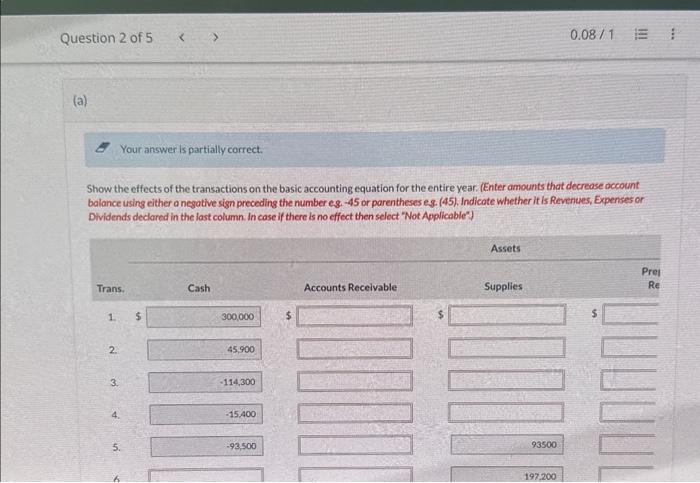

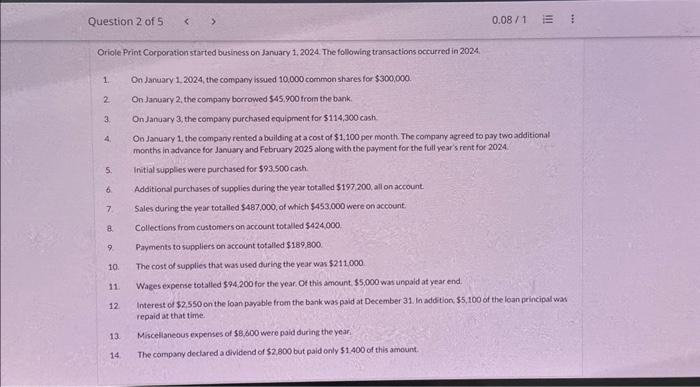

(b1) The parts of this question must be completed in order. This part will be available when you complete the part above. (b2) The parts of this question must be completed in order. This part will be available when you complete the part above. (b3) The parts of this question must be completed in order. This part will be available when you complete the part above. Oriole Print Corporation started business on January 1, 2024. The following transactions occurred in 2024. 1. On lanuary 1, 2024, the company issued 10,000 common shares for \\( \\$ 300,000 \\). 2. On January 2 , the company borrowed \\( \\$ 45,900 \\) tron the bunk. 3. On January 3 , the company purchased equipment for \\( \\$ 114,300 \\mathrm{cash} \\). 4. On January 1, the company rented a building at a cost of \\( \\$ 1,100 \\) per month. The compary agreed to pay two additional months in advance for January and February 2025 alone with the payment for the full year's rent for 2024. 5. Initial supplies were purchased for \\( \\$ 93.500 \\) cash. 6. Additional purchuses of supplies during the year totalled \\( \\$ 197,200 \\), all on account. 7. Sales during the year totailed \\( \\$ 487,000 \\), of which \\( \\$ 453,000 \\) were on account. 8. Collections from customers on account totaled \\( \\$ 424,000 \\) 9. Payments to suppliers on account totalled \\( \\$ 189,800 \\) 10. The cost of supplies that was used during the year was \\( \\$ 211000 \\) 11. Wages expense totalled \\( \\$ 94,200 \\) for the year, Of this amount, \\( \\$ 5,000 \\) was unpaid at year end. 12. Interest of \\( \\$ 2,550 \\) on the loan pyyble from the bankwas paid at December 31 . In add tion \\( \\$ 5,100 \\) of the loan principal was repaid at that time. 13. Miscelaneous expenses of \\( \\$ 8,600 \\) wero poid during the year. 14. The company declared a dividend of \\( \\$ 2,800 \\) but paid only \\( \\$ 1.400 \\) of this amount. Show the effects of the transactions on the basic accounting equation for the entire year. (Enter amounts that decrease occount balance using either a negative sign preceding the number es, -45 or parentheses e g. (45). Indicate whether it is Revenues, Expenses or Dividends declared in the last column. In case if there is no effect then select \"Not Applicable\")