Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The TinX Corp. is investing in a machine which will increase the quality of their product. The initial investment in the machine is $800,000.

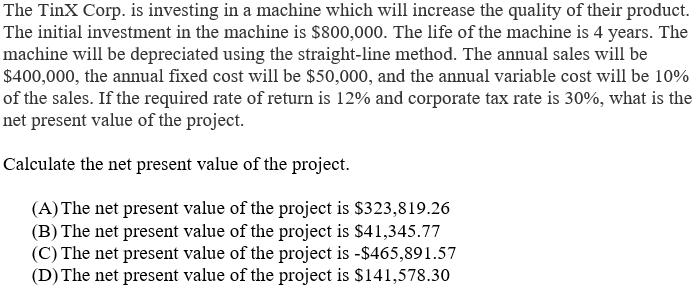

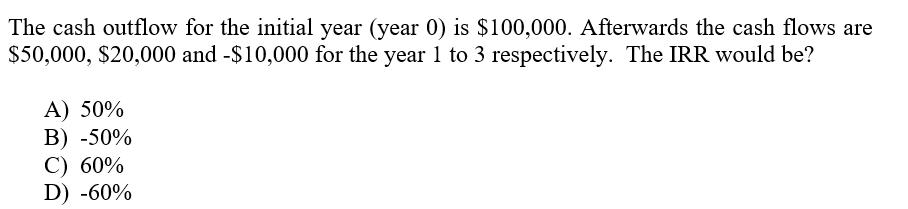

The TinX Corp. is investing in a machine which will increase the quality of their product. The initial investment in the machine is $800,000. The life of the machine is 4 years. The machine will be depreciated using the straight-line method. The annual sales will be $400,000, the annual fixed cost will be $50,000, and the annual variable cost will be 10% of the sales. If the required rate of return is 12% and corporate tax rate is 30%, what is the net present value of the project. Calculate the net present value of the project. (A) The net present value of the project is $323,819.26 (B) The net present value of the project is $41,345.77 (C) The net present value of the project is -$465,891.57 (D) The net present value of the project is $141,578.30 The cash outflow for the initial year (year 0) is $100,000. Afterwards the cash flows are $50,000, $20,000 and -$10,000 for the year 1 to 3 respectively. The IRR would be? A) 50% B) -50% C) 60% D) -60%

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The correct answer is D 14157830 Explanation The net present value of the project is calculated as f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started