Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b Your father's employer was just acquired, and he was given a severance payment of $312,500, which he invested at a 7.5% annual rate. He

b

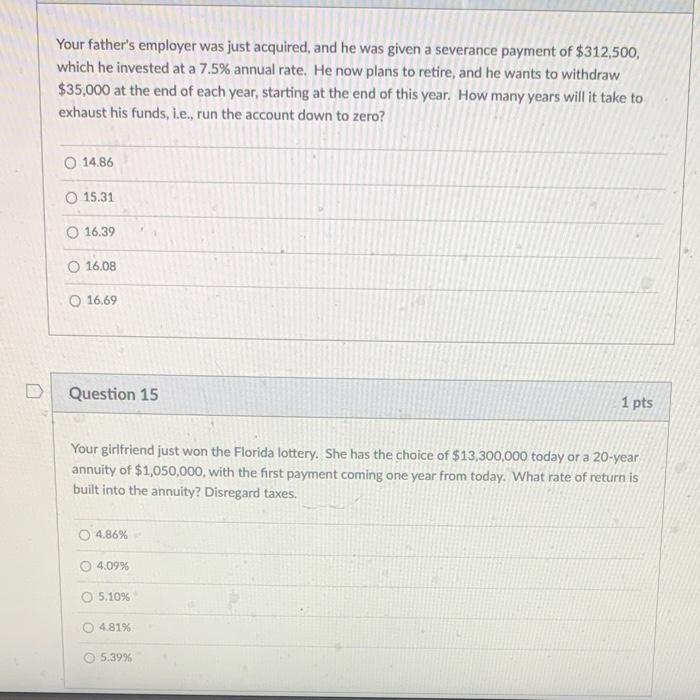

Your father's employer was just acquired, and he was given a severance payment of $312,500, which he invested at a 7.5% annual rate. He now plans to retire, and he wants to withdraw $35,000 at the end of each year, starting at the end of this year. How many years will it take to exhaust his funds, i.e., run the account down to zero? O 14.86 O 15.31 16.39 0 16.08 16.69 Question 15 1 pts Your girlfriend just won the Florida lottery. She has the choice of $13,300,000 today or a 20-year annuity of $1,050,000, with the first payment coming one year from today. What rate of return is built into the annuity? Disregard taxes. 4.86% 4.09% 05.10% 4.81% 5.39%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started