Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B1. Product calculation and KRV analysis You own the company Pudder INC which produces snowboards. The business is doing well, but you want a

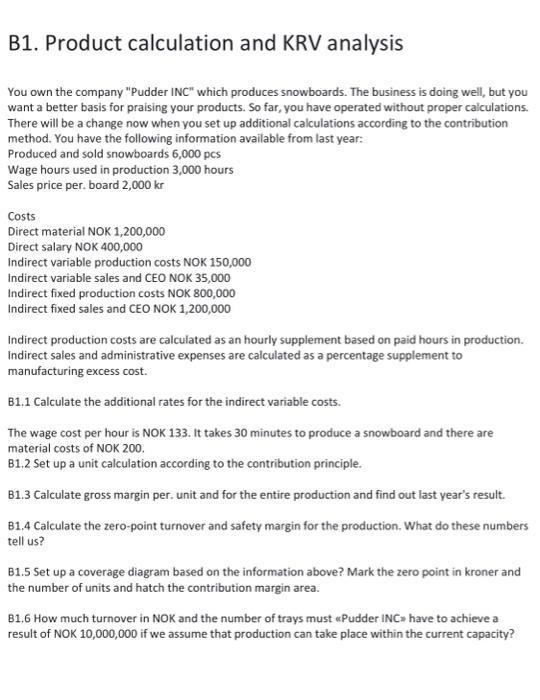

B1. Product calculation and KRV analysis You own the company "Pudder INC" which produces snowboards. The business is doing well, but you want a better basis for praising your products. So far, you have operated without proper calculations. There will be a change now when you set up additional calculations according to the contribution method. You have the following information available from last year: Produced and sold snowboards 6,000 pcs Wage hours used in production 3,000 hours Sales price per. board 2,000 kr Costs Direct material NOK 1,200,000 Direct salary NOK 400,000 Indirect variable production costs NOK 150,000 Indirect variable sales and CEO NOK 35,000 Indirect fixed production costs NOK 800,000 Indirect fixed sales and CEO NOK 1,200,000 Indirect production costs are calculated as an hourly supplement based on paid hours in production. Indirect sales and administrative expenses are calculated as a percentage supplement to manufacturing excess cost. B1.1 Calculate the additional rates for the indirect variable costs. The wage cost per hour is NOK 133. It takes 30 minutes to produce a snowboard and there are material costs of NOK 200. 81.2 Set up a unit calculation according to the contribution principle. B1.3 Calculate gross margin per. unit and for the entire production and find out last year's result. B1.4 Calculate the zero-point turnover and safety margin for the production. What do these numbers tell us? B1.5 Set up a coverage diagram based on the information above? Mark the zero point in kroner and the number of units and hatch the contribution margin area. B1.6 How much turnover in NOK and the number of trays must Pudder INC have to achieve a result of NOK 10,000,000 if we assume that production can take place within the current capacity?

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

B11 Calculate Additional Rates for Indirect Variable Costs First lets calculate the indirect variable production cost per hour and the indirect variab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started