Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( b ) What is the corporate WACC assuming Margaret ( 1 ) does not purchase the property and ( 2 ) does purchase the

b

What is the corporate WACC assuming Margaret does not purchase the property and does purchase the property? Round

answers to decimal place, eg

WACC without purchase

WACC with purchase

eTextbook and Media

Attempts: of used

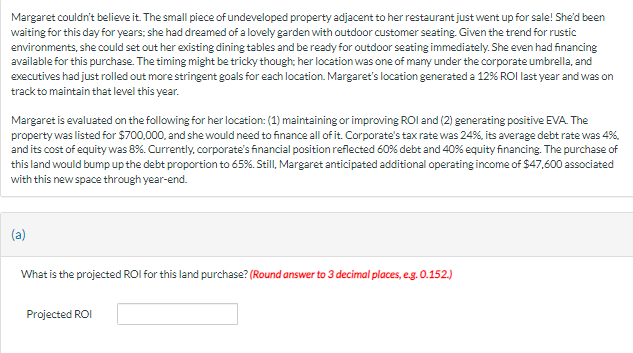

c Margaret couldn't believe it The small piece of undeveloped property adjacent to her restaurant just went up for sale! She'd been

waiting for this day for years; she had dreamed of a lovely garden with outdoor customer seating. Given the trend for rustic

environments, she could set out her existing dining tables and be ready for outdoor seating immediately. She even had financing

available for this purchase. The timing might be tricky though; her location was one of many under the corporate umbrella, and

executives had just rolled out more stringent goals for each location. Margaret's location generated a ROI last year and was on

track to maintain that level this year.

Margaret is evaluated on the following for her location: maintaining or improving ROI and generating positive EVA. The

property was listed for $ and she would need to finance all of it Corporate's tax rate was its average debt rate was

and its cost of equity was Currently, corporate's financial position reflected debt and equity financing. The purchase of

this land would bump up the debt proportion to Still, Margaret anticipated additional operating income of $ associated

with this new space through yearend.

a

What is the projected ROI for this land purchase? Round answer to decimal places, eg

Projected ROI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started