Answered step by step

Verified Expert Solution

Question

1 Approved Answer

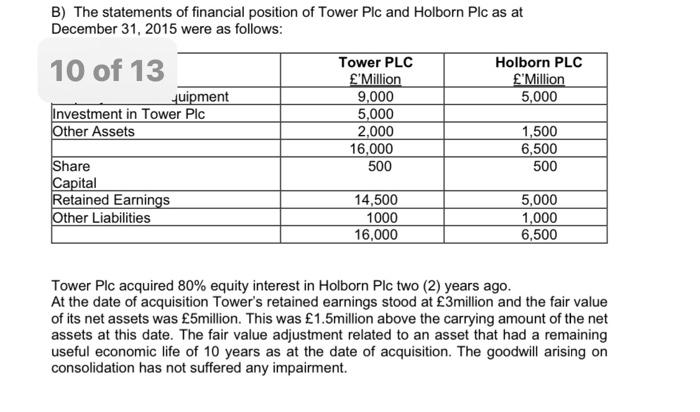

B) The statements of financial position of Tower Plc and Holborn Plc as at December 31, 2015 were as follows: Tower PLC Holborn PLC

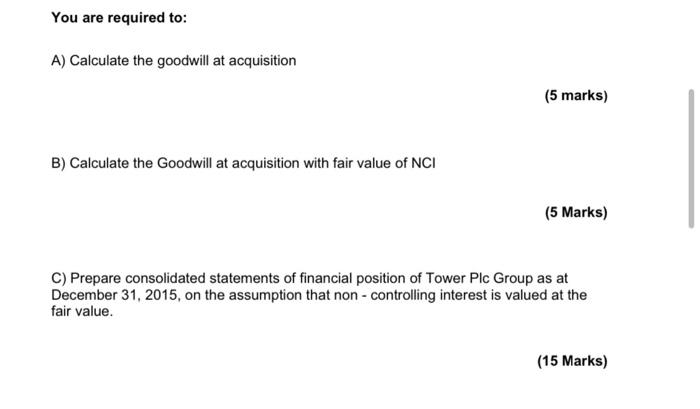

B) The statements of financial position of Tower Plc and Holborn Plc as at December 31, 2015 were as follows: Tower PLC Holborn PLC 10 of 13 'Million 'Million quipment 9,000 5,000 Investment in Tower Plc 5,000 Other Assets 2,000 1,500 16,000 6,500 Share 500 500 Capital Retained Earnings 14,500 5,000 Other Liabilities 1000 1,000 16,000 6,500 Tower Plc acquired 80% equity interest in Holborn Plc two (2) years ago. At the date of acquisition Tower's retained earnings stood at 3million and the fair value of its net assets was 5million. This was 1.5million above the carrying amount of the net assets at this date. The fair value adjustment related to an asset that had a remaining useful economic life of 10 years as at the date of acquisition. The goodwill arising on consolidation has not suffered any impairment. You are required to: A) Calculate the goodwill at acquisition (5 marks) B) Calculate the Goodwill at acquisition with fair value of NCI (5 Marks) C) Prepare consolidated statements of financial position of Tower Plc Group as at December 31, 2015, on the assumption that non-controlling interest is valued at the fair value. (15 Marks)

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a Amount in million Cost of investment in Holborn 5000 Less 80 of fair value of net assets of Holbor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started