Answered step by step

Verified Expert Solution

Question

1 Approved Answer

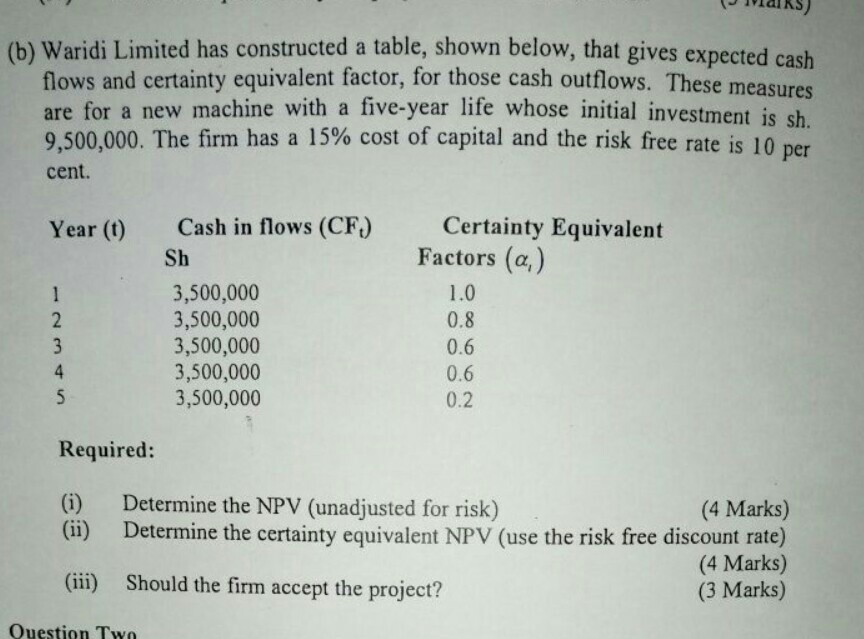

(b) Waridi Limited has constructed a table, shown below, that gives expected cash flows and certainty equivalent factor, for those cash outflows. These mea are

(b) Waridi Limited has constructed a table, shown below, that gives expected cash flows and certainty equivalent factor, for those cash outflows. These mea are for a new machine with a five-year life whose initial investment is sh 9,500,000. The firm has a 15% cost of capital and the risk free rate is 10 per sures cent. Year (t) Cash in flows (CF) Certainty Equivalent Sh Factors (a,) 3,500,000 3,500,000 3,500,000 3,500,000 3,500,000 1.0 0.8 0.6 0.6 0.2 4 Required: Determine the NPV (unadjusted for risk) (i) (ii) (4 Marks) Determine the certainty equivalent NPV (use the risk free discount rate) (4 Marks) (3 Marks) (iii) should the firm accept the project? Question Two

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started