Answered step by step

Verified Expert Solution

Question

1 Approved Answer

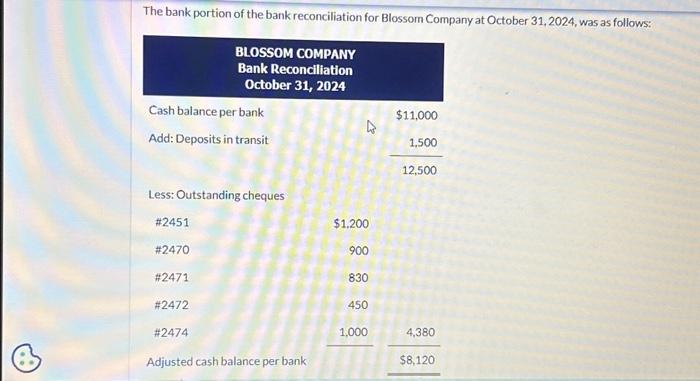

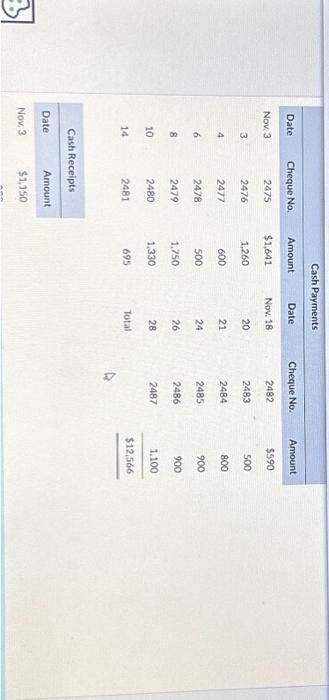

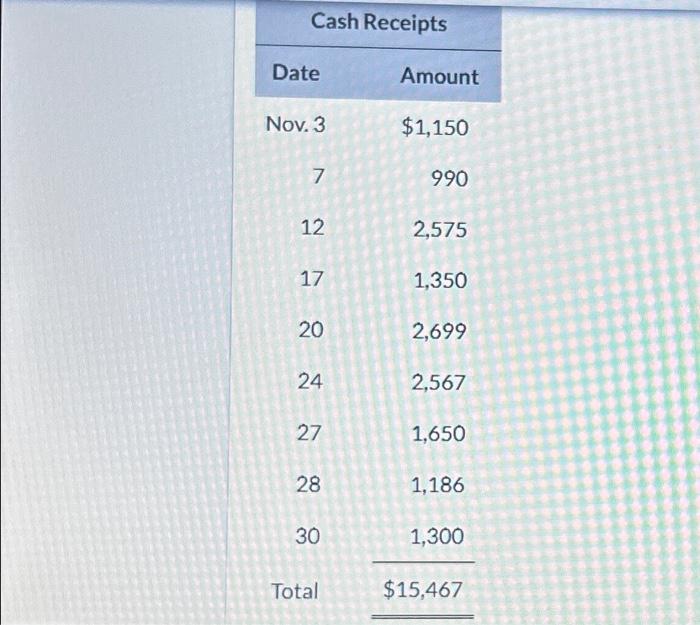

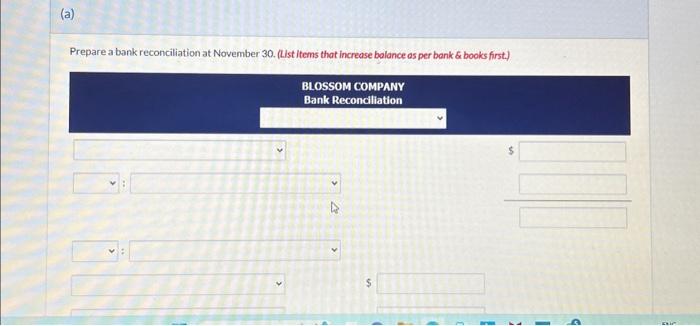

B The bank portion of the bank reconciliation for Blossom Company at October 31, 2024, was as follows: Cash balance per bank Add: Deposits in

B The bank portion of the bank reconciliation for Blossom Company at October 31, 2024, was as follows: Cash balance per bank Add: Deposits in transit Less: Outstanding cheques #2451 #2470 #2471 BLOSSOM COMPANY Bank Reconciliation October 31, 2024 #2472 #2474 Adjusted cash balance per bank 4 $1,200 900 830 450 1,000 $11,000 1,500 12,500 4,380 $8,120

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started