Answered step by step

Verified Expert Solution

Question

1 Approved Answer

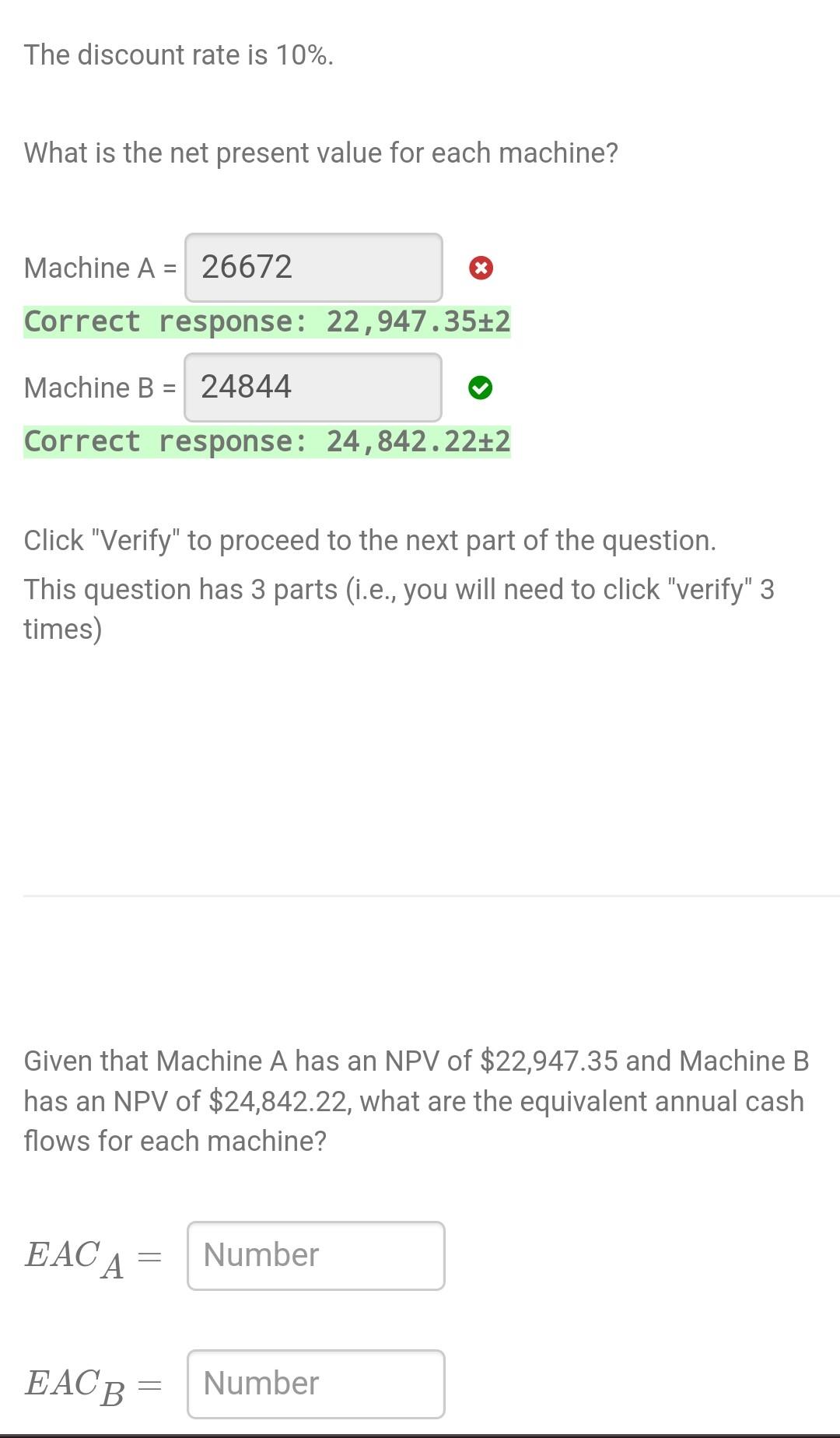

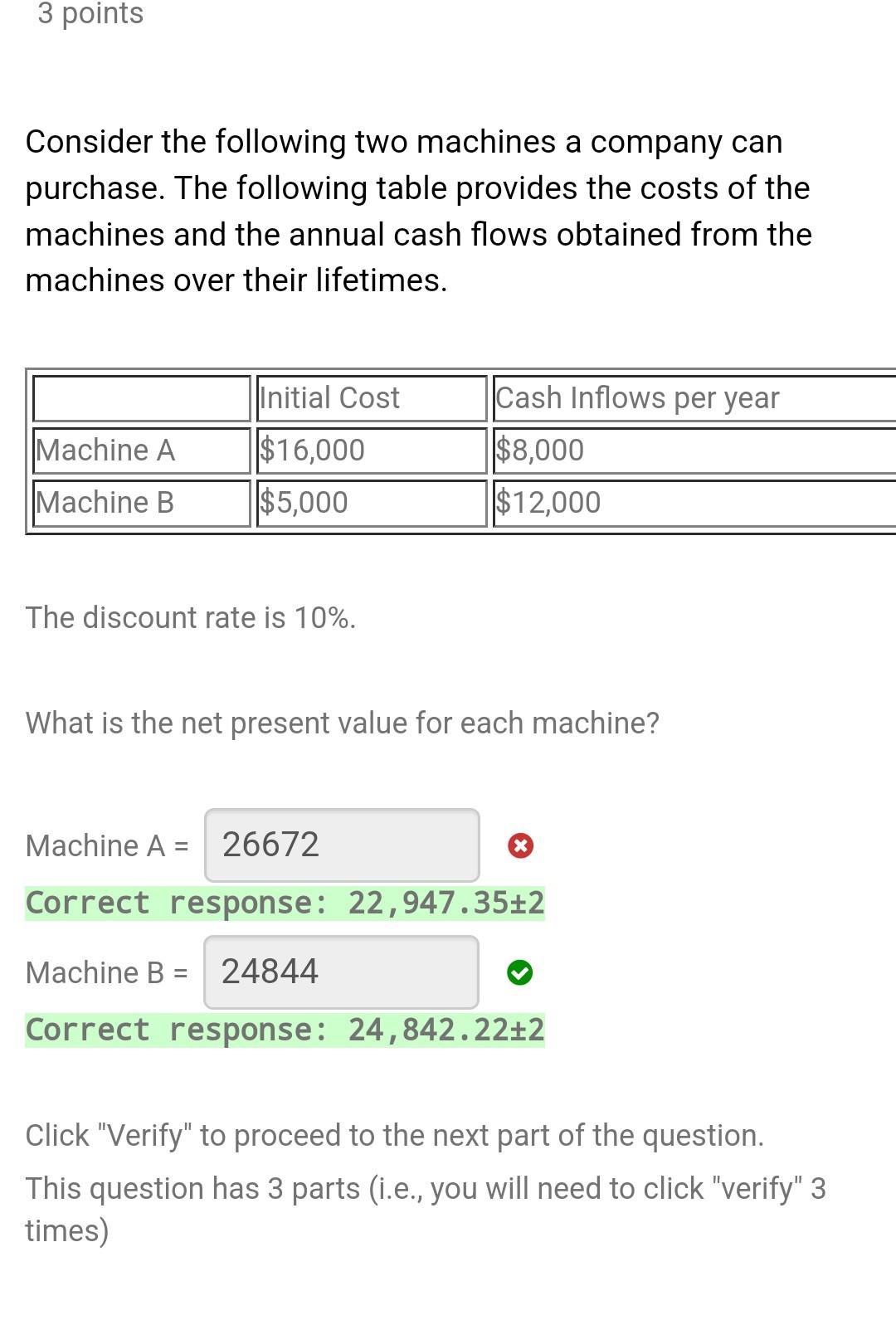

b The discount rate is 10%. What is the net present value for each machine? Machine A= Correct response: 22,947.352 Machine B= Correct response: 24,842.222

b

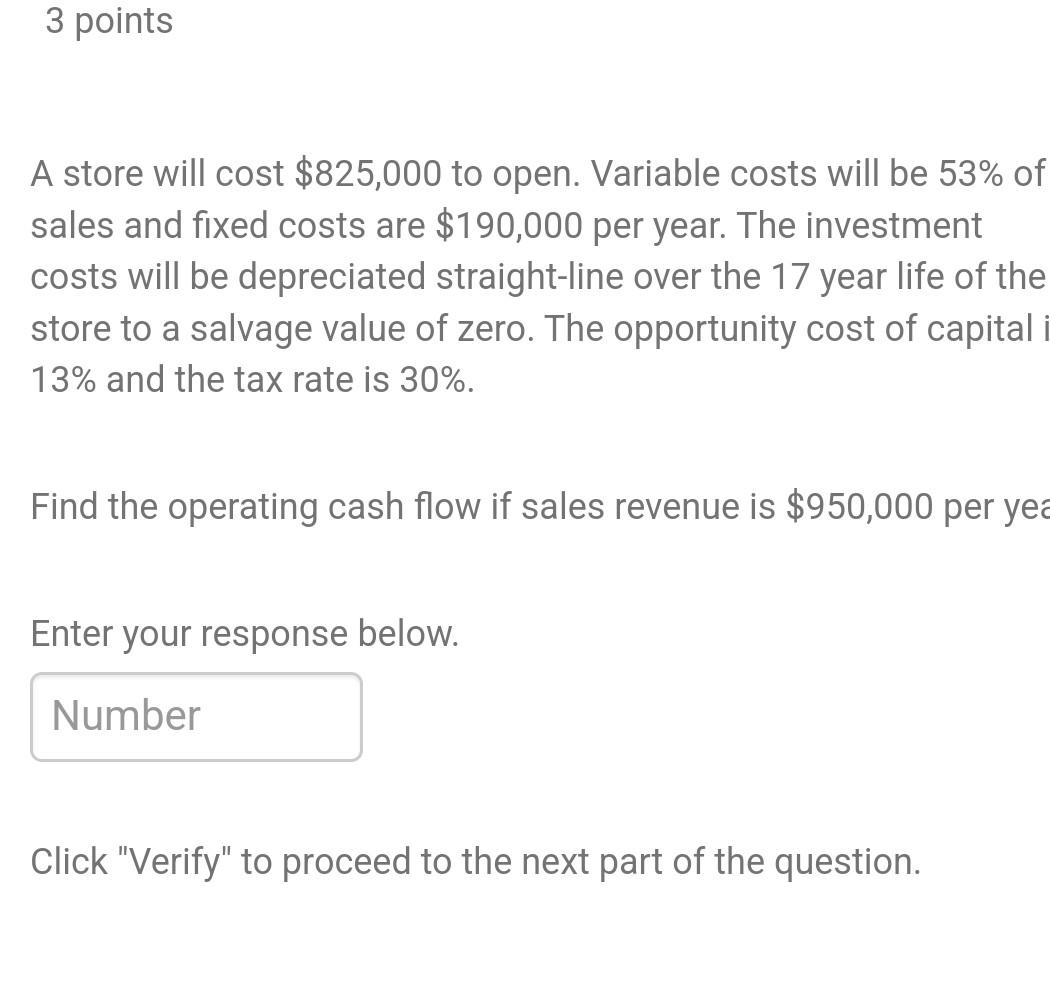

The discount rate is 10%. What is the net present value for each machine? Machine A= Correct response: 22,947.352 Machine B= Correct response: 24,842.222 Click "Verify" to proceed to the next part of the question. This question has 3 parts (i.e., you will need to click "verify" 3 times) Given that Machine A has an NPV of $22,947.35 and Machine B has an NPV of $24,842.22, what are the equivalent annual cash flows for each machine? EACA= EACB= 3 points A store will cost $825,000 to open. Variable costs will be 53% of sales and fixed costs are $190,000 per year. The investment costs will be depreciated straight-line over the 17 year life of the store to a salvage value of zero. The opportunity cost of capital 13% and the tax rate is 30%. Find the operating cash flow if sales revenue is $950,000 per yea Enter your response below. Click "Verify" to proceed to the next part of the question. Consider the following two machines a company can purchase. The following table provides the costs of the machines and the annual cash flows obtained from the machines over their lifetimes. The discount rate is 10%. What is the net present value for each machine? Machine A= Correct response: 22,947.352 Machine B= Correct response: 24,842.222 Click "Verify" to proceed to the next part of the question. This question has 3 parts (i.e., you will need to click "verify" 3 times) The discount rate is 10%. What is the net present value for each machine? Machine A= Correct response: 22,947.352 Machine B= Correct response: 24,842.222 Click "Verify" to proceed to the next part of the question. This question has 3 parts (i.e., you will need to click "verify" 3 times) Given that Machine A has an NPV of $22,947.35 and Machine B has an NPV of $24,842.22, what are the equivalent annual cash flows for each machine? EACA= EACB= 3 points A store will cost $825,000 to open. Variable costs will be 53% of sales and fixed costs are $190,000 per year. The investment costs will be depreciated straight-line over the 17 year life of the store to a salvage value of zero. The opportunity cost of capital 13% and the tax rate is 30%. Find the operating cash flow if sales revenue is $950,000 per yea Enter your response below. Click "Verify" to proceed to the next part of the question. Consider the following two machines a company can purchase. The following table provides the costs of the machines and the annual cash flows obtained from the machines over their lifetimes. The discount rate is 10%. What is the net present value for each machine? Machine A= Correct response: 22,947.352 Machine B= Correct response: 24,842.222 Click "Verify" to proceed to the next part of the question. This question has 3 parts (i.e., you will need to click "verify" 3 times)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started