Answered step by step

Verified Expert Solution

Question

1 Approved Answer

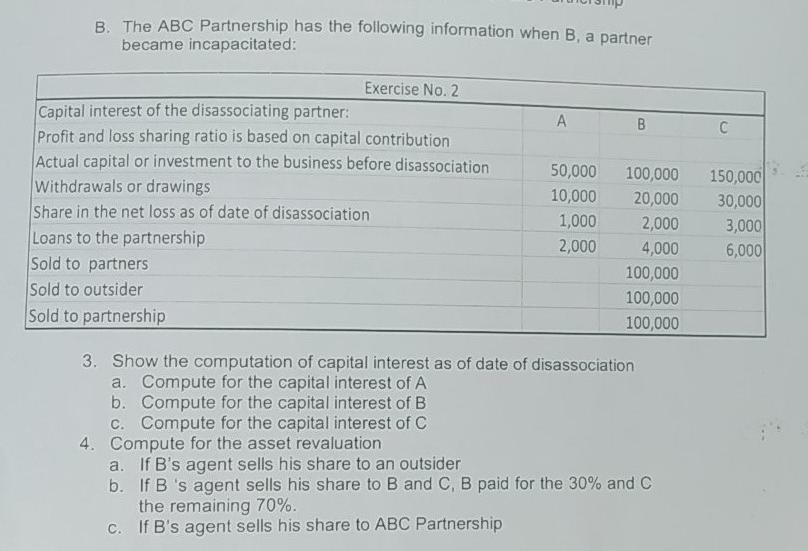

B. The ABC Partnership has the following information when B, a partner became incapacitated: Exercise No. 2 Capital interest of the disassociating partner: Profit

B. The ABC Partnership has the following information when B, a partner became incapacitated: Exercise No. 2 Capital interest of the disassociating partner: Profit and loss sharing ratio is based on capital contribution Actual capital or investment to the business before disassociation Withdrawals or drawings Share in the net loss as of date of disassociation Loans to the partnership Sold to partners Sold to outsider Sold to partnership A 4. Compute for the asset revaluation 50,000 10,000 1,000 2,000 3. Show the computation of capital interest as of date of disassociation a. Compute for the capital interest of A b. Compute for the capital interest of B c. Compute for the capital interest of C B 100,000 20,000 2,000 4,000 100,000 100,000 100,000 a. If B's agent sells his share to an outsider b. If B 's agent sells his share to B and C, B paid for the 30% and C the remaining 70%. c. If B's agent sells his share to ABC Partnership C 150,000 30,000 3,000 6,000

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a Computation of capital interest of A B and C as of date of disassociation Partner A Capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started