Answered step by step

Verified Expert Solution

Question

1 Approved Answer

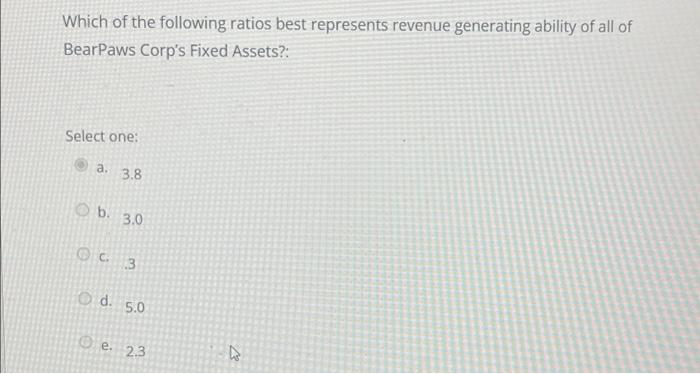

b Which of the following ratios best represents revenue generating ability of all of BearPaws Corp's Fixed Assets?: Select one: a. 3.8 b. 3.0 C3

b

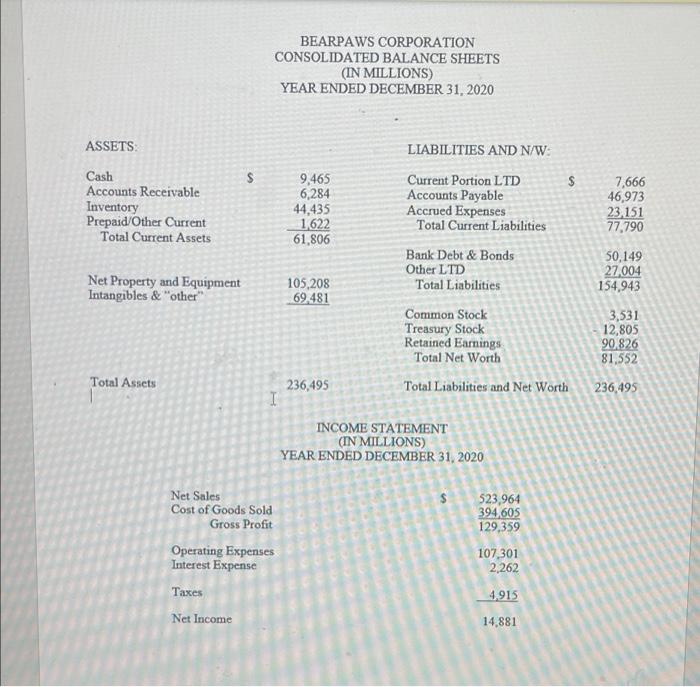

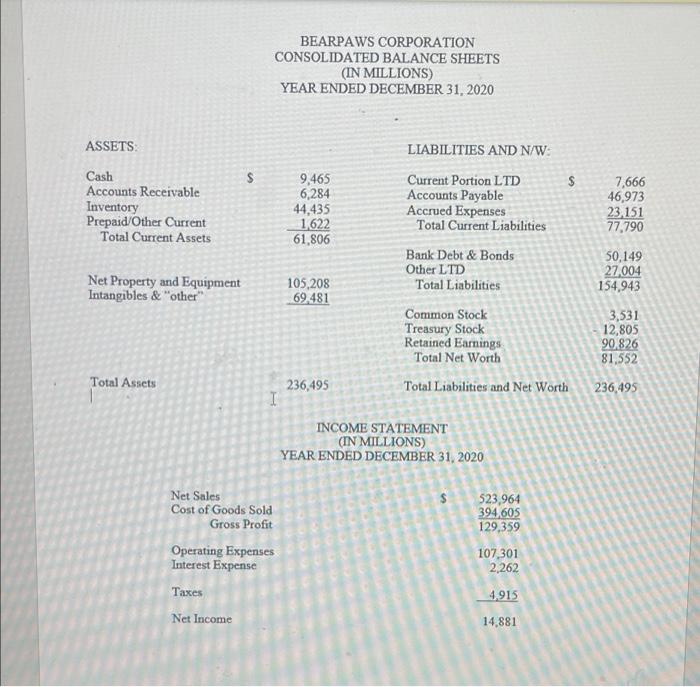

Which of the following ratios best represents revenue generating ability of all of BearPaws Corp's Fixed Assets?: Select one: a. 3.8 b. 3.0 C3 O d. 5.0 e 2.3 v BEARPAWS CORPORATION CONSOLIDATED BALANCE SHEETS (IN MILLIONS) YEAR ENDED DECEMBER 31, 2020 ASSETS S Cash Accounts Receivable Inventory Prepaid/Other Current Total Current Assets 7,666 46,973 23.151 77,790 Net Property and Equipment Intangibles & "other" 50,149 27,004 154,943 LIABILITIES AND N/W: 9,465 Current Portion LTD $ 6,284 Accounts Payable 44,435 Accrued Expenses 1.622 Total Current Liabilities 61,806 Bank Debt & Bonds Other LTD 105,208 Total Liabilities 69,481 Common Stock Treasury Stock Retained Earnings Total Net Worth 236,495 Total Liabilities and Net Worth I INCOME STATEMENT (IN MILLIONS) YEAR ENDED DECEMBER 31, 2020 3,531 12,805 90.826 81,552 Total Assets 236,495 $ 523,964 394605 129,359 Net Sales Cost of Goods Sold Gross Profit Operating Expenses Interest Expense Taxes Net Income 107,301 2,262 4,915 14,881

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started