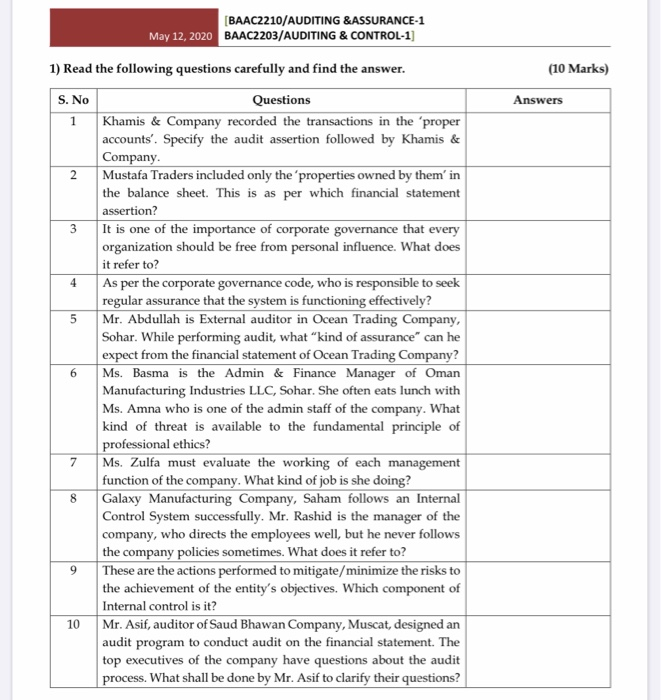

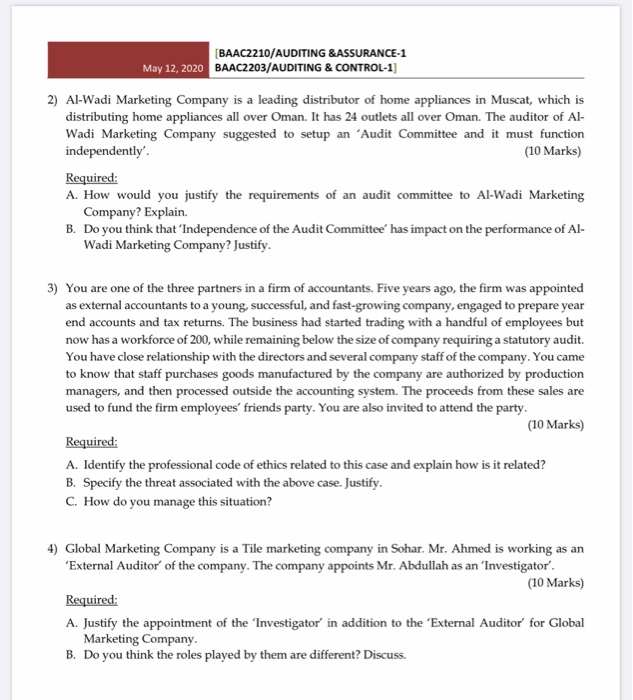

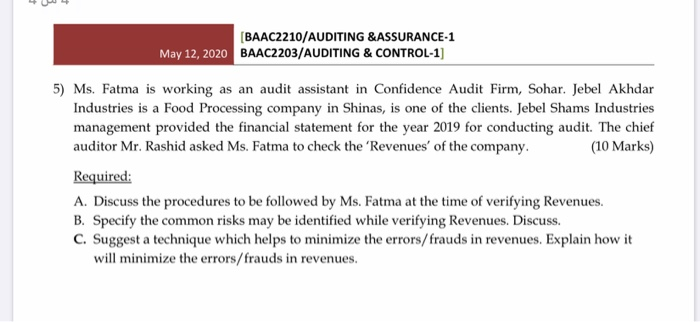

[BAAC2210/AUDITING & ASSURANCE-1 May 12, 2020 BAAC2203/AUDITING & CONTROL-1] 1) Read the following questions carefully and find the answer. (10 Marks) S. No Answers Questions Khamis & Company recorded the transactions in the 'proper accounts. Specify the audit assertion followed by Khamis & Company. Mustafa Traders included only the properties owned by them' in the balance sheet. This is as per which financial statement assertion? It is one of the importance of corporate governance that every organization should be free from personal influence. What does it refer to? As per the corporate governance code, who is responsible to seek regular assurance that the system is functioning effectively? Mr. Abdullah is External auditor in Ocean Trading Company, Sohar. While performing audit, what kind of assurance can he expect from the financial statement of Ocean Trading Company? Ms. Basma is the Admin & Finance Manager of Oman Manufacturing Industries LLC, Sohar. She often eats lunch with Ms. Amna who is one of the admin staff of the company. What kind of threat is available to the fundamental principle of professional ethics? Ms. Zulfa must evaluate the working of each management function of the company. What kind of job is she doing? Galaxy Manufacturing Company, Saham follows an Internal Control System successfully. Mr. Rashid is the manager of the company, who directs the employees well, but he never follows the company policies sometimes. What does it refer to? These are the actions performed to mitigate/minimize the risks to the achievement of the entity's objectives. Which component of Internal control is it? Mr. Asif, auditor of Saud Bhawan Company, Muscat, designed an audit program to conduct audit on the financial statement. The top executives of the company have questions about the audit process. What shall be done by Mr. Asif to clarify their questions? 7 BAAC2210/AUDITING &ASSURANCE-1 May 12, 2020 BAAC2203/AUDITING & CONTROL-1) 2) Al-Wadi Marketing Company is a leading distributor of home appliances in Muscat, which is distributing home appliances all over Oman. It has 24 outlets all over Oman. The auditor of Al- Wadi Marketing Company suggested to setup an 'Audit Committee and it must function independently (10 Marks) Required: A. How would you justify the requirements of an audit committee to Al-Wadi Marketing Company? Explain B. Do you think that 'Independence of the Audit Committee' has impact on the performance of Al- Wadi Marketing Company? Justify. 3) You are one of the three partners in a firm of accountants. Five years ago, the firm was appointed as external accountants to a young, successful, and fast-growing company, engaged to prepare year end accounts and tax returns. The business had started trading with a handful of employees but now has a workforce of 200, while remaining below the size of company requiring a statutory audit. You have close relationship with the directors and several company staff of the company. You came to know that staff purchases goods manufactured by the company are authorized by production managers, and then processed outside the accounting system. The proceeds from these sales are used to fund the firm employees' friends party. You are also invited to attend the party. (10 Marks) Required: A. Identify the professional code of ethics related to this case and explain how is it related? B. Specify the threat associated with the above case. Justify. C. How do you manage this situation? 4) Global Marketing Company is a Tile marketing company in Sohar. Mr. Ahmed is working as an 'External Auditor of the company. The company appoints Mr. Abdullah as an 'Investigator'. (10 Marks) Required: A. Justify the appointment of the 'Investigator' in addition to the 'External Auditor' for Global Marketing Company. B. Do you think the roles played by them are different? Discuss. [BAAC2210/AUDITING &ASSURANCE-1 May 12, 2020 BAAC2203/AUDITING & CONTROL-1] 5) Ms. Fatma is working as an audit assistant in Confidence Audit Firm, Sohar. Jebel Akhdar Industries is a Food Processing company in Shinas, is one of the clients. Jebel Shams Industries management provided the financial statement for the year 2019 for conducting audit. The chief auditor Mr. Rashid asked Ms. Fatma to check the 'Revenues of the company. (10 Marks) Required: A. Discuss the procedures to be followed by Ms. Fatma at the time of verifying Revenues. B. Specify the common risks may be identified while verifying Revenues. Discuss C. Suggest a technique which helps to minimize the errors/frauds in revenues. Explain how it will minimize the errors/frauds in revenues