Answered step by step

Verified Expert Solution

Question

1 Approved Answer

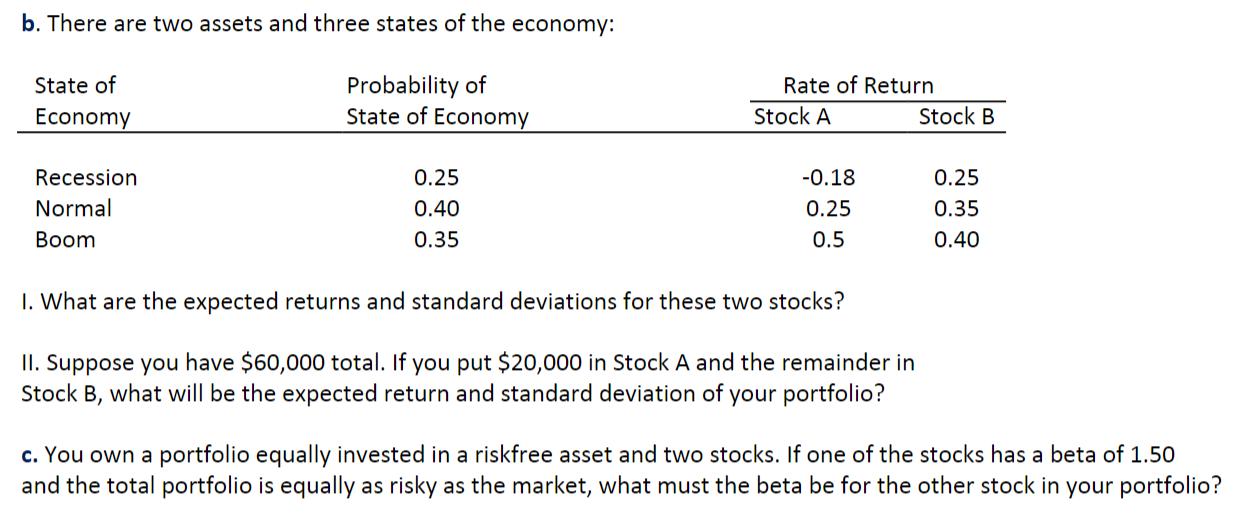

b. There are two assets and three states of the economy: Probability of State of Economy State of Economy Recession Normal Boom 0.25 0.40

b. There are two assets and three states of the economy: Probability of State of Economy State of Economy Recession Normal Boom 0.25 0.40 0.35 Rate of Return Stock A -0.18 0.25 0.5 1. What are the expected returns and standard deviations for these two stocks? II. Suppose you have $60,000 total. If you put $20,000 in Stock A and the remainder in Stock B, what will be the expected return and standard deviation of your portfolio? Stock B 0.25 0.35 0.40 c. You own a portfolio equally invested in a riskfree asset and two stocks. If one of the stocks has a beta of 1.50 and the total portfolio is equally as risky as the market, what must the beta be for the other stock in your portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

This question pertains to portfolio theory and calculating expected returns and standard deviations for financial assets based on different states of the economy Lets break it down step by step b I Ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started