Question

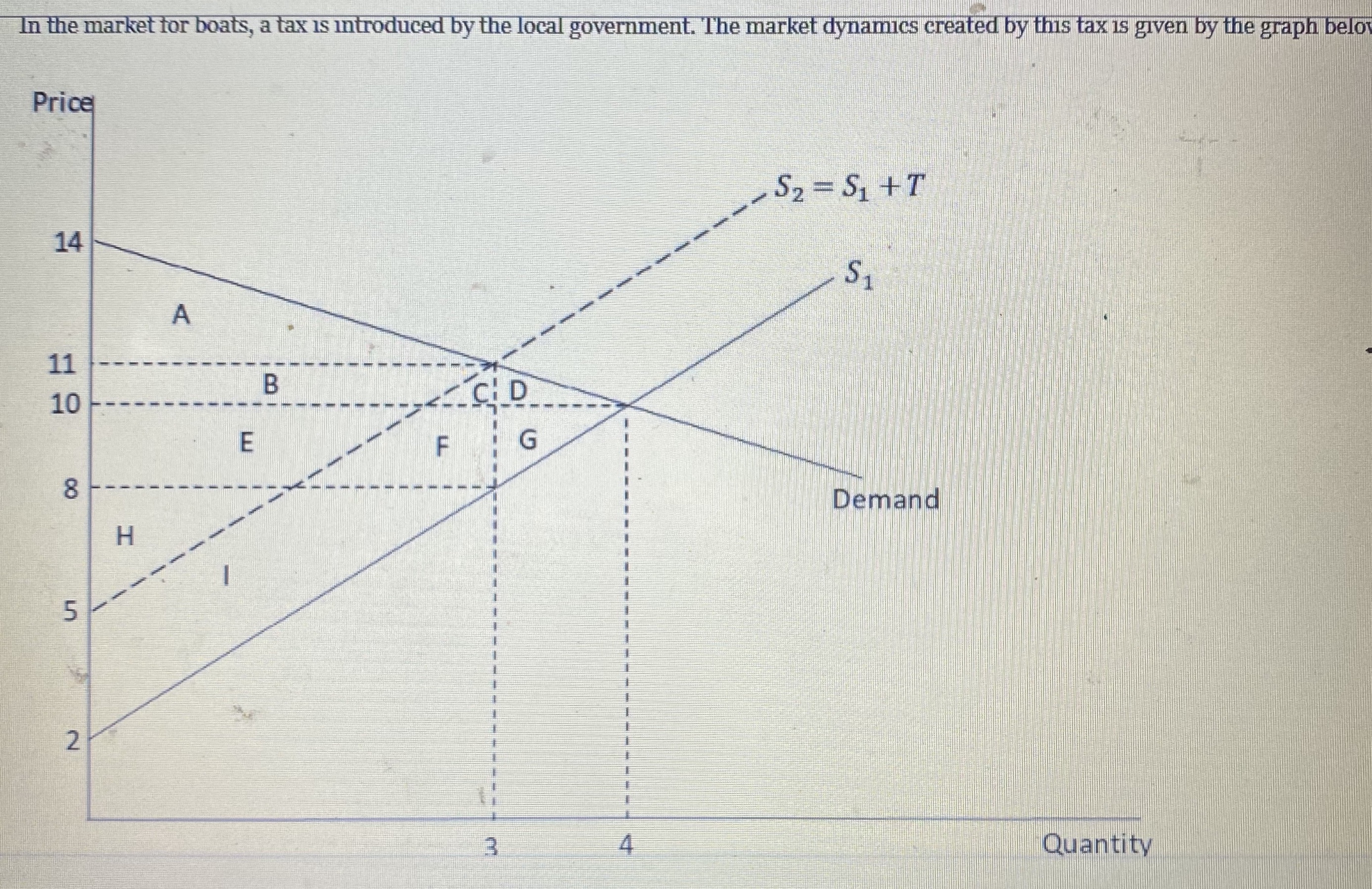

b. What price will consumers pay after taxes are imposed? c. What price will producers receive after taxes are imposed? d. What is the tax

b. What price will consumers pay after taxes are imposed? c. What price will producers receive after taxes are imposed? d. What is the tax rate (tax for each unit of good) after taxes are imposed? e. What revenue does government make from taxes? f. What is the consumer surplus before taxes are imposed? g. What is producer surplus before taxes are imposed? h. What is the consumer surplus after taxes are imposed? i. What is producer surplus after taxes are imposed? j. What is deadweight loss caused by the taxes? Note: if your answer is a negative value do NOT put the negative symbol in front of your answer, write only the number.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started