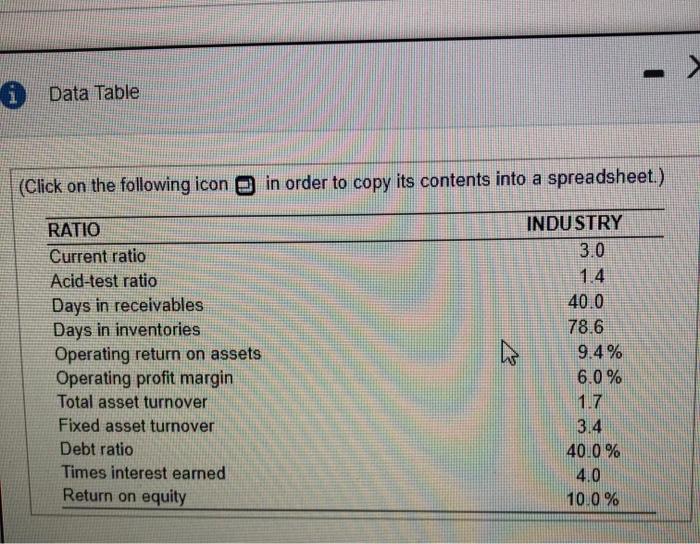

b. (T Compared to the northy, how liquid is the fem? (Select the best choice below) ON Artes les liquid than the average firms in its Industry because the total asset turnover is higher than industry waathough the feed not ever low OU. Aith more quid than the werage teme in its indstry because the operating rumons and operating profit margar higher than the Industy average OC. Artistes que han the average firms in Is Industry because the current rate and acid tot stanswer and the days in receive and days inventory an iman the industy average OD. Art is more liquid than the werage firme in its industry because the operating retum onun qully, and the interes are all higher than Industy average 21. Compared to the industry are is managers generating atractive operating profit on the firm's Select the best choice below OM Yes O No by compared to the industry, how is the firm financing is assets? (Select from the drop-down mens The formes deb than the average company in the industry, which suggests a bit nad, but cont potem only as indicated by a times rested (4) Compared to the industry, we is managers generating a good rebum on equity (Selechest choice blow DAY Artz, Inc., Income Statement for the Year Ended 12/31/2018 S Sales 4,533 (2.782) $ 1,751 Cost of goods sold Gross profits Operating expenses Marketing, and general and administrative expenses Depreciation expenses Total operating expenses Operating profits (1.074) (271) $ (1,345) $ 406 (65) Interest expense Earnings before taxes (taxble income) $ 341 (72) Income taxes $ 269 Net income Artz, Inc., Balance Sheet for 12/31/2018 ASSETS 2018 557 Cash Accounts receivable 600 904 $ Inventory Total current assets Gross fixed assets Accumulated depreciation Net foxed assets $ 2,061 2,018 (805) $ 1.213 $ 3,274 Total assets LIABILITIES AND OWNERS' EQUITY Accounts payable Short-term notes payable Total current liabdities $ 566 386 $ 952 463 Long-term debt 1,415 Total liabilities Common equity Common stock (par and paid in capital) Retained earnings $ 541 1,318 Total common equity $ 1.859 $ Total abilities and equity 3,274 0 Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) & RATIO Current ratio Acid-test ratio Days in receivables Days in inventories Operating return on assets Operating profit margin Total asset turnover Fixed asset turnover Debt ratio Times interest earned Return on equity INDUSTRY 3.0 1.4 40.0 78.6 9.4 % 6.0 % 1.7 3.4 40.0 % 4.0 10.0 %