Question: b. Which of the ratios calculated in part (a) do you think should be most crucial in determining whether the bank should extend the line

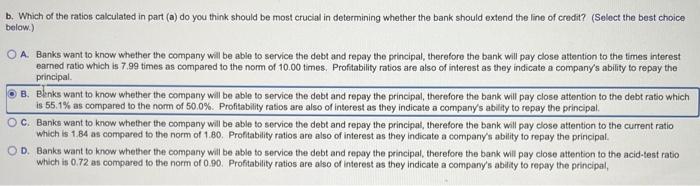

b. Which of the ratios calculated in part (a) do you think should be most crucial in determining whether the bank should extend the line of credit? (Select the best choice below.) A. Banks want to know whether the company will be able to service the debt and repay the principal, therefore the bank will pay close attention to the times interest earned ratio which is 7.99 times as compared to the nom of 10.00 times. Profitability ratios are also of interest as they indicate a company's ability to repay the principal. B. Elenks want to know whether the company will be able to service the debt and repay the principal, therefore the bank will pay close attention to the debt ratio which is 55.1% as compared to the norm of 50.0%. Profitability ratios are also of interest as they indicate a company's ability to repay the principal. C. Banks want to know whether the company will be able to service the debt and repay the principal, therefore the bank will pay close attention to the current ratio Which is 1.84 as compared to the norm of 1.80. Profitability ratios are also of interest as they indicate a company's ability to repay the priricipal. D. Banks want to know whether the company will be able to service the debt and repay the principal, therefore the bank will pay close attention to the acid-test ratio which is 0.72 as compared to the norm of 0.90. Profitability ratios are also of interest as they indicate a compary's ability to repay the principal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts