Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Babes Dog Obedience School, Inc., wants to maintain its current capital structure of 50 percent common equity, 10 percent preferred stock, and 40 percent debt.

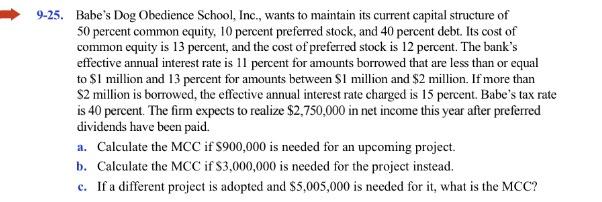

Babes Dog Obedience School, Inc., wants to maintain its current capital structure of 50 percent common equity, 10 percent preferred stock, and 40 percent debt. Its cost of common equity is 13 percent, and the cost of preferred stock is 12 percent. The banks effective annual interest rate is 11 percent for amounts borrowed that are less than or equal to $1 million and 13 percent for amounts between $1 million and $2 million. If more than $2 million is borrowed, the effective annual interest rate charged is 15 percent. Babes tax rate is 40 percent. The firm expects to realize $2,750,000 in net income this year after preferred dividends have been paid.

a. Calculate the MCC if $900,000 is needed for an upcoming project.

b. Calculate the MCC if $3,000,000 is needed for the project instead.

c. If a different project is adopted and $5,005,000 is needed for it, what is the MCC?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started