Answered step by step

Verified Expert Solution

Question

1 Approved Answer

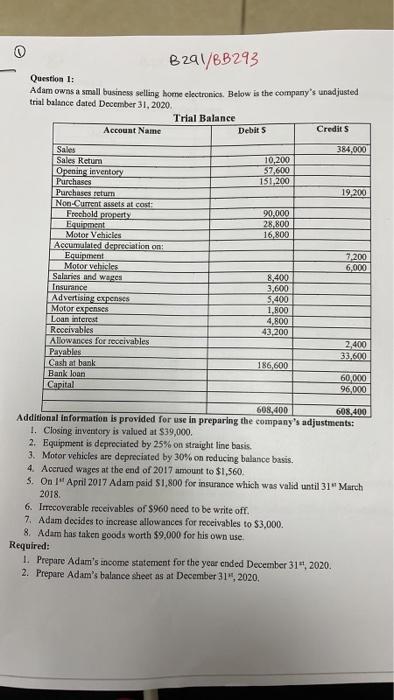

B291/BB293 Question 1: Adam owns a small business selling home electronics. Below is the company's unadjusted trial balance dated December 31, 2020. Sales Sales Return

B291/BB293 Question 1: Adam owns a small business selling home electronics. Below is the company's unadjusted trial balance dated December 31, 2020. Sales Sales Return Account Name Opening inventory Purchases Purchases return Non-Current assets at cost: Freehold property Equipment Motor Vehicles Accumulated depreciation on: Equipment Motor vehicles Salaries and wages Insurance Advertising expenses Motor expenses Loan interest Receivables Allowances for receivables Payables Cash at bank Bank loan Capital Trial Balance Debit $ 10,200 57,600 151,200 90,000 28,800 16,800 8,400 3,600 5,400 1,800 4,800 43,200 186,600 Credit S 6. Irrecoverable receivables of $960 need to be write off. 7. Adam decides to increase allowances for receivables to $3,000. 8. Adam has taken goods worth $9,000 for his own use. Required: 384,000 19,200 1. Prepare Adam's income statement for the year ended December 31st, 2020. 2. Prepare Adam's balance sheet as at December 31st, 2020. 7,200 6,000 2,400 33,600 608,400 Additional information is provided for use in preparing the company's adjustments: 1. Closing inventory is valued at $39,000. 2. Equipment is depreciated by 25% on straight line basis. 3. Motor vehicles are depreciated by 30% on reducing balance basis. 60,000 96,000 4. Accrued wages at the end of 2017 amount to $1,560. 5. On 1st April 2017 Adam paid $1,800 for insurance which was valid until 31st March 2018. 608,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started