Answered step by step

Verified Expert Solution

Question

1 Approved Answer

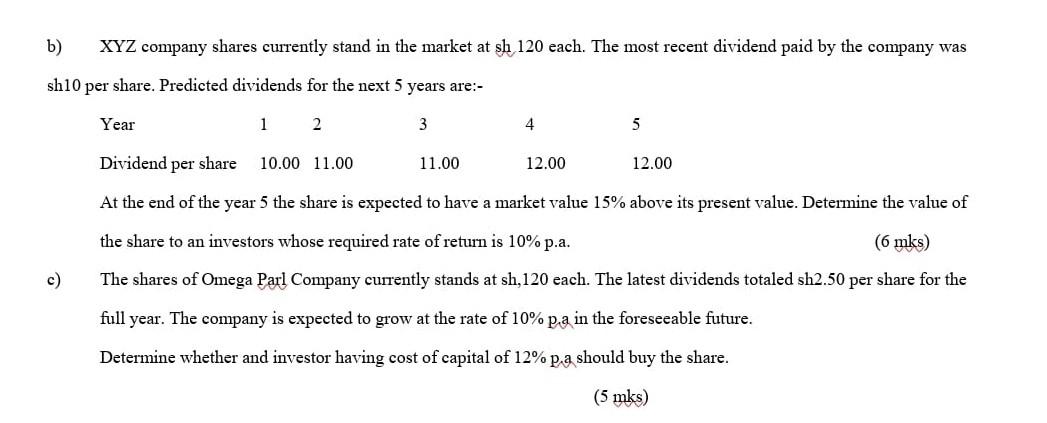

b) XYZ company shares currently stand in the market at sh 120 each. The most recent dividend paid by the company was sh10 per share.

b) XYZ company shares currently stand in the market at sh 120 each. The most recent dividend paid by the company was sh10 per share. Predicted dividends for the next 5 years are:- Year 1 2 3 4 5 Dividend per share 10.00 11.00 11.00 12.00 12.00 At the end of the year 5 the share is expected to have a market value 15% above its present value. Determine the value of c) the share to an investors whose required rate of return is 10%p.a. (6 mks) The shares of Omega Parl Company currently stands at sh,120 each. The latest dividends totaled sh2.50 per share for the full year. The company is expected to grow at the rate of 10% pa in the foreseeable future. Determine whether and investor having cost of capital of 12% p.a should buy the share. (5 mks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started