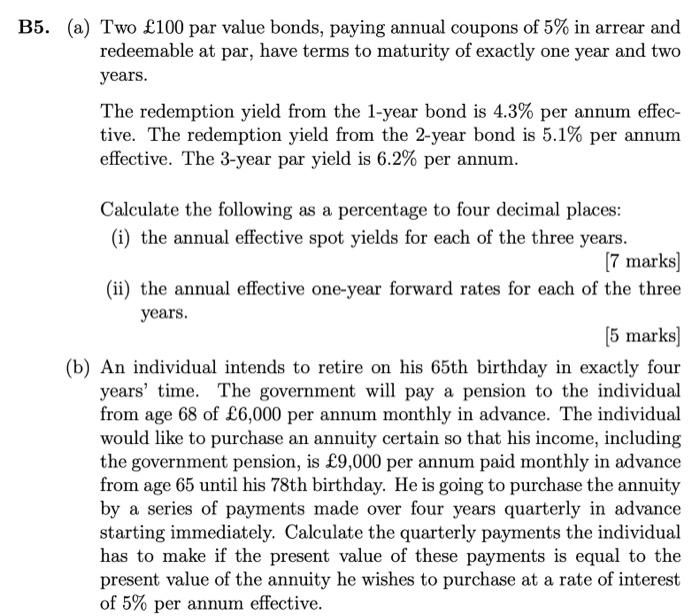

B5. (a) Two 100 par value bonds, paying annual coupons of 5% in arrear and redeemable at par, have terms to maturity of exactly one year and two years. The redemption yield from the 1-year bond is 4.3% per annum effec- tive. The redemption yield from the 2-year bond is 5.1% per annum effective. The 3-year par yield is 6.2% per annum. Calculate the following as a percentage to four decimal places: (i) the annual effective spot yields for each of the three years. [7 marks] (ii) the annual effective one-year forward rates for each of the three years. (5 marks) (b) An individual intends to retire on his 65th birthday in exactly four years' time. The government will pay a pension to the individual from age 68 of 6,000 per annum monthly in advance. The individual would like to purchase an annuity certain so that his income, including the government pension, is 9,000 per annum paid monthly in advance from age 65 until his 78th birthday. He is going to purchase the annuity by a series of payments made over four years quarterly in advance starting immediately. Calculate the quarterly payments the individual has to make if the present value of these payments is equal to the present value of the annuity he wishes to purchase at a rate of interest of 5% per annum effective. B5. (a) Two 100 par value bonds, paying annual coupons of 5% in arrear and redeemable at par, have terms to maturity of exactly one year and two years. The redemption yield from the 1-year bond is 4.3% per annum effec- tive. The redemption yield from the 2-year bond is 5.1% per annum effective. The 3-year par yield is 6.2% per annum. Calculate the following as a percentage to four decimal places: (i) the annual effective spot yields for each of the three years. [7 marks] (ii) the annual effective one-year forward rates for each of the three years. (5 marks) (b) An individual intends to retire on his 65th birthday in exactly four years' time. The government will pay a pension to the individual from age 68 of 6,000 per annum monthly in advance. The individual would like to purchase an annuity certain so that his income, including the government pension, is 9,000 per annum paid monthly in advance from age 65 until his 78th birthday. He is going to purchase the annuity by a series of payments made over four years quarterly in advance starting immediately. Calculate the quarterly payments the individual has to make if the present value of these payments is equal to the present value of the annuity he wishes to purchase at a rate of interest of 5% per annum effective