Answered step by step

Verified Expert Solution

Question

1 Approved Answer

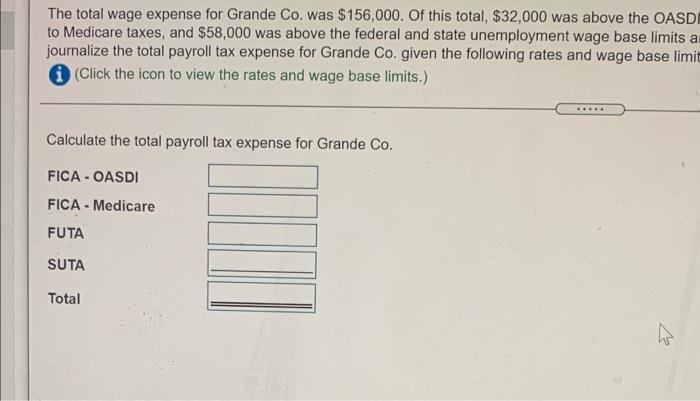

b The total wage expense for Grande Co. was $156,000. Of this total, $32,000 was above the OASDI to Medicare taxes, and $58,000 was above

b

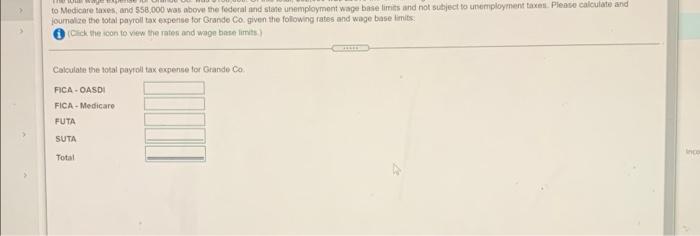

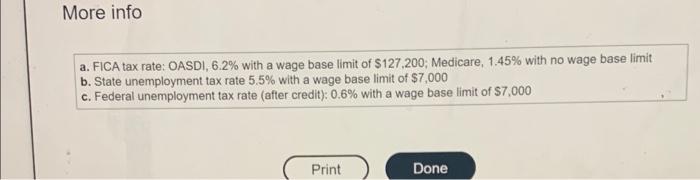

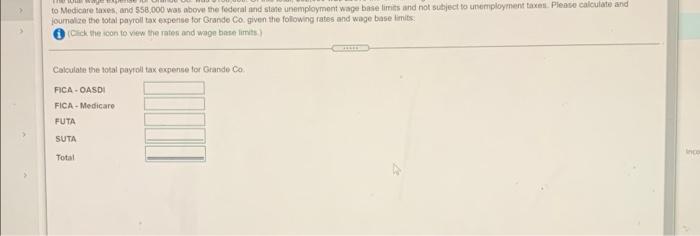

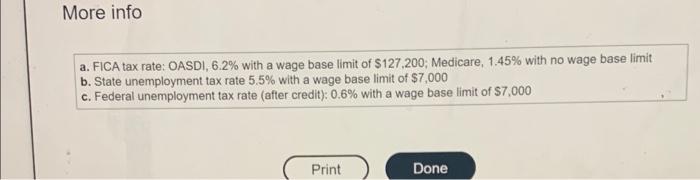

The total wage expense for Grande Co. was $156,000. Of this total, $32,000 was above the OASDI to Medicare taxes, and $58,000 was above the federal and state unemployment wage base limits a journalize the total payroll tax expense for Grande Co. given the following rates and wage base limit (Click the icon to view the rates and wage base limits.) Calculate the total payroll tax expense for Grande Co. FICA - OASDI FICA - Medicare FUTA SUTA Total to Medicare taxes and 558,000 was above the federal and state unemployment wage base limits and not subject to unemployment taxes. Please calculate and joumalize the total payroll tax expertise for Grande Co, given the following rates and wage base limits Click the icon to view the rates and wage base limits Calculate the total payroll tax expense for Grande Co. FICA OASDI FICA-Medicare FUTA SUTA Total More info a. FICA tax rate: OASDI, 6.2% with a wage base limit of $127.200; Medicare, 1.45% with no wage base limit b. State unemployment tax rate 5.5% with a wage base limit of $7,000 c. Federal unemployment tax rate (after credit): 0.6% with a wage base limit of $7,000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started