Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B4 only Question B3 (continued) Required: (a) Prepare adjusting entries for the year 2019 if Faber Company uses the Income Statement approach and estimates 5%

B4 only

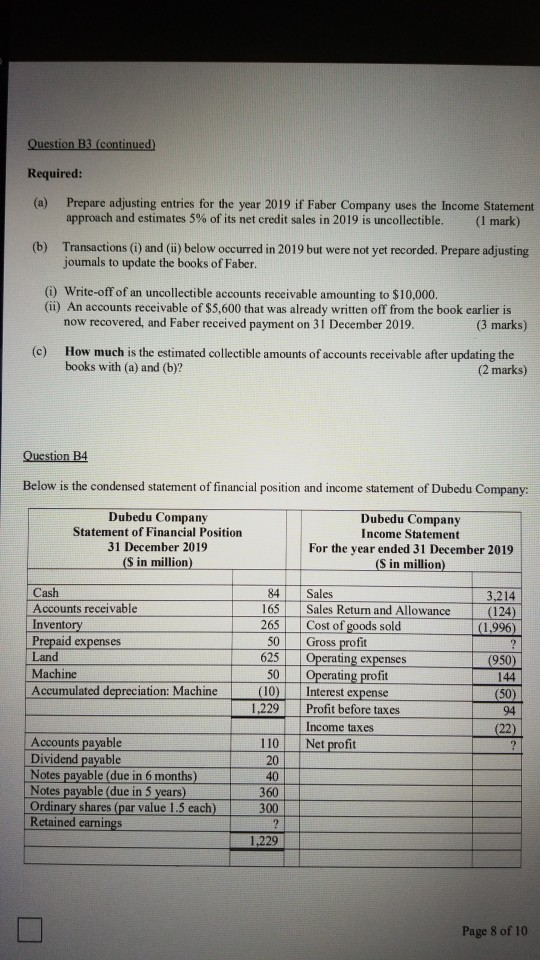

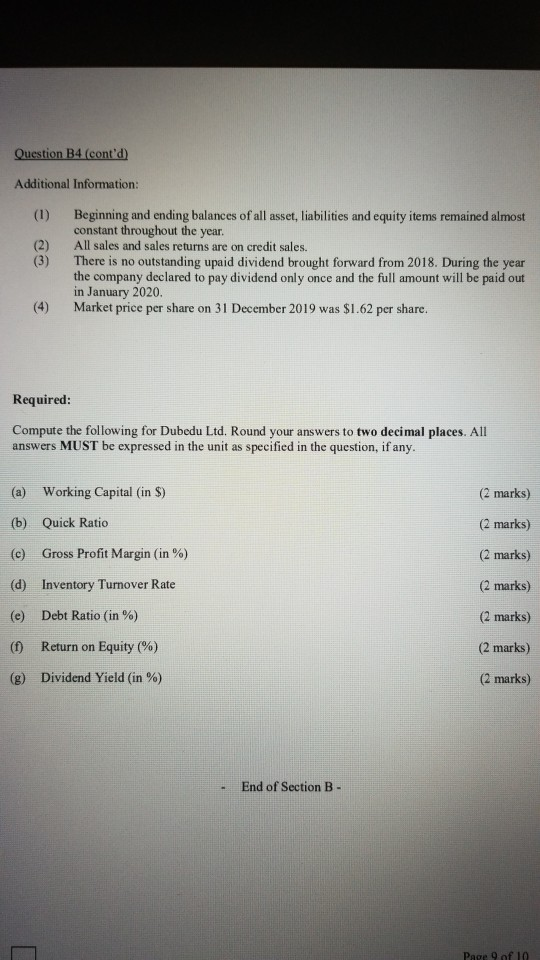

Question B3 (continued) Required: (a) Prepare adjusting entries for the year 2019 if Faber Company uses the Income Statement approach and estimates 5% of its net credit sales in 2019 is uncollectible. (1 mark) (b) Transactions (1) and (ii) below occurred in 2019 but were not yet recorded. Prepare adjusting joumals to update the books of Faber. 1) Write-off of an uncollectible accounts receivable amounting to $10,000. (ii) An accounts receivable of $5,600 that was already written off from the book earlier is now recovered, and Faber received payment on 31 December 2019. (3 marks) How much is the estimated collectible amounts of accounts receivable after updating the books with (a) and (b)? (2 marks) Question B4 Below is the condensed statement of financial position and income statement of Dubedu Company: Dubedu Company Dubedu Company Statement of Financial Position Income Statement 31 December 2019 For the year ended 31 December 2019 (S in million) (S in million) Cash Accounts receivable Inventory Prepaid expenses Land Machine Accumulated depreciation: Machine 84 165 265 50 625 50 (10) 1,229 Sales Sales Retum and Allowance Cost of goods sold Gross profit Operating expenses Operating profit Interest expense Profit before taxes Income taxes Net profit 3,214 (124) (1.996) ? (950) 144 (50) 94 (22) ? Accounts payable Dividend payable Notes payable (due in 6 months) Notes payable (due in 5 years) Ordinary shares (par value 1.5 each) Retained earnings 110 20 40 360 300 ? 1,229 Page 8 of 10 Question B4 (cont'd) Additional Information: (1) (2) (3) Beginning and ending balances of all asset, liabilities and equity items remained almost constant throughout the year. All sales and sales returns are on credit sales. There is no outstanding upaid dividend brought forward from 2018. During the year the company declared to pay dividend only once and the full amount will be paid out in January 2020 Market price per share on 31 December 2019 was $1.62 per share. Required: Compute the following for Dubedu Ltd. Round your answers to two decimal places. All answers MUST be expressed in the unit as specified in the question, if any. (a) Working Capital (in $) (2 marks) (b) Quick Ratio (2 marks) (c) Gross Profit Margin (in %) (2 marks) (d) Inventory Turnover Rate (2 marks) (e) Debt Ratio (in %) (2 marks) Return on Equity (%) (2 marks) (g) Dividend Yield (in %) (2 marks) End of Section B - Page 9 of 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started