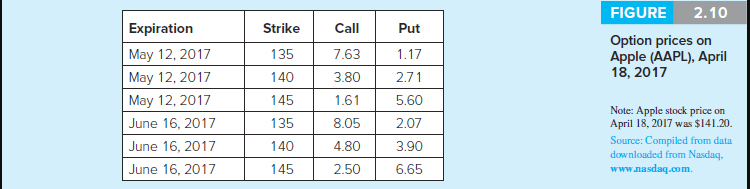

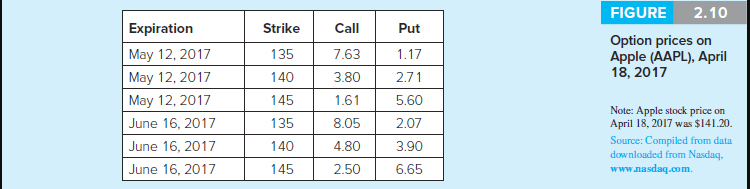

b-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Rate of return % c-1. What if you had bought an September put with exercise price $140 instead? Would you exercise the put at a stock price of $140? Yes O No c-2. What is the rate of return on your position? (Negative value should be indicated by a minus sign.) Rate of return : % Strike Call Put FIGURE 2.10 Option prices on Apple (AAPL), April 18, 2017 1.17 135 140 Expiration May 12, 2017 May 12, 2017 May 12, 2017 June 16, 2017 June 16, 2017 June 16, 2017 2.71 5.60 2.07 145 135 140 145 7.63 3.80 1.61 8.05 4.80 3.90 6.65 Note: Apple stock price on April 18, 2017 was $141.20. Source: Compiled from data downloaded from Nasdaq, www.nasdaq.com 2.50 Refer to the stock options on Apple in the Figure 2.10. Suppose you buy an September expiration call option on 300 shares with the excise price of $140. a-1. If the stock price in September is $141, will you exercise your call? O Yes O No a-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Net profit of a-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Rate of return : % b-1. Would you exercise the call if you had bought the September call with the exercise price $135? Yes O No b-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Net loss of b-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Rate of return : % b-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Rate of return % c-1. What if you had bought an September put with exercise price $140 instead? Would you exercise the put at a stock price of $140? Yes O No c-2. What is the rate of return on your position? (Negative value should be indicated by a minus sign.) Rate of return : % Strike Call Put FIGURE 2.10 Option prices on Apple (AAPL), April 18, 2017 1.17 135 140 Expiration May 12, 2017 May 12, 2017 May 12, 2017 June 16, 2017 June 16, 2017 June 16, 2017 2.71 5.60 2.07 145 135 140 145 7.63 3.80 1.61 8.05 4.80 3.90 6.65 Note: Apple stock price on April 18, 2017 was $141.20. Source: Compiled from data downloaded from Nasdaq, www.nasdaq.com 2.50 Refer to the stock options on Apple in the Figure 2.10. Suppose you buy an September expiration call option on 300 shares with the excise price of $140. a-1. If the stock price in September is $141, will you exercise your call? O Yes O No a-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Net profit of a-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Rate of return : % b-1. Would you exercise the call if you had bought the September call with the exercise price $135? Yes O No b-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Net loss of b-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Rate of return : %