Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BACHELOR OF COMMERCE IN SUPPLY CHAIN MANAGEMENT YEAR 1 ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE AC QUESTION THREE [35] Bongani Magwaza has been in business

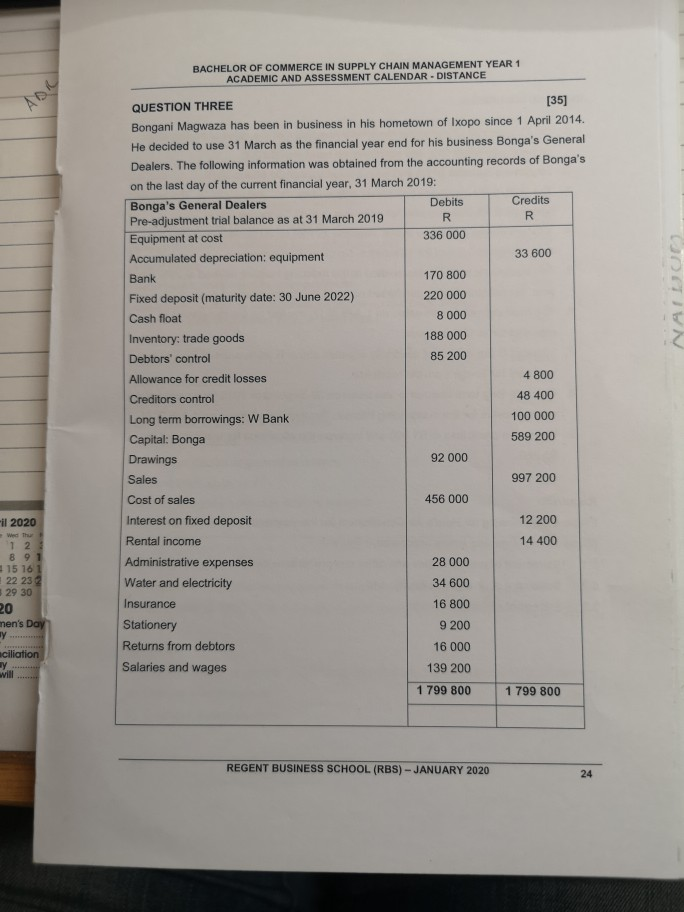

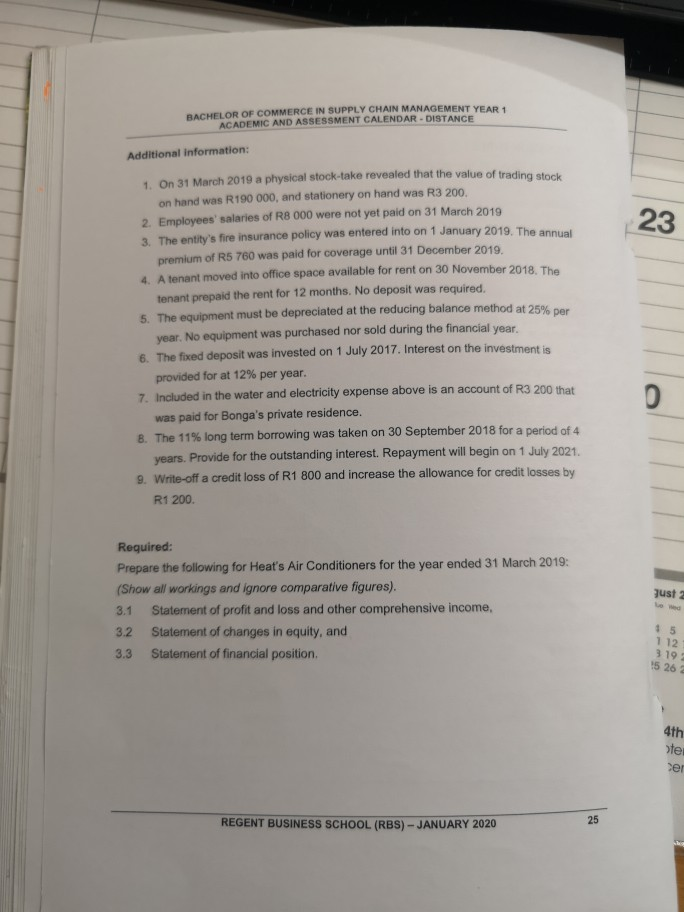

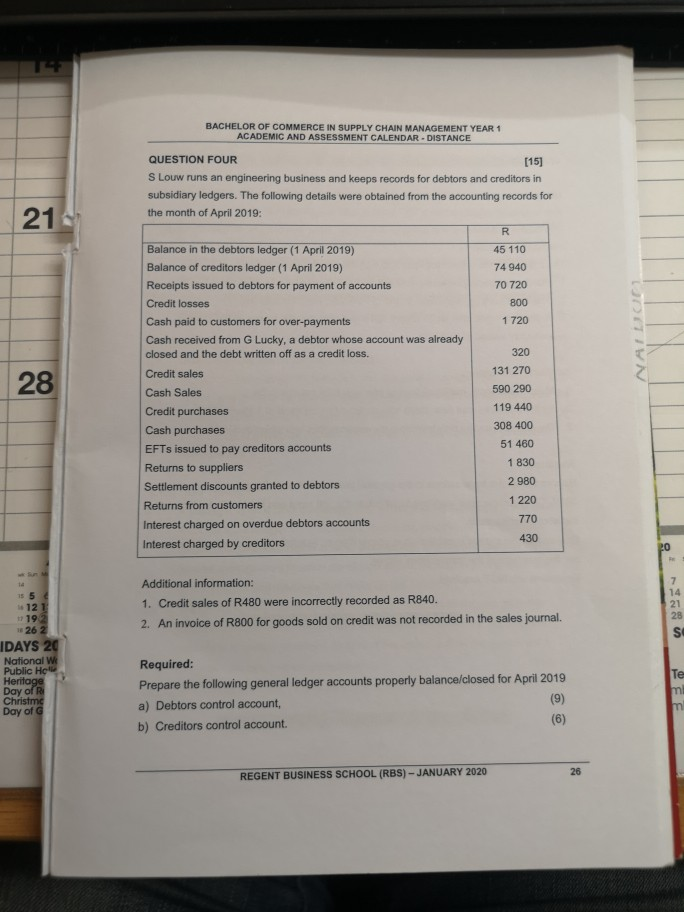

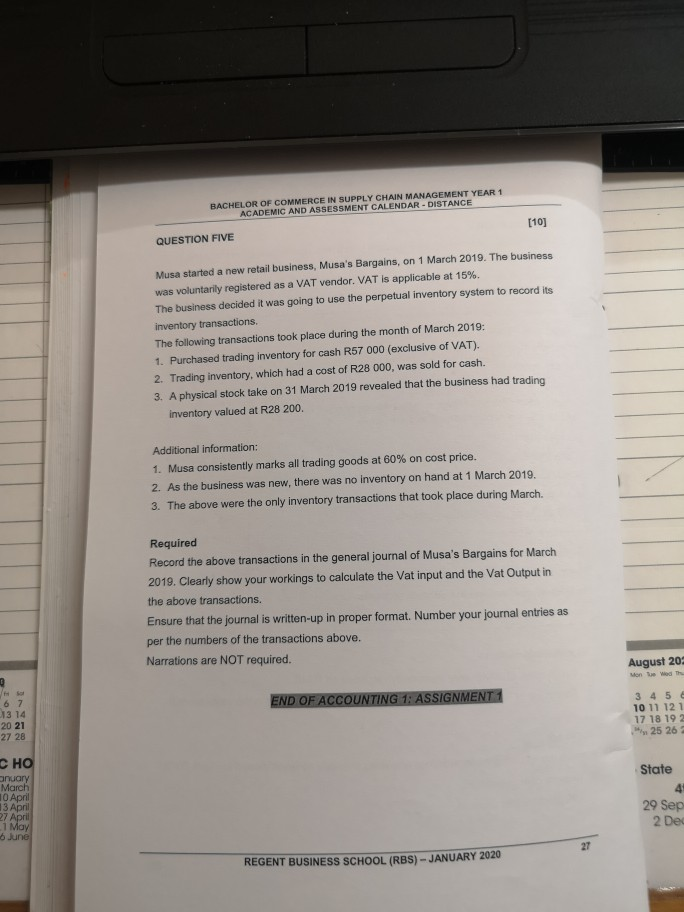

BACHELOR OF COMMERCE IN SUPPLY CHAIN MANAGEMENT YEAR 1 ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE AC QUESTION THREE [35] Bongani Magwaza has been in business in his hometown of Ixopo since 1 April 2014. He decided to use 31 March as the financial year end for his business Bonga's General Dealers. The following information was obtained from the accounting records of Bonga's on the last day of the current financial year, 31 March 2019: Bonga's General Dealers Debits Credits Pre-adjustment trial balance as at 31 March 2019 Equipment at cost 336 000 Accumulated depreciation: equipment 33 600 Bank 170 800 Fixed deposit (maturity date: 30 June 2022) 220 000 Cash float 8 000 Inventory: trade goods 188 000 Debtors' control 85 200 Allowance for credit losses 4 800 Creditors control 48 400 Long term borrowings: W Bank 100 000 Capital: Bonga 589 200 Drawings 92 000 Sales 997 200 Cost of sales 456 000 Interest on fixed deposit 12 200 Rental income 14 400 Administrative expenses 28 000 Water and electricity 34 600 Insurance 16 800 Stationery 9 200 Returns from debtors 16 000 Salaries and wages 139 200 1 799 800 1 799 800 il 2020 1 2 8 91 1 15 16 1 22 23 2 29 30 men's Day ciliation REGENT BUSINESS SCHOOL (RBS) - JANUARY 2020 RACHELOR OF COMMERCE IN SUPPLY CHAIN MANAGEMENT YEAP ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE Additional information: On 31 March 2019 a physical stock-take revealed that the value of trading stock on hand was R190 000, and stationery on hand was R3 200. 2. Employees' salaries of R8 000 were not yet paid on 31 March 2019 3 The entity's fire insurance policy was entered into on 1 January 2019. The premium of R5 760 was paid for coverage until 31 December 2019. 4. Atenant moved into office space available for rent on 30 November 2018. The tenant prepaid the rent for 12 months. No deposit was required. 5. The equipment must be depreciated at the reducing balance method at 250 var. No equipment was purchased nor sold during the financial year 6. The fixed deposit was invested on 1 July 2017. Interest on the investment is provided for at 12% per year. 7. Included in the water and electricity expense above is an account of R3 200 that was paid for Bonga's private residence. B. The 11% long term borrowing was taken on 30 September 2018 for a period of 4 years. Provide for the outstanding interest. Repayment will begin on 1 July 2021. 9. Write-off a credit loss of R1 800 and increase the allowance for credit losses by R1 200 Just 2 Required: Prepare the following for Heat's Air Conditioners for the year ended 31 March 2019: (Show all workings and ignore comparative figures). 3.1 Statement of profit and loss and other comprehensive income, 3.2 Statement of changes in equity, and 3.3 Statement of financial position. 15 112 319 !5 26 2 4th otel REGENT BUSINESS SCHOOL (RBS) - JANUARY 2020 BACHELOR OF COMMERCE IN SUPPLY CHAIN MANAGEMENT YEAR 1 ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE QUESTION FOUR [15] S Louw runs an engineering business and keeps records for debtors and creditors in subsidiary ledgers. The following details were obtained from the accounting records for the month of April 2019: R 45 110 74 940 70 720 800 1720 OOTIN 320 28 Balance in the debtors ledger (1 April 2019) Balance of creditors ledger (1 April 2019) Receipts issued to debtors for payment of accounts Credit losses Cash paid to customers for over-payments Cash received from G Lucky, a debtor whose account was already closed and the debt written off as a credit loss. Credit sales Cash Sales Credit purchases Cash purchases EFTs issued to pay creditors accounts Returns to suppliers Settlement discounts granted to debtors Returns from customers Interest charged on overdue debtors accounts Interest charged by creditors 131 270 590 290 119 440 308 400 51 460 1 830 2980 1 220 430 Additional information: 1. Credit sales of R480 were incorrectly recorded as R840. 2. An invoice of R800 for goods sold on credit was not recorded in the sales journal. 15 121 1 192 26 2 IDAYS 20 National W Public Hol Heritage Day of R Christm Day of G Required: Prepare the following general ledger accounts properly balance/closed for April 2019 a) Debtors control account, b) Creditors control account. REGENT BUSINESS SCHOOL (RBS) - JANUARY 2020 BACHELOR OF COMMERCE IN SUPPLY CHAIN MANAGEMENT YEAR 1 ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE [10] QUESTION FIVE Musa started a new retail business, Musa's Bargains, on 1 March 2019. The business was voluntarily registered as a VAT vendor. VAT is applicable at 15%. The business decided it was going to use the perpetual inventory system to record its inventory transactions. The following transactions took place during the month of March 2019: 1. Purchased trading inventory for cash R57 000 (exclusive of VAT). 2. Trading inventory, which had a cost of R28 000, was sold for cash. 3. A physical stock take on 31 March 2019 revealed that the business had trading inventory valued at R28 200. Additional information: 1. Musa consistently marks all trading goods at 60% on cost price. 2. As the business was new, there was no inventory on hand at 1 March 2019. 3. The above were the only inventory transactions that took place during March. Required Record the above transactions in the general journal of Musa's Bargains for March 2019. Clearly show your workings to calculate the Vat input and the Vat Output in the above transactions. Ensure that the journal is written-up in proper format. Number your journal entries as per the numbers of the transactions above. Narrations are NOT required. August 20 Monte Wed The END OF ACCOUNTING 1: ASSIGNMENT 1 67 13 14 20 21 27 28 3 4 5 6 10 11 12 1 17 18 19 2 * 25 26 State anuary March 10 April 13 April 27 April 1 May June 29 Sep 2 Dec REGENT BUSINESS SCHOOL (RBS) - JANUARY 2020 BACHELOR OF COMMERCE IN SUPPLY CHAIN MANAGEMENT YEAR 1 ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE AC QUESTION THREE [35] Bongani Magwaza has been in business in his hometown of Ixopo since 1 April 2014. He decided to use 31 March as the financial year end for his business Bonga's General Dealers. The following information was obtained from the accounting records of Bonga's on the last day of the current financial year, 31 March 2019: Bonga's General Dealers Debits Credits Pre-adjustment trial balance as at 31 March 2019 Equipment at cost 336 000 Accumulated depreciation: equipment 33 600 Bank 170 800 Fixed deposit (maturity date: 30 June 2022) 220 000 Cash float 8 000 Inventory: trade goods 188 000 Debtors' control 85 200 Allowance for credit losses 4 800 Creditors control 48 400 Long term borrowings: W Bank 100 000 Capital: Bonga 589 200 Drawings 92 000 Sales 997 200 Cost of sales 456 000 Interest on fixed deposit 12 200 Rental income 14 400 Administrative expenses 28 000 Water and electricity 34 600 Insurance 16 800 Stationery 9 200 Returns from debtors 16 000 Salaries and wages 139 200 1 799 800 1 799 800 il 2020 1 2 8 91 1 15 16 1 22 23 2 29 30 men's Day ciliation REGENT BUSINESS SCHOOL (RBS) - JANUARY 2020 RACHELOR OF COMMERCE IN SUPPLY CHAIN MANAGEMENT YEAP ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE Additional information: On 31 March 2019 a physical stock-take revealed that the value of trading stock on hand was R190 000, and stationery on hand was R3 200. 2. Employees' salaries of R8 000 were not yet paid on 31 March 2019 3 The entity's fire insurance policy was entered into on 1 January 2019. The premium of R5 760 was paid for coverage until 31 December 2019. 4. Atenant moved into office space available for rent on 30 November 2018. The tenant prepaid the rent for 12 months. No deposit was required. 5. The equipment must be depreciated at the reducing balance method at 250 var. No equipment was purchased nor sold during the financial year 6. The fixed deposit was invested on 1 July 2017. Interest on the investment is provided for at 12% per year. 7. Included in the water and electricity expense above is an account of R3 200 that was paid for Bonga's private residence. B. The 11% long term borrowing was taken on 30 September 2018 for a period of 4 years. Provide for the outstanding interest. Repayment will begin on 1 July 2021. 9. Write-off a credit loss of R1 800 and increase the allowance for credit losses by R1 200 Just 2 Required: Prepare the following for Heat's Air Conditioners for the year ended 31 March 2019: (Show all workings and ignore comparative figures). 3.1 Statement of profit and loss and other comprehensive income, 3.2 Statement of changes in equity, and 3.3 Statement of financial position. 15 112 319 !5 26 2 4th otel REGENT BUSINESS SCHOOL (RBS) - JANUARY 2020 BACHELOR OF COMMERCE IN SUPPLY CHAIN MANAGEMENT YEAR 1 ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE QUESTION FOUR [15] S Louw runs an engineering business and keeps records for debtors and creditors in subsidiary ledgers. The following details were obtained from the accounting records for the month of April 2019: R 45 110 74 940 70 720 800 1720 OOTIN 320 28 Balance in the debtors ledger (1 April 2019) Balance of creditors ledger (1 April 2019) Receipts issued to debtors for payment of accounts Credit losses Cash paid to customers for over-payments Cash received from G Lucky, a debtor whose account was already closed and the debt written off as a credit loss. Credit sales Cash Sales Credit purchases Cash purchases EFTs issued to pay creditors accounts Returns to suppliers Settlement discounts granted to debtors Returns from customers Interest charged on overdue debtors accounts Interest charged by creditors 131 270 590 290 119 440 308 400 51 460 1 830 2980 1 220 430 Additional information: 1. Credit sales of R480 were incorrectly recorded as R840. 2. An invoice of R800 for goods sold on credit was not recorded in the sales journal. 15 121 1 192 26 2 IDAYS 20 National W Public Hol Heritage Day of R Christm Day of G Required: Prepare the following general ledger accounts properly balance/closed for April 2019 a) Debtors control account, b) Creditors control account. REGENT BUSINESS SCHOOL (RBS) - JANUARY 2020 BACHELOR OF COMMERCE IN SUPPLY CHAIN MANAGEMENT YEAR 1 ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE [10] QUESTION FIVE Musa started a new retail business, Musa's Bargains, on 1 March 2019. The business was voluntarily registered as a VAT vendor. VAT is applicable at 15%. The business decided it was going to use the perpetual inventory system to record its inventory transactions. The following transactions took place during the month of March 2019: 1. Purchased trading inventory for cash R57 000 (exclusive of VAT). 2. Trading inventory, which had a cost of R28 000, was sold for cash. 3. A physical stock take on 31 March 2019 revealed that the business had trading inventory valued at R28 200. Additional information: 1. Musa consistently marks all trading goods at 60% on cost price. 2. As the business was new, there was no inventory on hand at 1 March 2019. 3. The above were the only inventory transactions that took place during March. Required Record the above transactions in the general journal of Musa's Bargains for March 2019. Clearly show your workings to calculate the Vat input and the Vat Output in the above transactions. Ensure that the journal is written-up in proper format. Number your journal entries as per the numbers of the transactions above. Narrations are NOT required. August 20 Monte Wed The END OF ACCOUNTING 1: ASSIGNMENT 1 67 13 14 20 21 27 28 3 4 5 6 10 11 12 1 17 18 19 2 * 25 26 State anuary March 10 April 13 April 27 April 1 May June 29 Sep 2 Dec REGENT BUSINESS SCHOOL (RBS) - JANUARY 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started