Answered step by step

Verified Expert Solution

Question

1 Approved Answer

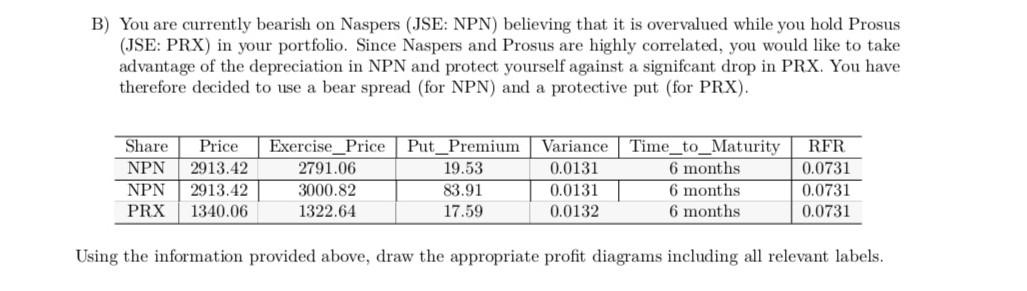

B) You are currently bearish on Naspers (JSE: NPN) believing that it is overvalued while you hold Prosus (JSE: PRX) in your portfolio. Since Naspers

B) You are currently bearish on Naspers (JSE: NPN) believing that it is overvalued while you hold Prosus (JSE: PRX) in your portfolio. Since Naspers and Prosus are highly correlated, you would like to take advantage of the depreciation in NPN and protect yourself against a signifcant drop in PRX. You have therefore decided to use a bear spread (for NPN) and a protective put (for PRX). Price Variance Exercise Price 2791.06 RFR 0.0731 2913.42 0.0131 Share NPN NPN PRX Put_Premium 19.53 83.91 17.59 Time_to_Maturity 6 months 6 months 6 months 2913.42 3000.82 0.0131 0.0731 1340.06 1322.64 0.0132 0.0731 Using the information provided above, draw the appropriate profit diagrams including all relevant labels. B) You are currently bearish on Naspers (JSE: NPN) believing that it is overvalued while you hold Prosus (JSE: PRX) in your portfolio. Since Naspers and Prosus are highly correlated, you would like to take advantage of the depreciation in NPN and protect yourself against a signifcant drop in PRX. You have therefore decided to use a bear spread (for NPN) and a protective put (for PRX). Price Variance Exercise Price 2791.06 RFR 0.0731 2913.42 0.0131 Share NPN NPN PRX Put_Premium 19.53 83.91 17.59 Time_to_Maturity 6 months 6 months 6 months 2913.42 3000.82 0.0131 0.0731 1340.06 1322.64 0.0132 0.0731 Using the information provided above, draw the appropriate profit diagrams including all relevant labels

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started