Question

B1 - Problem solving Rainy State Government had good revenues and generated enough surplus to invest in $180,000 shares issued by North Bank, an AustralianQUESTION

B1 - Problem solving\ Rainy State Government had good revenues and generated enough surplus to invest in

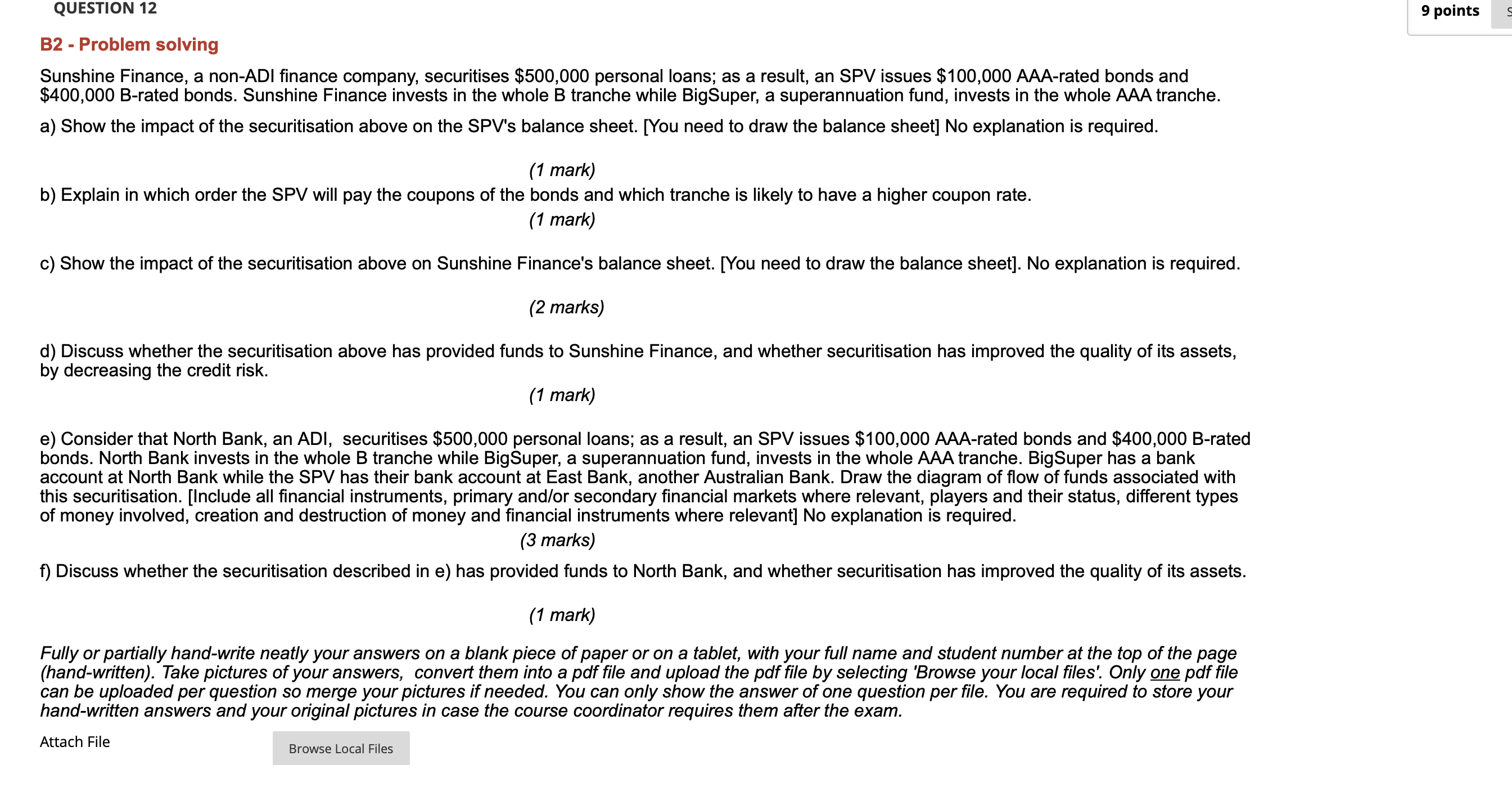

$180,000shares issued by North Bank, an AustralianQUESTION 12\ B2 - Problem solving\ Sunshine Finance, a non-ADI finance company, securitises

$500,000personal loans; as a result, an SPV issues

$100,000AAA-rated bonds and\

$400,000B-rated bonds. Sunshine Finance invests in the whole B tranche while BigSuper, a superannuation fund, invests in the whole AAA tranche.\ a) Show the impact of the securitisation above on the SPV's balance sheet. [You need to draw the balance sheet] No explanation is required.\ (1 mark)\ b) Explain in which order the SPV will pay the coupons of the bonds and which tranche is likely to have a higher coupon rate.\ (1 mark)\ c) Show the impact of the securitisation above on Sunshine Finance's balance sheet. [You need to draw the balance sheet]. No explanation is required.\ (2 marks)\ d) Discuss whether the securitisation above has provided funds to Sunshine Finance, and whether securitisation has improved the quality of its assets,\ by decreasing the credit risk.\ (1 mark)\ e) Consider that North Bank, an ADI, securitises

$500,000personal loans; as a result, an SPV issues

$100,000AAA-rated bonds and

$400,000B-rated\ bonds. North Bank invests in the whole B tranche while BigSuper, a superannuation fund, invests in the whole AAA tranche. BigSuper has a bank\ account at North Bank while the SPV has their bank account at East Bank, another Australian Bank. Draw the diagram of flow of funds associated with\ this securitisation. [Include all financial instruments, primary and/or secondary financial markets where relevant, players and their status, different types\ of money involved, creation and destruction of money and financial instruments where relevant] No explanation is required.\ (3 marks)\ f) Discuss whether the securitisation described in e) has provided funds to North Bank, and whether securitisation has improved the quality of its assets.\ (1 mark)\ Fully or partially hand-write neatly your answers on a blank piece of paper or on a tablet, with your full name and student number at the top of the page\ (hand-written). Take pictures of your answers, convert them into a pdf file and upload the pdf file by selecting 'Browse your local files'. Only one pdf file\ can be uploaded per question so merge your pictures if needed. You can only show the answer of one question per file. You are required to store your\ hand-written answers and your original pictures in case the course coordinator requires them after the exam.\ Attach File\ commercial bank (transaction 1). Hobby Club, which had exceptionally high expenses well above their revenues, takes a loan of

$70,000from North\ Bank (transaction 2).\ Hobby Club has a deposit account at North Bank. Rainy State Government has a deposit account at South Bank, another Australian commercial bank.\ a) Draw two balance sheets, one for Hobby Club and one for North Bank. Represent the respective changes in Hobby Club's balance sheet and in\ North Bank's balance sheet resulting from transactions 1 and 2. [Clearly indicate the name of the item affected in the balance sheet, the change in

$\ value and between brackets the number of the transaction.] No explanation is required.\ (4 marks)\ b) Draw one diagram of flow of funds that includes transactions 1 and 2. [Clearly indicate the financial instruments, the financial markets, the banks, the\ type of money involved, creation and destruction where relevant, and the status of the different parties - SSU, DSU and financial intermediary]. Do NOT\ include the central bank. Each party should appear only once. No explanation is required.\ (5 marks)\ c) Which components of the story constitute channelling of funds in the financial system and for which

$value? Do funds transit through a financial\ intermediary? Explain your answers in detail.\ (2 marks)\ d) Does the story involve net change of private money in the payment system and, if so, in which direction and which

$value? Explain your answers in\ detail.\ (2 marks)\ Fully or partially hand-write neatly your answers on a blank piece of paper or on a tablet, with your full name and student number at the top of the page\ (hand-written). Take pictures of your answers, convert them into a pdf file and upload the pdf file by selecting 'Browse your local files'. Only one pdf file\ can be uploaded per question so merge your pictures if needed. You can only show the answer of one question per file. You are required to store your\ hand-written answers and your original pictures in case the course coordinator requires them after the exam.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started