Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b34 7. Deferred Revenue Expenditure Sometimes the amount of revenue expenditure incurred in large-scale and business gets benefits from such expenditure for more than one

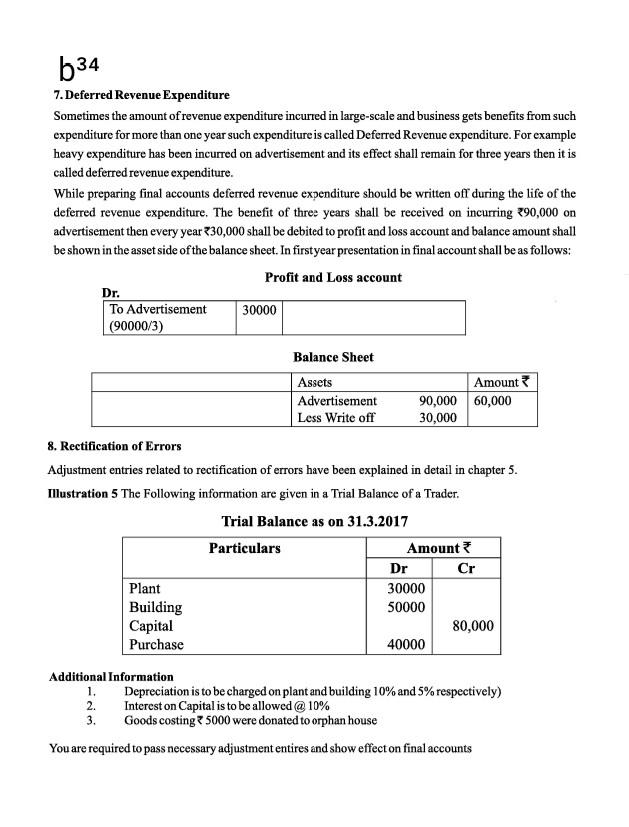

b34 7. Deferred Revenue Expenditure Sometimes the amount of revenue expenditure incurred in large-scale and business gets benefits from such expenditure for more than one year such expenditure is called Deferred Revenue expenditure. For example heavy expenditure has been incurred on advertisement and its effect shall remain for three years then it is called deferred revenue expenditure. While preparing final accounts deferred revenue expenditure should be written off during the life of the deferred revenue expenditure. The benefit of three years shall be received on incurring 290,000 on advertisement then every year 330,000 shall be debited to profit and loss account and balance amount shall be shown in the asset side of the balance sheet. In firstyear presentation in final account shall be as follows: Profit and Loss account Dr. To Advertisement 30000 (90000/3) Balance Sheet Assets Amount Advertisement 90,000 60,000 Less Write off 30,000 8. Rectification of Errors Adjustment entries related to rectification of errors have been explained in detail in chapter 5. Illustration 5 The Following information are given in a Trial Balance of a Trader. Trial Balance as on 31.3.2017 Particulars Amount Dr Plant 30000 Building 50000 Capital 80,000 Purchase 40000 Cr Additional Information 1. Depreciation is to be charged on plant and building 10% and 5% respectively) 2. Interest on Capital is to be allowed @ 10% 3. Goods costing 5000 were donated to orphan house You are required to pass necessary adjustment entires and show effect on final accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started