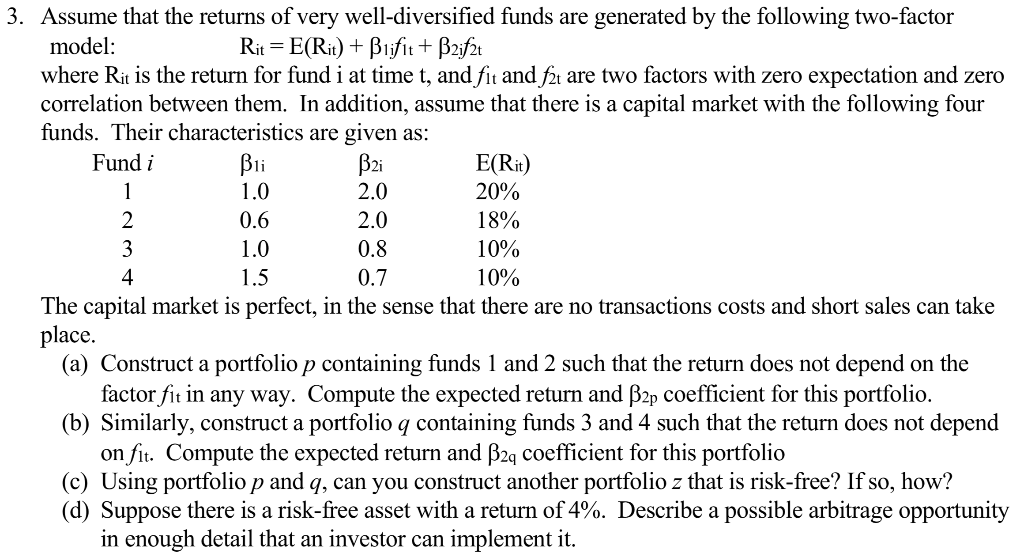

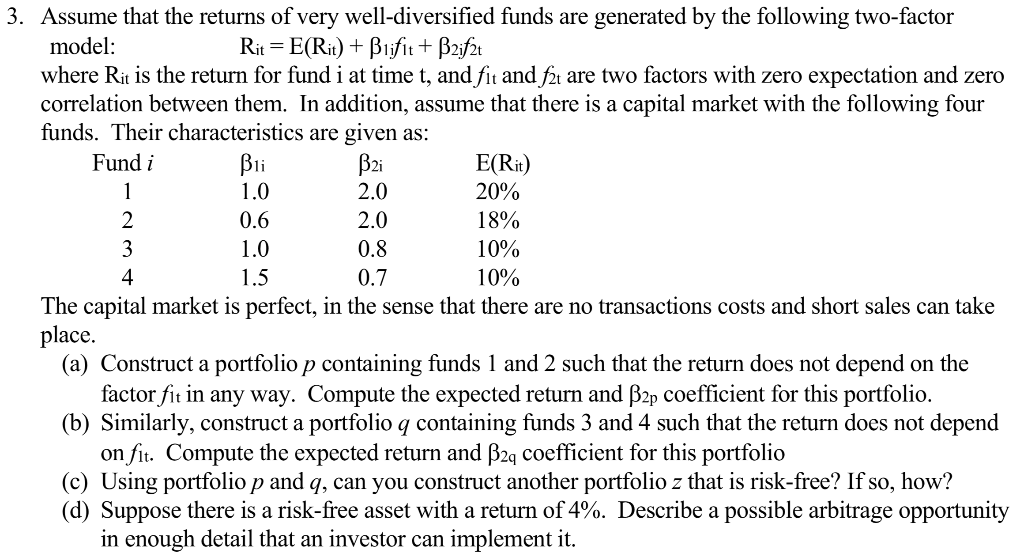

B2i 0.6 2.0 0.8 3. Assume that the returns of very well-diversified funds are generated by the following two-factor model: Rit = E(Rit) + Biifit + B2if2t where Rit is the return for fund i at time t, and fit and f2t are two factors with zero expectation and zero correlation between them. In addition, assume that there is a capital market with the following four funds. Their characteristics are given as: Fund i E(Rit) 1.0 2.0 20% 18% 1.0 10% 1.5 10% The capital market is perfect, in the sense that there are no transactions costs and short sales can take place. (a) Construct a portfolio p containing funds 1 and 2 such that the return does not depend on the factor fit in any way. Compute the expected return and B2p coefficient for this portfolio. (b) Similarly, construct a portfolio q containing funds 3 and 4 such that the return does not depend on fit. Compute the expected return and B2q coefficient for this portfolio (c) Using portfolio p and q, can you construct another portfolio z that is risk-free? If so, how? (d) Suppose there is a risk-free asset with a return of 4%. Describe a possible arbitrage opportunity in enough detail that an investor can implement it. 0.7 B2i 0.6 2.0 0.8 3. Assume that the returns of very well-diversified funds are generated by the following two-factor model: Rit = E(Rit) + Biifit + B2if2t where Rit is the return for fund i at time t, and fit and f2t are two factors with zero expectation and zero correlation between them. In addition, assume that there is a capital market with the following four funds. Their characteristics are given as: Fund i E(Rit) 1.0 2.0 20% 18% 1.0 10% 1.5 10% The capital market is perfect, in the sense that there are no transactions costs and short sales can take place. (a) Construct a portfolio p containing funds 1 and 2 such that the return does not depend on the factor fit in any way. Compute the expected return and B2p coefficient for this portfolio. (b) Similarly, construct a portfolio q containing funds 3 and 4 such that the return does not depend on fit. Compute the expected return and B2q coefficient for this portfolio (c) Using portfolio p and q, can you construct another portfolio z that is risk-free? If so, how? (d) Suppose there is a risk-free asset with a return of 4%. Describe a possible arbitrage opportunity in enough detail that an investor can implement it. 0.7