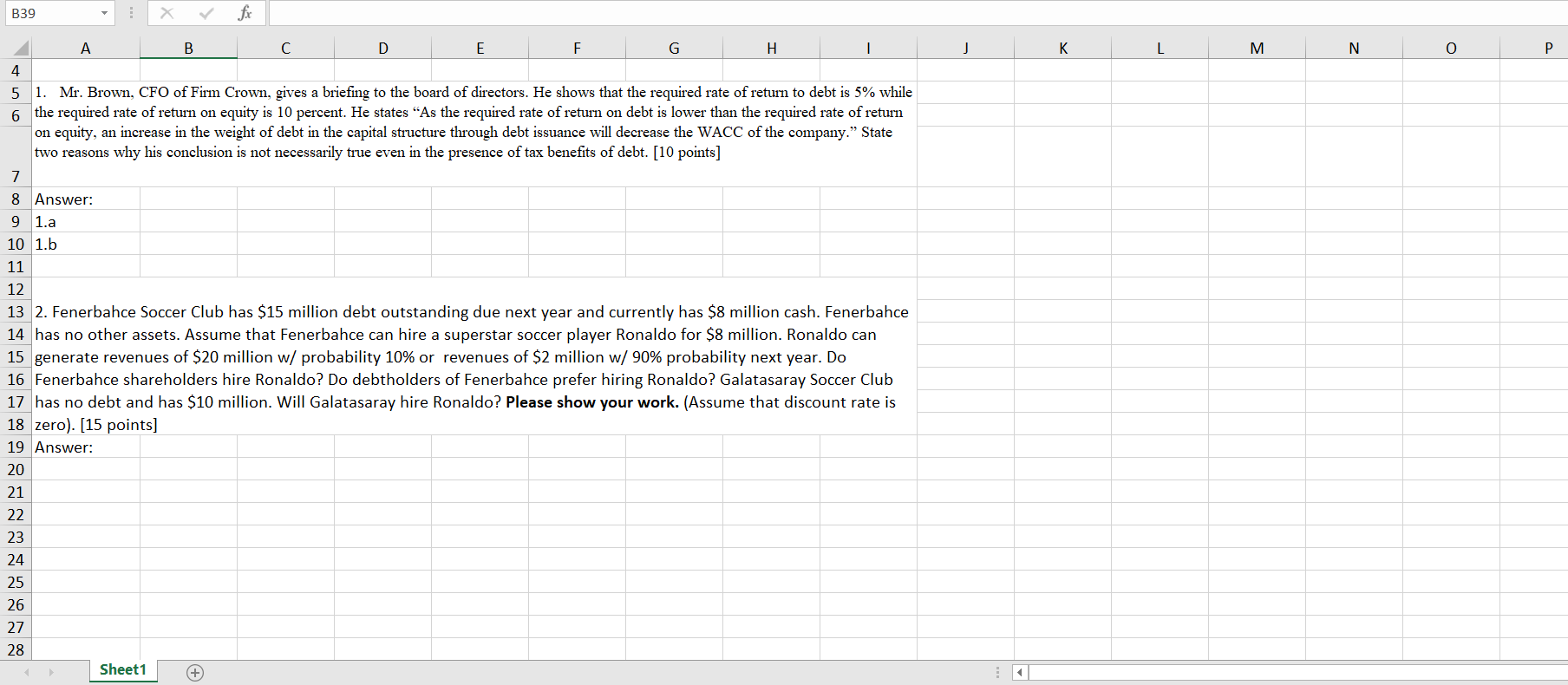

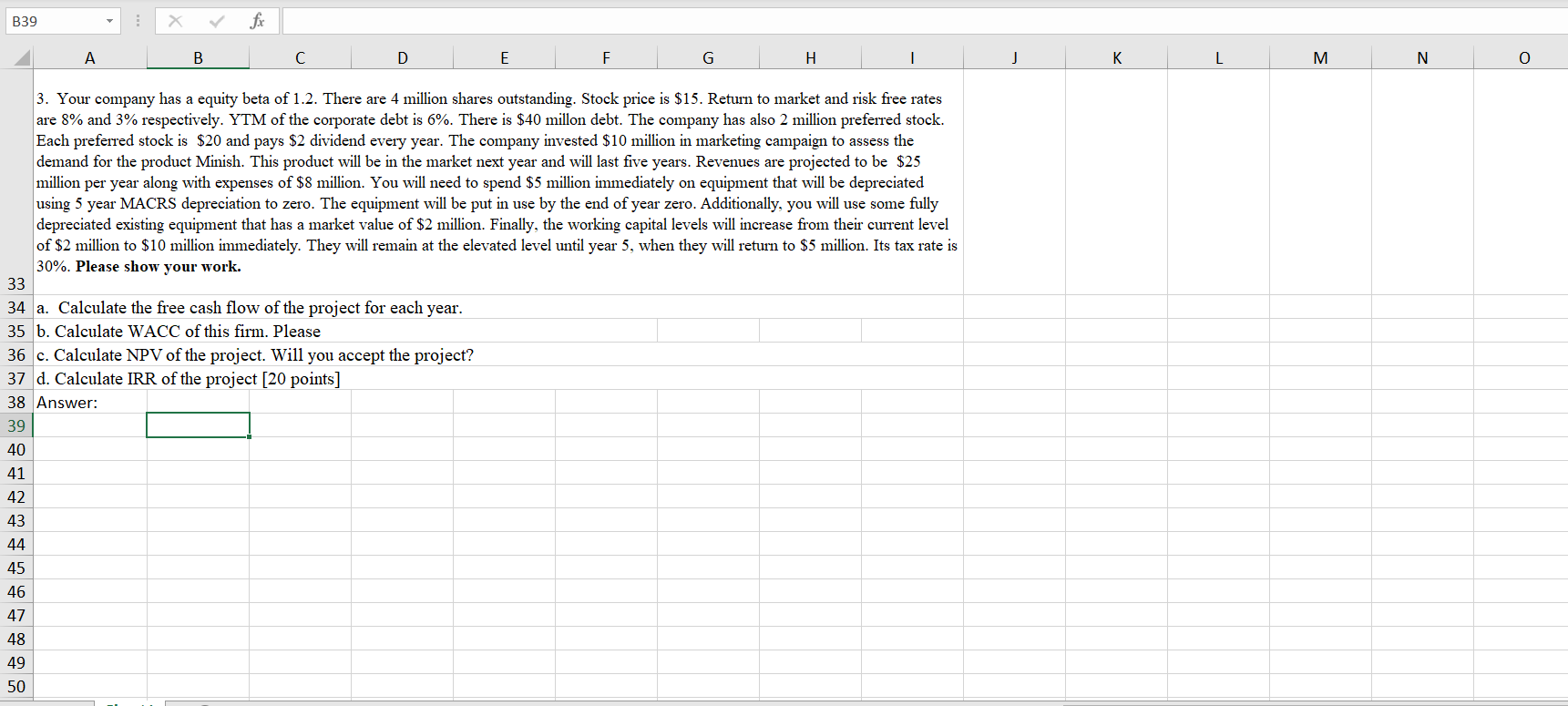

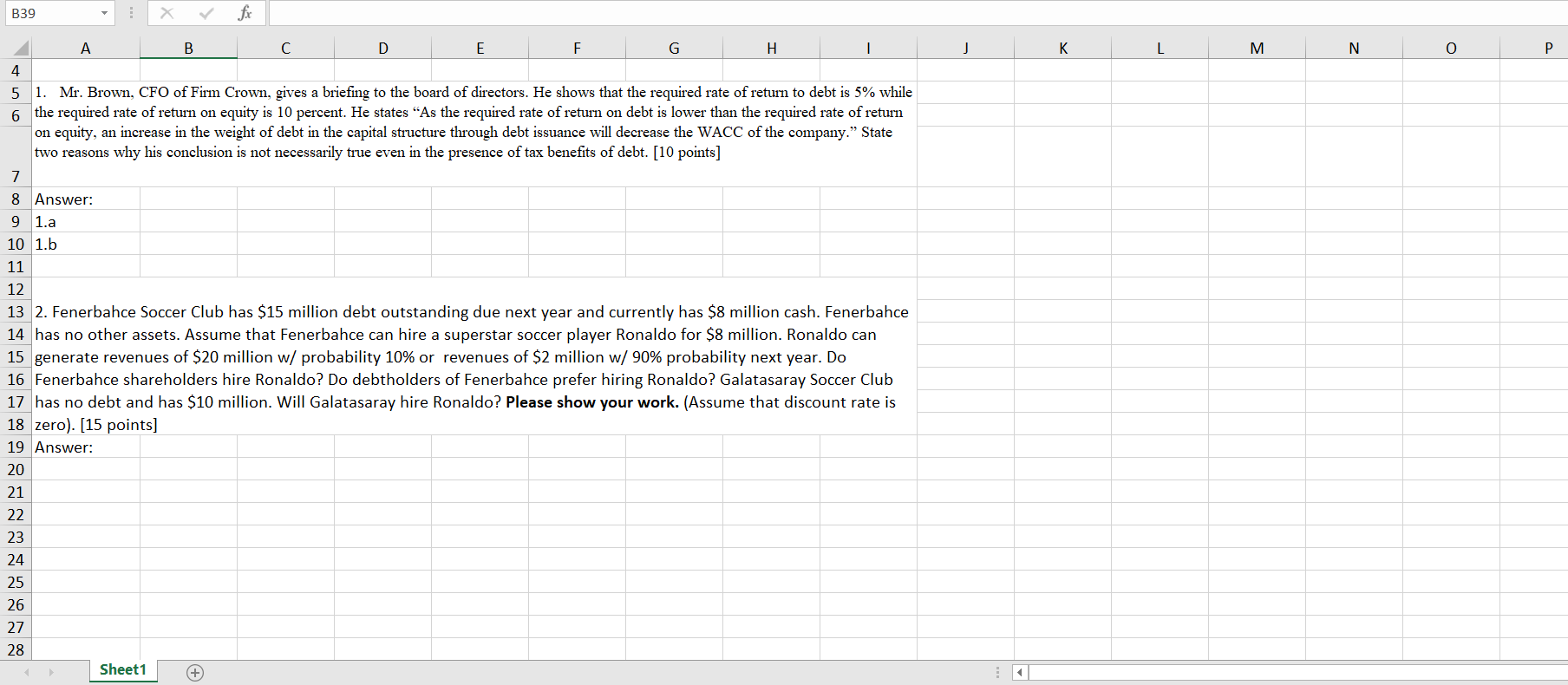

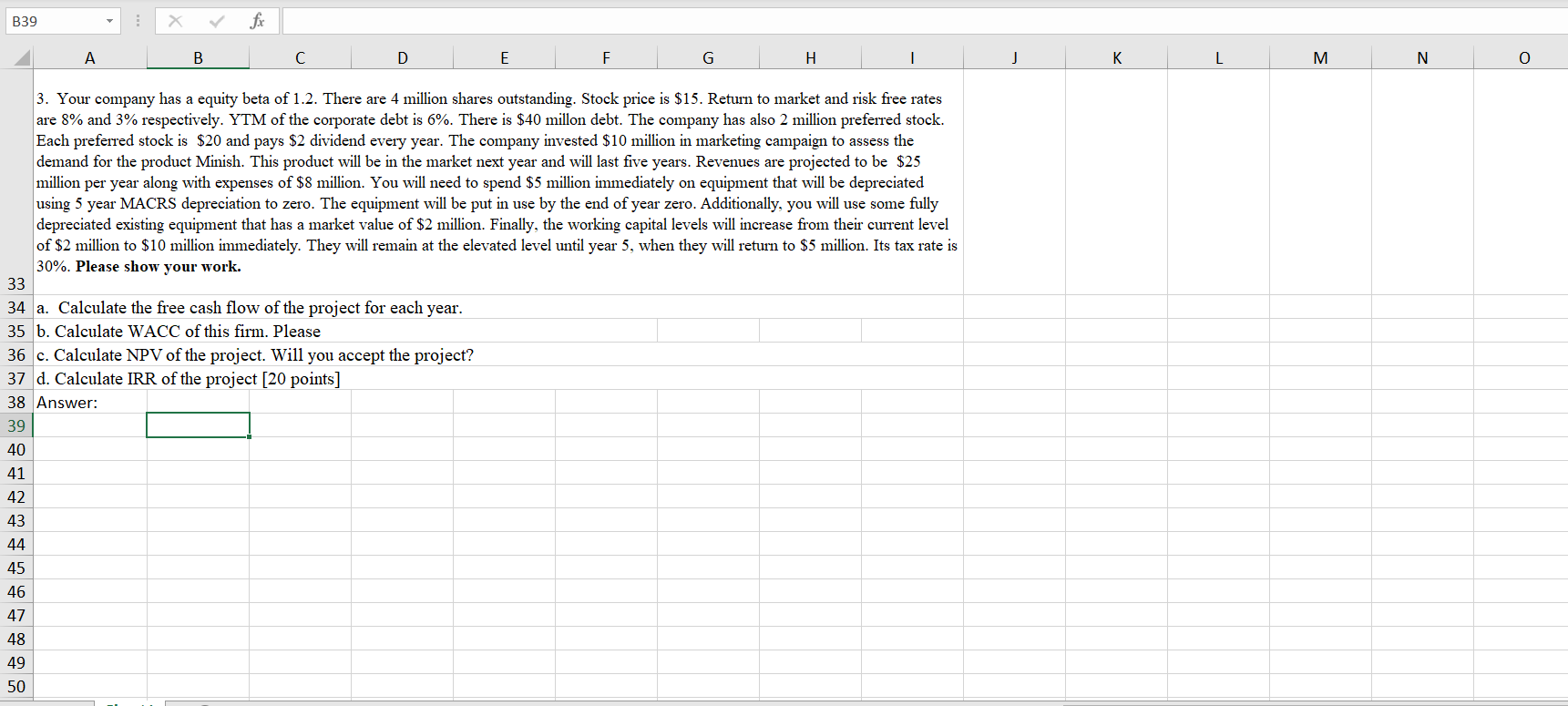

B39 A B D F F G H K M N 0 P 4 5 1. Mr. Brown, CFO of Firm Crown, gives a briefing to the board of directors. He shows that the required rate of return to debt is 5% while 6 the required rate of return on equity is 10 percent. He states As the required rate of return on debt is lower than the required rate of return on equity, an increase in the weight of debt in the capital structure through debt issuance will decrease the WACC of the company. State two reasons why his conclusion is not necessarily true even in the presence of tax benefits of debt. [10 points] 7 8 Answer: 9 1.a 10 1.b 11 12 13 2. Fenerbahce Soccer Club has $15 million debt outstanding due next year and currently has $8 million cash. Fenerbahce 14 has no other assets. Assume that Fenerbahce can hire a superstar soccer player Ronaldo for $8 million. Ronaldo can 15 generate revenues of $20 million w/ probability 10% or revenues of $2 million w/ 90% probability next year. Do 16 Fenerbahce shareholders hire Ronaldo? Do debtholders of Fenerbahce prefer hiring Ronaldo? Galatasaray Soccer Club 17 has no debt and $10 million. Will Galatasaray hire Ronaldo? Please show your work. (Assume that discount rate 18 zero). [15 points] 19 Answer: 20 21 22 23 24 25 26 27 28 Sheet1 B39 fic A B D E F G H K L M N o 3. Your company has a equity beta of 1.2. There are 4 million shares outstanding. Stock price is $15. Return to market and risk free rates are 8% and 3% respectively. YTM of the corporate debt is 6%. There is $40 millon debt. The company has also 2 million preferred stock. Each preferred stock is $20 and pays $2 dividend every year. The company invested $10 million in marketing campaign to assess the demand for the product Minish. This product will be in the market next year and will last five years. Revenues are projected to be $25 million per year along with expenses of $8 million. You will need to spend $5 million immediately on equipment that will be depreciated using 5 year MACRS depreciation to zero. The equipment will be put in use by the end of year zero. Additionally, you will use some fully depreciated existing equipment that has a market value of $2 million. Finally, the working capital levels will increase from their current level of $2 million to $10 million immediately. They will remain at the elevated level until year 5, when they will return to $5 million. Its tax rate is 30%. Please show your work. 33 34 a. Calculate the free cash flow of the project for each year. 35 b. Calculate WACC of this firm. Please 36 c. Calculate NPV of the project. Will you accept the project? 37 d. Calculate IRR of the project (20 points] 38 Answer: 39 40 41 42 43 44 45 46 47 48 49 50