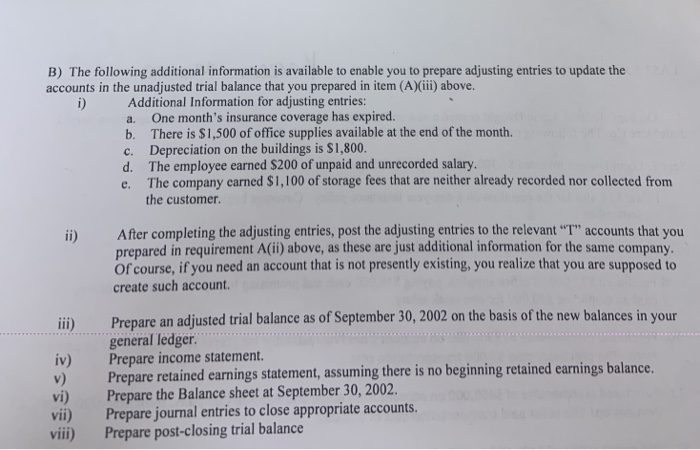

B) The following additional information is available to enable you to prepare adjusting entries to update the accounts in the unadjusted trial balance that you prepared in item (A)(ii) above. i) Additional Information for adjusting entries: a. One month's insurance coverage has expired b. There is $1,500 of office supplies available at the end of the month. c. Depreciation on the buildings is $1,800. d. The employee earned $200 of unpaid and unrecorded salary. e. The company carned $1,100 of storage fees that are neither already recorded nor collected from the customer. After completing the adjusting entries, post the adjusting entries to the relevant "T" accounts that you prepared in requirement A(i) above, as these are just additional information for the same company. of course, if you need an account that is not presently existing, you realize that you are supposed to create such account ii) ii) Prepare an adjusted trial balance as of September 30, 2002 on the basis of the new balances in your general ledger Prepare income statement. Prepare retained earnings statement, assuming there is no beginning retained earnings balance. iv) vi) Prepare the Balance sheet at September 30, 2002. vii) Prepare journal entries to close appropriate accounts. vii) Prepare post-closing trial balance B) The following additional information is available to enable you to prepare adjusting entries to update the accounts in the unadjusted trial balance that you prepared in item (A)(ii) above. i) Additional Information for adjusting entries: a. One month's insurance coverage has expired b. There is $1,500 of office supplies available at the end of the month. c. Depreciation on the buildings is $1,800. d. The employee earned $200 of unpaid and unrecorded salary. e. The company carned $1,100 of storage fees that are neither already recorded nor collected from the customer. After completing the adjusting entries, post the adjusting entries to the relevant "T" accounts that you prepared in requirement A(i) above, as these are just additional information for the same company. of course, if you need an account that is not presently existing, you realize that you are supposed to create such account ii) ii) Prepare an adjusted trial balance as of September 30, 2002 on the basis of the new balances in your general ledger Prepare income statement. Prepare retained earnings statement, assuming there is no beginning retained earnings balance. iv) vi) Prepare the Balance sheet at September 30, 2002. vii) Prepare journal entries to close appropriate accounts. vii) Prepare post-closing trial balance