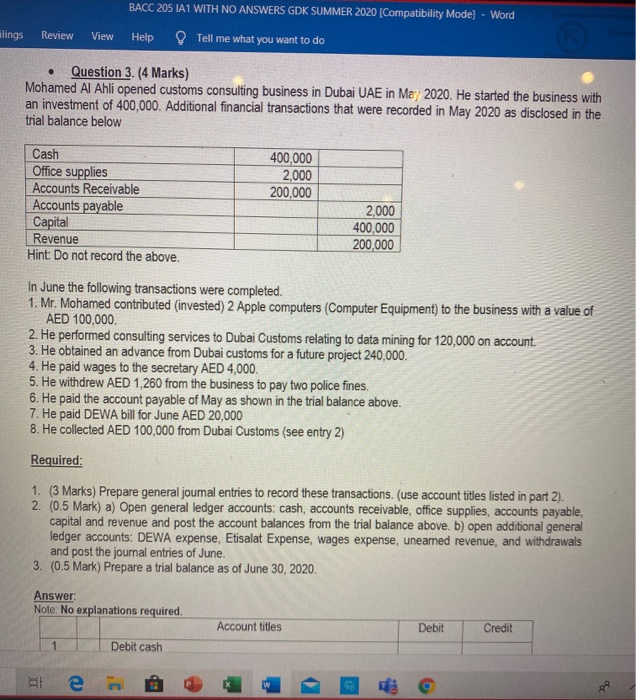

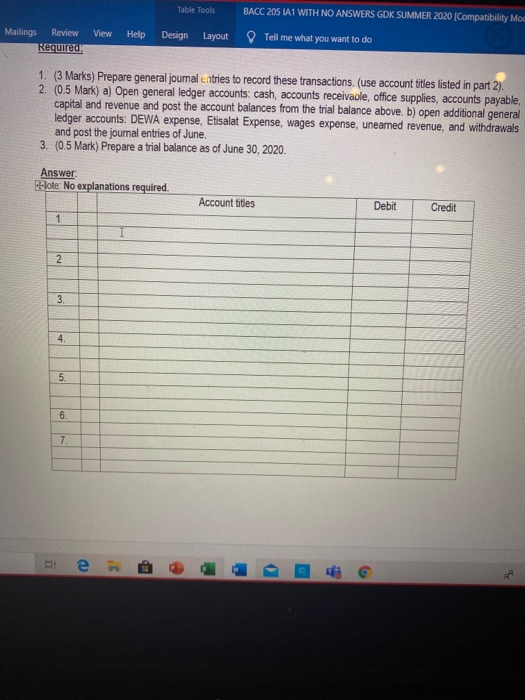

BACC 205 IA1 WITH NO ANSWERS GDK SUMMER 2020 [Compatibility Mode] - Word Elings Review View Help Tell me what you want to do . Question 3. (4 Marks) Mohamed Al Ahli opened customs consulting business in Dubai UAE in May 2020. He started the business with an investment of 400,000. Additional financial transactions that were recorded in May 2020 as disclosed in the trial balance below 400,000 2,000 200,000 Cash Office supplies Accounts Receivable Accounts payable Capital Revenue Hint: Do not record the above. 2,000 400,000 200,000 In June the following transactions were completed. 1. Mr. Mohamed contributed (invested) 2 Apple computers (Computer Equipment) to the business with a value of AED 100,000 2. He performed consulting services to Dubai Customs relating to data mining for 120,000 on account. 3. He obtained an advance from Dubai customs for a future project 240,000. 4. He paid wages to the secretary AED 4,000. 5. He withdrew AED 1,260 from the business to pay two police fines. 6. He paid the account payable of May as shown in the trial balance above. 7. He paid DEWA bill for June AED 20,000 8. He collected AED 100,000 from Dubai Customs (see entry 2) Required: 1. (3 Marks) Prepare general journal entries to record these transactions. (use account titles listed in part 2). 2. (0.5 Mark) a) Open general ledger accounts: cash, accounts receivable, office supplies, accounts payable, capital and revenue and post the account balances from the trial balance above. b) open additional general ledger accounts: DEWA expense, Etisalat Expense, wages expense, uneared revenue, and withdrawals and post the journal entries of June. 3. (0.5 Mark) Prepare a trial balance as of June 30, 2020. Answer: Note: No explanations required. Account titles Debit Credit Debit cash 11 29 Table Tools BACC 205 11 WITH NO ANSWERS GDK SUMMER 2020 [Compatibility Moe View Help Mailings Review Required Design Layout Tell me what you want to do 1. (3 Marks) Prepare general joumal entries to record these transactions. (use account titles listed in part 2). 2. (0.5 Mark) a) Open general ledger accounts: cash, accounts receivable, office supplies, accounts payable, capital and revenue and post the account balances from the trial balance above. b) open additional general ledger accounts: DEWA expense, Etisalat Expense, wages expense, uneared revenue, and withdrawals and post the journal entries of June. 3. (0.5 Mark) Prepare a trial balance as of June 30, 2020 Answer: lote: No explanations required. Account titles Debit Credit 1 2 3. 4. 5. 6. 7 e ED e - 29