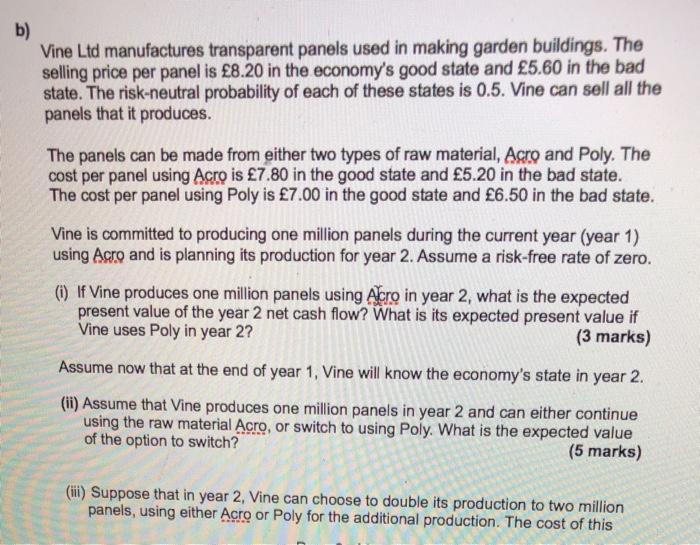

b) Vine Ltd manufactures transparent panels used in making garden buildings. The selling price per panel is 8.20 in the economy's good state and 5.60 in the bad state. The risk-neutral probability of each of these states is 0.5. Vine can sell all the panels that it produces. The panels can be made from either two types of raw material, Acro and Poly. The cost per panel using Acro is 7.80 in the good state and 5.20 in the bad state. The cost per panel using Poly is 7.00 in the good state and 6.50 in the bad state. Vine is committed to producing one million panels during the current year (year 1) using Asro and is planning its production for year 2. Assume a risk-free rate of zero. () If Vine produces one million panels using Acro in year 2, what is the expected present value of the year 2 net cash flow? What is its expected present value if Vine uses Poly in year 2? (3 marks) Assume now that at the end of year 1, Vine will know the economy's state in year 2. (ii) Assume that Vine produces one million panels in year 2 and can either continue using the raw material Acro, or switch to using Poly. What is the expected value of the option to switch? (5 marks) (iii) Suppose that in year 2, Vine can choose to double its production to two million panels, using either Acro or Poly for the additional production. The cost of this b) Vine Ltd manufactures transparent panels used in making garden buildings. The selling price per panel is 8.20 in the economy's good state and 5.60 in the bad state. The risk-neutral probability of each of these states is 0.5. Vine can sell all the panels that it produces. The panels can be made from either two types of raw material, Acro and Poly. The cost per panel using Acro is 7.80 in the good state and 5.20 in the bad state. The cost per panel using Poly is 7.00 in the good state and 6.50 in the bad state. Vine is committed to producing one million panels during the current year (year 1) using Asro and is planning its production for year 2. Assume a risk-free rate of zero. () If Vine produces one million panels using Acro in year 2, what is the expected present value of the year 2 net cash flow? What is its expected present value if Vine uses Poly in year 2? (3 marks) Assume now that at the end of year 1, Vine will know the economy's state in year 2. (ii) Assume that Vine produces one million panels in year 2 and can either continue using the raw material Acro, or switch to using Poly. What is the expected value of the option to switch? (5 marks) (iii) Suppose that in year 2, Vine can choose to double its production to two million panels, using either Acro or Poly for the additional production. The cost of this