Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) What is the value of Roxy Inc.? Is the project worth pursuing? [10 marks] The estimated value of Roxy Inc. is: ____________ The estimated

(b) What is the value of Roxy Inc.? Is the project worth pursuing? [10 marks]

The estimated value of Roxy Inc. is: ____________

The estimated gain to your friend from investing in Roxys Inc. is: ____

Is the investment worth pursuing (Yes/No) ______

[SHOW YOUR WORKING]

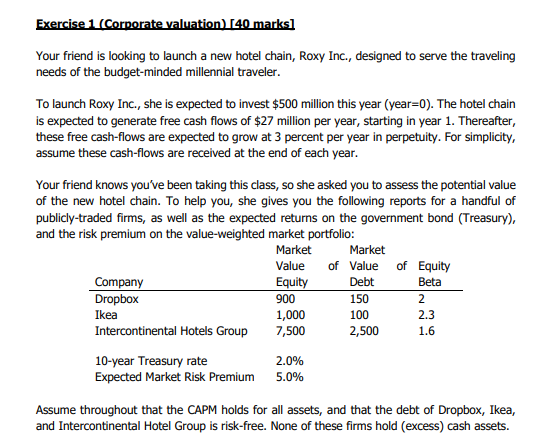

Exercise 1 (Corporate valuation) [40 marks] Your friend is looking to launch a new hotel chain, Roxy Inc., designed to serve the traveling needs of the budget-minded millennial traveler. To launch Roxy Inc., she is expected to invest $500 million this year (year=0). The hotel chain is expected to generate free cash flows of $27 million per year, starting in year 1. Thereafter, these free cash-flows are expected to grow at 3 percent per year in perpetuity. For simplicity, assume these cash-flows are received at the end of each year. Your friend knows you've been taking this class, so she asked you to assess the potential value of the new hotel chain. To help you, she gives you the following reports for a handful of publicly-traded firms, as well as the expected returns on the government bond (Treasury), and the risk premium on the value-weighted market portfolio: Market Market Value of Value of Equity Company Equity Debt Beta Dropbox 900 150 2 Ikea 1,000 100 2.3 Intercontinental Hotels Group 7,500 2,500 10-year Treasury rate 2.0% Expected Market Risk Premium 5.0% 1.6 Assume throughout that the CAPM holds for all assets, and that the debt of Dropbox, Ikea, and Intercontinental Hotel Group is risk-free. None of these firms hold (excess) cash assetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started