Question

b) The market portfolio (M) provides an expected return of 11% pa. The risk-free rate of return (r f ) is 3% pa. Based on

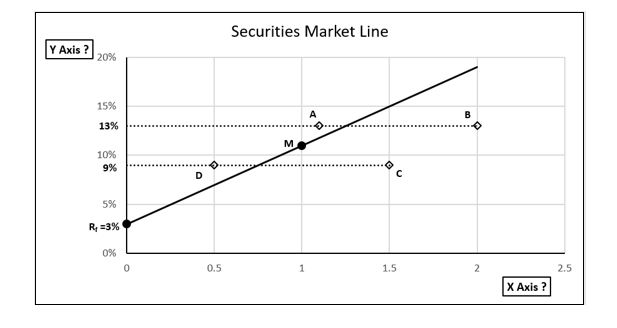

b) The market portfolio (M) provides an expected return of 11% pa. The risk-free rate of return (rf) is 3% pa. Based on this information, equity analyst Ming Shi draws the following Securities Market Line (SML) and identifies some investment opportunities (A, B, C and D) on the graph for his clients.

Mings client Jen wants to earn 2% pa abnormal return (Alpha) from her investments; however, she is a very risk-averse investor and doesnt want to take a short position.

Mings other client Kim wants to earn 5% pa Alpha from her investments, and she doesnt mind taking a short position.

A.Identify the labels for Axis X and Axis Y in the Chart above.

B.Among A, B, C and D on the graph - identify which investment is most appropriate for Jen to fulfil her investment goal. Justify your answer with proper calculations and reasons.

C. Among A, B, C and D on the graph - identify which investment is most appropriate for Kim to fulfil her investment goal. Justify your answer with proper calculations and reasons.

Securities Market Line Y AxisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started