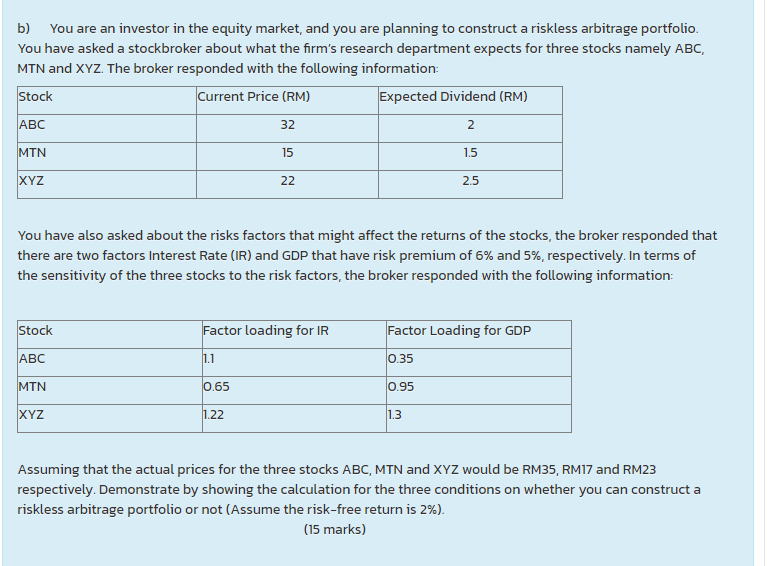

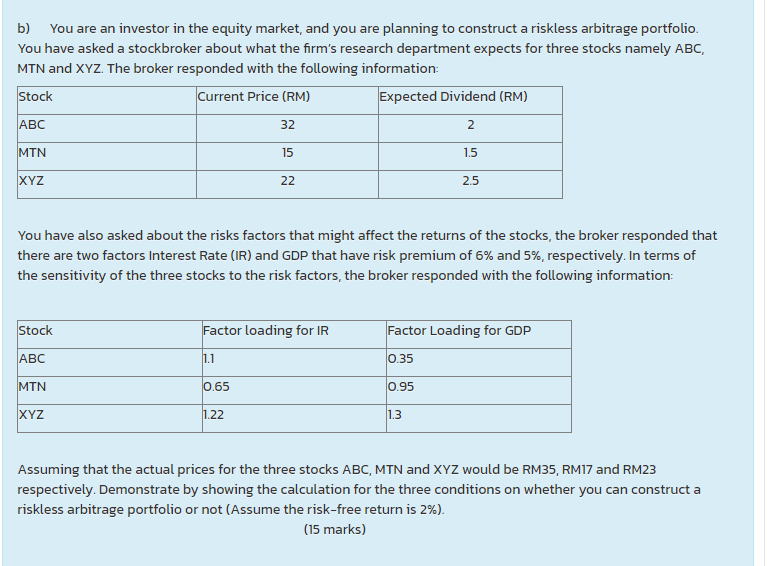

b) You are an investor in the equity market, and you are planning to construct a riskless arbitrage portfolio. You have asked a stockbroker about what the firm's research department expects for three stocks namely ABC, MTN and XYZ. The broker responded with the following information: Stock Current Price (RM) Expected Dividend (RM) ABC 32 2 MTN 15 1.5 XYZ 22 2.5 You have also asked about the risks factors that might affect the returns of the stocks, the broker responded that there are two factors Interest Rate (IR) and GDP that have risk premium of 6% and 5%, respectively. In terms of the sensitivity of the three stocks to the risk factors, the broker responded with the following information: Stock Factor loading for IR Factor Loading for GDP ABC 1.1 0.35 MTN 0.65 0.95 XYZ 1.22 1.3 Assuming that the actual prices for the three stocks ABC, MTN and XYZ would be RM35, RM17 and RM23 respectively. Demonstrate by showing the calculation for the three conditions on whether you can construct a riskless arbitrage portfolio or not (Assume the risk-free return is 2%). (15 marks) b) You are an investor in the equity market, and you are planning to construct a riskless arbitrage portfolio. You have asked a stockbroker about what the firm's research department expects for three stocks namely ABC, MTN and XYZ. The broker responded with the following information: Stock Current Price (RM) Expected Dividend (RM) ABC 32 2 MTN 15 1.5 XYZ 22 2.5 You have also asked about the risks factors that might affect the returns of the stocks, the broker responded that there are two factors Interest Rate (IR) and GDP that have risk premium of 6% and 5%, respectively. In terms of the sensitivity of the three stocks to the risk factors, the broker responded with the following information: Stock Factor loading for IR Factor Loading for GDP ABC 1.1 0.35 MTN 0.65 0.95 XYZ 1.22 1.3 Assuming that the actual prices for the three stocks ABC, MTN and XYZ would be RM35, RM17 and RM23 respectively. Demonstrate by showing the calculation for the three conditions on whether you can construct a riskless arbitrage portfolio or not (Assume the risk-free return is 2%). (15 marks)